Egypt's Second Largest Public Bank Leaps Into China Via One Belt One Road. Egyptian (EGPT) banks are moving east (FXI) for international expansion.

Egypt’s largest banks have opened up branches in China to strengthen mutual trade between the two countries and take advantage of China’s One Belt One Road (OBOR) initiative. In a recent interview with China’s news agency Xinhua, Akef Abdel-Latif al-Maghraby, vice chairman of Egypt’s national bank Banque Misr said, “We see China as one of the priorities of our bank for external expansion due to the large Chinese market and the volume of trade between China and Egypt that has exceeded 11 billion U.S. dollars.” Credit Suisse (CS) expects China’s One Belt One Road Project to attract $500 billion worth of investments over the next five years. Egypt’s Reserves Hit Highest Level Since 2011 After IMF Deal - Bloomberg.

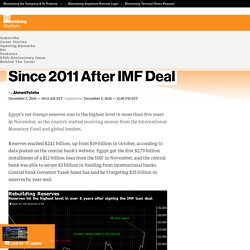

Egypt’s net foreign reserves rose to the highest level in more than five years in November, as the country started receiving money from the International Monetary Fund and global lenders.

Reserves reached $23.1 billion, up from $19 billion in October, according to data posted on the central bank’s website. Egypt got the first $2.75 billion installment of a $12 billion loan from the IMF in November, and the central bank was able to secure $2 billion in funding from international banks. Central bank Governor Tarek Amer has said he’s targeting $25 billion in reserves by year-end. Authorities burned through billions of dollars to defend the local currency after the 2011 Arab Spring uprising ousted President Hosni Mubarak and years of turmoil undermined the economy. Remittances to non-GCC Arab countries on the rise; Egypt tops.

The Middle East has cemented its place as one of the top outward remittance hubs in the world, with the figure in excess of $120 billion (Dh440.4 billion) for that year.

A complementary internal research conducted by Xpress Money, a money transfer company, indicated that remittances within the Middle East are rising rapidly as well, particularly with the Arab nationals transferring money from GCC countries to other Arab countries. The research indicated that not only are Arabs sending money more frequently, but the amounts tend to also be larger. Of all Arab expatriates across multiple nationalities surveyed, 71 per cent send money back home, with 38 per cent sending money home at least once a month, and another 32 per cent sending money at least every 2-3 months.

On an average, Arabs are also more likely to send more money home, with figures showing expat Arab remitters based in select GCC countries regularly transferring amounts in the $700-1,000 (Dh2,570-3,670) range. Egypt Devalues Currency 13% Due to Crippling Dollar Shortage. Egypt central bank says it injected $14 bln in three months. Business World News of Saturday, 13 February 2016 Source: Reuters People and vehicles are seen caught in a traffic jam in front of the Central Bank of Egypt's Hq.

Egypt's central bank has injected over $14 billion dollars into local banks over the past three months to facilitate import activity and curb inflation on essential goods, a government statement said on Thursday. Egypt has been facing an acute dollar shortage that has hampered import activity and sapped industrial production ever since a 2011 uprising drove away foreign investors and tourists, key sources of dollars.

The government has in recent months applied various measures, from import restrictions to higher tariffs, to conserve scarce dollars while the central bank has injected foreign currency into the banking system to free up essential imports. "To this end the central bank has provided more than $14 billion over three months and this has had an immediate impact on foreign trade and industrial activity," it continued. Untitled. Egypt's president Sisi launches loan program for SMEs. Framework ready soon for Egyptian investment fund.

Reuters , Sunday 14 Jun 2015 The legal framework for a proposed 5 billion Egyptian pound ($655 million) sovereign investment fund will be complete within four months, Egypt's state news agency quoted the planning minister as saying on Sunday.

The government on Thursday approved a proposal to set up the "Amlak" fund, which will act as the state's investment arm and is intended to encourage diversification and support sustainable economic and social development. The fund will have a board of trustees headed by the prime minister and will be managed by investment banks in order to attract private sector investors to the projects it will fund, Planning Minister Ashraf al-Arabi said, according to state news agency MENA. The fund will finance infrastructure projects in areas such as energy, railways and roads, al-Arabi said. It will have sub-funds for each sector, in which foreign sovereign funds will be able to take a 50 percent stake. Egyptian banks ready for mega projects. By Mohammad El Agamy Photo Credit:Reuters/Asmaa Waguih Egyptian banks are in a strong position to help finance mega projects planned in the country following an investment summit that secured major deals with multinationals and regional companies, senior officials at several local lenders told Zawya.

The government had been borrowing heavily from local banks through treasury issues over the past few years, but the banks, which have highly liquid balance sheets, are now ready to redeploy their assets to longer term corporate lending as Egypt recovers from four years of political and economic turmoil.Mounir El Zahed, chairman and CEO of Banque du Caire, said the Egyptian banking sector had weathered the years of upheaval that battered the economy following the 2011 revolution. " Mohamed Ashmawy, chairman of the United Bank Egypt, agreed, saying the government's economic roadmap had encouraged banks to fund both private sector and public sector projects. " © Zawya 2015 © Copyright Zawya. Egypt to repay $1bn to Qatar in October. Finance: Egypt's small borrowers have big potential. Low-tech entrepreneurs are queueing up for loans, but until the new law comes into force only banks and NGOs can offer them.

Photo©Amr Dalsh/Reuters A new law permitting non-bank for-profit lending institutions may unleash a revolution in microfinance by allowing more actors and innovators to get involved. Tamer Taha is a part of Egypt's thriving start-up community. A few years ago, he noticed that microfinance came at a high cost and even higher interest rates, and with logistics which he says create inefficiencies. Microfinance is another industry and is not based on collateral and documents and cash flows He also realised that general interest in and financial support for innovative ideas was mostly going to the top of the pyramid, comprised of tech start-ups and mobile phone applications. EGP 100,000 microfinance limit subject to 5% increase: EFSA chairman. The EGP 100,000 limit set for microfinance loans is subject to a future increase that should not exceed 5%, chairman of the Egyptian Financial Supervisory Authority Sherif Samy told the Daily News Egypt.

“The increase should not exceed 5% per annum and should be approved by the Egyptian prime minister,” Samy added. President Abdel Fattah Al-Sisi issued a decree approving the microfinance law, which was prepared by EFSA on Thursday. The law, which is the first of its kind in Egypt, will allow companies and non-government organisations (NGOs) to finance projects that are normally ineligible for bank loans.

Samy claimed that this is the most important economic legislation issued since January 2011. AlexBank: Becoming the best bank in Egypt for SMEs. Interview with Roberto Vercelli, Managing Director & CEO of AlexBank.

Lack of Financing Threatens Egypt's SME Sector. Lack of funding options threatens growth prospects of crucial sector Carpenter Mahmoud Kholief and tech entrepreneur Amr Shady are from opposite ends of Egyptian society, but they share a common dilemma: how to finance their businesses.

Both men are members of Egypt’s entrepreneur class. Shady belongs to the rising middle-class “startup revolution”, which has roots in the early-2000s. Kholief is part of the micro-financed version that has been bubbling away quietly for more than two decades. Any entrepreneur will say finding someone to fund their dream is the biggest challenge, but in Egypt, the needs of these two groups are behind a fundamental change in how small- and medium-sized enterprises (SMEs) are operated, and how financiers deploy their cash.

The 2011 revolution hurt Egypt’s nascent venture capital ecosystem, and only the most committed microfinancers, such as the Alexandria Business Association (ABA) and Banque du Caire, are back on track. 10% of Egyptians use prepaid Visa cards: MENA director of prepaid products. 10% of Egyptians use prepaid Visa cards(AFP Photo) The Middle East and North Africa region (MENA) has recorded the highest total volume of Visa prepaid card usage, with Egypt registering 10% penetration, compared to 60% in the United Arab Emirates (UAE), Visa MENA director of prepaid products Sumit Tyagi said on Friday during the 5th Emerging Markets Payments Conference (EMPC) taking place on 26 and 27 September in Sharm El-Sheikh.

MENA is the top region in terms of total volume of prepaid with 82.6% growth in the last year, according to Tyagi. Tyagi added that the volume of prepaid cards has increased globally by 156% between 2008 and 2013, noting that most of the prepaid cards solutions complement credit and debit card solutions and help payment companies reach a segment that both credit and debit cards cannot reach. Hassan said that the transactions value in Africa is expected to reach $85bn in 2016 compared to $12bn in 2011, stressing that Africa is leading mobile payments globally. Egypt raises EGP 61 billion for new Suez Canal. By Egyptian Streets | The head of Egypt’s Central Bank has announced that EGP 61 billion ($US 8.5 billion) for the construction of the country’s new Suez Canal. The target of EGP 60 billion from the sale of investment certificates was achieved within just 11 days.

Banks had witnessed high popular turnout over the past eleven days since the availability of the investment certificates. Revenue from the certificates hit EGP 39.5 billion at the end of last week, seven days after they became available. Ramez added. The investment certificates have an interest rate of 12 percent and were implemented to finance the new Suez Canal project. The investment certificates, which have an interest rate of 12 percent and were only available to Egyptians, will be used to finance the new Suez Canal project and is expected to raise the project’s revenue to USD 13 billion. NBE receives 800 applications for mortgage funding for low- and middle-income individuals. The National Bank of Egypt (NBE) says it received 800 requests for mortgage funding from those with low or average incomes last week.

Overview of banking sector performance over FY 2013/2014. Over the fiscal year (FY) 2013/2014, Egypt’s banking sector has provided the government with steadier footing, providing loans through treasury bonds to fill the budget deficit. Even with their major role in securing the economy, the banks have managed to record consistent profits.

With regard to state-owned banks, Banque du Caire’s pre-tax net profit increased by 22.48% in 2013 to register EGP 1.7bn compared to 1.4bn in 2012, the bank disclosed in August. Meanwhile, the post-tax net profit recorded EGP 1.024bn compared to EGP 830m in the previous FY. Net interest income has grown by EGP 600m to record EGP 2.9bn, compared to EGP 2.3bn in the previous year. Egypt to yield $168m from property tax on factories. The property tax law was approved by Egyptian President Abdel Fatah Al-Sisi last week. Commercial and industrial properties whose net rental value is less than 1,200 Egyptian pounds are exempt from the tax. On election day, Egypt bourse hits highest level since 2008.

The Egyptian Stock Market witnessed a significant rise in its main index EGX-30 index on Monday, recording 8,736.28 points, its highest level since 2008. Egypt foreign reserves up at $17.414 bln in March -c.bank. Egypt’s reserves hit new low. Barclays Egypt launches ‘Barclays Direct’ service for wages. Barclays Direct is a new service of Barclays Egypt to for companies’ wage payment. Egypt’s new finance minister plans stimulus, not austerity. Reuters Saturday, 27 July 2013 Egypt interim government will seek to avoid major austerity measures and instead work to stimulate the economy by improving security and pumping in new funds, the new finance minister, Ahmed Galal, said on Thursday. The government, sworn in last week after the military ousted Islamist President Mohamed Mursi, inherits a budget deficit that since January has been running at around $3.2 billion a month, equivalent to almost half of all state spending.

Business News: CIB ranked Egypt most efficient bank. "هيرميس" أحد أكبر بنوك الاستثمار في مصر والعالم العربي Seventeen PPP projects to be financed using sukuk: Panel. Petronas Towers, Malaysia (above). Malaysia accounts for 24% of the global sukuk market, said Ahmed El-Naggar. Qatar set to pump $2.5bn into Egypt over the next three months.

Morsy meets with Qatari Prime Minister and Foreign Minister Hamad bin Jassim Al-Thani in Cairo on 8 JanuaryAFP PHOTO / KHALED DESOUKI. Doing Business in Egypt.pdf (application/pdf Object) Egypt-based Islamic finance firm eyes $100 mln investment. Crédit Agricole Egypt Launches the First Visa Infinite Card in Egypt.