FDIC Law, Regulations, Related Acts - Consumer Protection. [Table of Contents] [Previous Page] [Next Page]

Efta. Untitled. We mention the acronym ACH quite a bit on the Dwolla blog: ACH payments, ACH Payouts, and API for ACH.

But I realize that this term may not be crystal clear for those who don’t deal in payments on a daily basis. We’re taking a step back to break down how ACH payments work. What Does ACH stand for? PARADIGM DOCUMENT FROM: THE TREASURY FINANCE AG, INDUSTRIESTRASSE 21, CH-6055ALPNACH DORF, SWITZERLAND. OPPT Commercial Bill UCC Filing. Money and financial problems. Internal Revenue Manual - 5.17.5 Suits Against the United States. 5.17.5 Suits Against the United States Manual Transmittal January 06, 2017.

Internal Revenue Manual - 25.3.3 Suits Against the United States and Claims for Damages under IRC § 7433. 25.3.3 Suits Against the United States and Claims for Damages under IRC § 7433 Manual Transmittal January 13, 2017 Purpose (1) This transmits revised IRM 25.3.3, Litigation and Judgments, Suits Against the United States and Claims for Damages under IRC § 7433.

Legal Tender Status. I thought that United States currency was legal tender for all debts.

Some businesses or governmental agencies say that they will only accept checks, money orders or credit cards as payment, and others will only accept currency notes in denominations of $20 or smaller. Isn't this illegal? The pertinent portion of law that applies to your question is the , specifically Section 31 U.S.C. 5103, entitled "Legal tender," which states: "United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues.

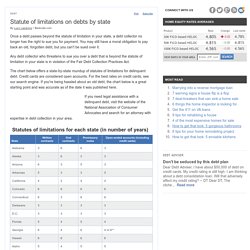

" Statute Of Limitations - On Debt, By State. Debt Once a debt passes beyond the statute of limitation in your state, a debt collector no longer has the right to sue you for payment.

You may still have a moral obligation to pay back an old, forgotten debt, but you can't be sued over it. 7 Things You Need to Know About the Statutes of Limitation for Debt. Certain credit cards and other financial products mentioned in this and other sponsored content on Credit.com are Partners with Credit.com.

Credit.com receives compensation if our users apply for and ultimately sign up for any financial products or cards offered. Hello, Reader! Thanks for checking out Credit.com. Untitled. Financial claims - statute of limitations clarified. Title 12 of the Code of Federal Regulations - Wikipedia. CFR Title 12 - Banks and Banking is one of fifty titles comprising the United States Code of Federal Regulations (CFR), containing the principal set of rules and regulations issued by federal agencies regarding banks and banking.

It is available in digital and printed form, and can be referenced online using the Electronic Code of Federal Regulations (e-CFR). Debt restructuring, vulture funds and human rights. As sovereign insolvency has obvious implications for the enjoyment of economic, social and cultural rights by debtors’ populations and of their right to development, international human rights law should be considered when defining and identifying the rules governing debt restructuring processes.

Standstill agreements, seniority, the distribution of financial losses between debtors and creditors and among creditors, the legitimacy of decision-making processes, holdout creditors’ rights, and the procedural and substantive aspects of vulture funds litigation are concrete examples of problems and challenges posed by every debt restructuring. The Independent Expert will undertake research in this area and when suitable, advocacy for a human rights-based approach to debt restructuring and debt relief. Letters and submissions: What's the Difference Between Bilateral and Unilateral Contracts? Contracts are a part of taking care of business, both personally and professionally.

Unilateral and bilateral contracts are something many people deal with on a daily basis, even though they aren't always aware of it. Learning the difference between each kind of agreement can help individuals of from all walks of life navigate legal matters with confidence. News Moneyval. [26 septembre 2016] MONEYVAL's annual report: anti-terrorist financing measures not fully exploited yet Following the publication today of MONEYVAL's annual report, its Chair, Daniel Thelesklaf, pointed out that identifying the financing of terrorism has not yet been fully exploited as a strategy in the overall fight against terrorism.

“We are struggling to find ways how to better combat terrorism. Money is needed to plan and perpetrate attacks. Currency Act of 1764 - Introduction and Text. The Currency Act of 1764 was passed after the French and Indian War had ended. The act banned the use of paper money in all colonies. In passing this, the British government was attempting to have a greater amount of control over the individual colonies. Following is the text of the Currency Act of 1764. This was just one of a series of acts which led to greater discontent amongst the colonists. Eventually, this discontent would lead to the American Revolution. MissingMoney.com Unclaimed Property FREE SEARCH - Officially endorsed By The States, Provinces and Naupa.

NAUPA. Inactive Bank Account Answers from the OCC. Former World Bank Attorney exposes the bankers and the BAR. What Is Shemittah? - The Sabbatical Year basics: absolution of loans, desisting from all field work, and the spiritual objective of all the above. - Shemittah. As soon as the Jews settled in the Holy Land, they began to count and observe seven-year cycles. Every cycle would culminate in a Sabbatical year, known as Shemittah, literally: “to release.” The year following the destruction of the second Holy Temple was the first year of a seven-year Sabbatical cycle. Global Banking: Regulations Force a Retreat - Businessweek. As global credit markets seized up in late 2008, European banks with U.S. operations borrowed heavily from the U.S. Federal Reserve discount window, the primary program for providing cash to banks facing a liquidity squeeze. At the time, these foreign lenders didn’t have to meet Fed capital rules to cover losses on American-based units provided their parent company was properly capitalized.

They competed and borrowed in the U.S. —but didn’t have to play by the house rules. Financial regulation. Division of Banks Home Page. Global Banking Regulations and Banks in Canada. Last modified: 13 March 2015 Fast facts During the 2008 global financial crisis, unlike banks in many other countries, no Canadian banks were bailed out or in danger of failing. The Regulation Of The Banking Industry Appears A Farce. Bank Secrecy Act. Bank regulation. Federal Banking Regulations: Up-to-date Bank Regulation Tools Written By Experts.

Laws and Regulations. All Regulations. Bank regulation in the United States. Law & Banking, 7th Edition. Topic: Banking Law. Bank regulation. FDIC: Laws & Regulations. Banking Law Research Guide. Banking Law - Guide to Bank Regulation Law - HG.org. If you can't PAY for anything Accept it "For Value" and DISCHARGE your DEBTS! Shemittah Loan Amnesty: Pruzbul - Questions and answers about the cancellation of debts on the Sabbatical year, and what we do about it - Shemittah. Loan Amnesty - Parshah Messages - Parsha.