Securitization. Money Market Funds. A money market fund is a type of mutual fund that is required by law to invest in low-risk securities.

These funds have relatively low risks compared to other mutual funds and pay dividends that generally reflect short-term interest rates. Unlike a “money market deposit account” at a bank, money market funds are not federally insured. Money market funds typically invest in government securities, certificates of deposit, commercial paper of companies, or other highly liquid and low-risk securities. They attempt to keep their net asset value (NAV) at a constant $1.00 per share – only the yield goes up and down. But a money market’s per share NAV may fall below $1.00 if the investments perform poorly. An investor tendering mutual fund shares, including shares of money market funds, for redemption generally must be paid within seven days of tender. Horizontal Integration. QuickMBA / Strategy / Horizontal Integration Horizontal Integration The acquisition of additional business activities at the same level of the value chain is referred to as horizontal integration.

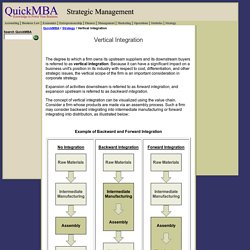

This form of expansion contrasts with vertical integration by which the firm expands into upstream or downstream activities. Vertical Integration. QuickMBA / Strategy / Vertical Integration Vertical Integration The degree to which a firm owns its upstream suppliers and its downstream buyers is referred to as vertical integration.

Because it can have a significant impact on a business unit's position in its industry with respect to cost, differentiation, and other strategic issues, the vertical scope of the firm is an important consideration in corporate strategy. Expansion of activities downstream is referred to as forward integration, and expansion upstream is referred to as backward integration. The concept of vertical integration can be visualized using the value chain. Example of Backward and Forward Integration Two issues that should be considered when deciding whether to vertically integrate is cost and control.

The following benefits and drawbacks consider these issues. Benefits of Vertical Integration Vertical integration potentially offers the following advantages: Mergers and acquisitions. Mergers and acquisitions (M&A) are both aspects of strategic management, corporate finance and management dealing with the buying, selling, dividing and combining of different companies and similar entities that can help an enterprise grow rapidly in its sector or location of origin, or a new field or new location, without creating a subsidiary, other child entity or using a joint venture.

The distinction between a "merger" and an "acquisition" has become increasingly blurred in various respects (particularly in terms of the ultimate economic outcome), although it has not completely disappeared in all situations. From a legal point of view, a merger is a legal consolidation of two companies into one entity, whereas an acquisition occurs when one company takes over another and completely establishes itself as the new owner (in which case the target company still exists as an independent legal entity controlled by the acquirer). Acquisition[edit] Legal structures[edit] Documentation[edit]

Invest FAQ: Stocks: Initial Public Offerings (IPOs) Last-Revised: 7 Nov 1995 Contributed-By: Art Kamlet (artkamlet at aol.com), Bill Rini (bill at moneypages.com) This article is divided into four parts: Introduction to IPOs The Mechanics of Stock Offerings The Underwriting Process IPO's in the Real World 1.

Introduction to IPOs When a company whose stock is not publicly traded wants to offer that stock to the general public, it usually asks an "underwriter" to help it do this work. For example, if BigGlom Corporation (BGC) wants to offer its privately- held stock to the public, it may contact BigBankBrokers (BBB) to handle the underwriting. A tentative date will be set, and a preliminary prospectus detailing all sorts of financial and business information will be issued by the issuer, usually with the underwriter's active assistance. Usually, terms and conditions of the offer are subject to change up until the issuer and underwriter agree to the final offer.

IPO Stock at the release price is usually not available to most of the public. Due Diligence Checklist - Angel Investors. Preparing For An Initial Public Offering In The United States: Raising Capital in the U.S. Capital Markets. The U.S. public capital markets are the largest, most flexible and most attractive source of capital to companies raising money through the sale of equity or debt securities.

In 1994, companies raised $66.5 billion in public equity offerings, including $23.2 billion raised in initial public offerings (IPOs). The equity markets have been particularly receptive to offerings by companies in technology, life sciences and other emerging growth industries. As a result, an increasing number of non-U.S. companies in emerging growth industries are recognizing the opportunity to raise money in an IPO in the United States, and to do so at a relatively favorable valuation. In determining to undertake an initial public offering in the United States, and in preparing itself for the offering process, a non-U.S. company should take steps to make the Company more accessible to U.S. investors.

Corporate governance Financial reporting Disclosure and publicity Corporate culture Employee benefits Conclusion. What is Underwriting. What is Investment Bank.