Democracy Now! Mobile Projectionists Light Up New York City Buildings, and Protesters’ Spirits, with Occupy-Themed Display As tens of thousands marched in a seemingly endless sea of people last night in downtown New York City, large words in light appeared projected onto several downtown buildings. We spoke with two of the projectionists who made it happen as they stood in the streets. AMY GOODMAN: During the march on the Brooklyn Bridge, as tens of thousands streamed in an endless sea of people, words in light appeared projected onto several downtown buildings. TAYLOR K.: My name is Taylor K. RENÉE FELTZ: How does this fit into the idea of occupying public space and putting your message out? TAYLOR K.: Fits perfectly in. AMY GOODMAN: Among the buildings where the projections were sent was the iconic Verizon building nearby.

Chart Of The Day: Fed Interventions Since 2008 The chart below, via Stone McCarthy, shows the months with Fed intervention since December 2008. That in the past 42 or so months, less than one third have been intervention-free, should close any open questions about whether the stock "market" is anything but a policy vehicle used by the Fed to perpetuate a broke(n) status quo now entirely dependent on every market up (and down) tick. We dread to think what would happen to those record low US bond yields if the market were to be left on its own without the backstop of guaranteed Fed intervention in the interest rate market... ironically something which Barclays is in boiling hot water for right about now. And a detailed breakdown:

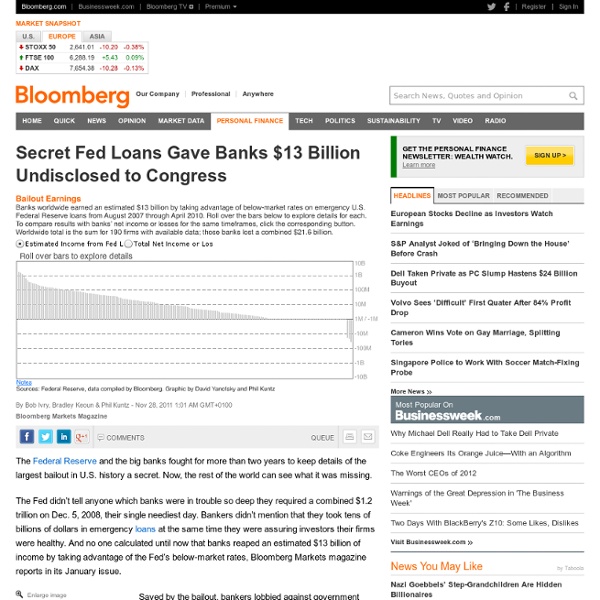

The $7 trillion secret loan program: The government and big banks should be punished for deceiving the public about their hush-hush bailout scheme Photograph by Jupiterimages/ Getty Images. Imagine you walked into a bank, applied for a personal line of credit, and filled out all the paperwork claiming to have no debts and an income of $200,000 per year. The bank, based on these representations, extended you the line of credit. Then, three years later, after fighting disclosure all the way, you were forced by a court to tell the truth: At the time you made the statements to the bank, you actually were unemployed, you had a $1 million mortgage on your house on which you had failed to make payments for six months, and you hadn’t paid even the minimum on your credit-card bills for three months. Yet this is exactly what the major American banks have done to the public. The banks’ claims of financial stability and solvency appear at a minimum to have been misleading—and may have been worse. So where are the inquiries into the false statements made by the bank CEOs? So what to do?

MF Global - Repo to maturity ‘Occupy Wall Street’ protest camp in L.A., Philadelphia remain despite arrests Early Monday morning, police surrounded the camp, but eventually said they would not evict the protesters. Reuters reports that around 2,000 protesters joined the camp to show their support. A few protesters and police clashed on a street corner after protesters refused to get out of the middle of the street. A small number of protesters were arrested. On a livestream recorded by some of the 100 or so protesters that remained after the night’s standoff, members of Occupy Los Angeles praised the police for their tactics, saying the cops handled the confrontation well. Police have stated that there is no hard deadline to remove the protesters, but that they would attempt to do so with as little “drama” as possible. Police Chief Charlie Beck said it remains unclear when the nearly two-month-old Occupy LA camp would be cleared. “There is no concrete deadline,” Beck told reporters Monday morning after hundreds of officers withdrew without moving in on the camp. A hearing in U.S.

Exposing the Fed: What is the Federal Reserve? Part 3 Editor Note: For those of you who are not familiar with Marilyn MacGruder Barnewall, she is the woman who wrote the definitive book on Ambassador Lee Wanta, Wanta! Black Swan, White Hat. I listened to several interviews with Marilyn that were conducted by Teri Ambach and the team at Global News and Views on Facebook. (Marilyn MacGruder Barnewall, Global Financial Affairs Editor) Unfortunately, the same cannot be said about the Federal Reserve System. It is a privately held corporation owned by bankers… most of whose names are seen on Wall Street (though international banks now own larger and larger shares of the Federal Reserve System, placing control of America’s economy in the hands of non-American foreigners). Before talking about what the Federal Reserve System does, one other important fact needs to be mentioned: The Federal Reserve is an unlawful organization. Article 1 Section 8 of the Constitution says the following: The loans were to cover up secret bank and corporate bailouts.

7.77 trillion in secret Federal Reserve loans to banks? I have been looking into the claim recently made by any number of internet sites (for example, here’s one of the many hundreds, if you insist on a link) that the Federal Reserve made $7.77 trillion in secret loans to banks. The claim is outrageously inaccurate, as I explain below. Let me begin with some accounting basics. Suppose that at the start of January I make a 3-month loan of $100 to person A and a 1-month loan of $100 to person B. At the start of February, person B rolls it over into a new 1-month loan, and does so again at the beginning of March. The correct answer, of course, is that I lent $100 to person A and I lent $100 to person B. This is a very elementary point in economics or accounting. On the other hand, if your goal is to come up with a number that sounds really big, you’ll be excited to learn that I also lent $100 to person C in the form of a series of daily loans. So where in particular did people come up with this $7.77 trillion figure?

What happened at MF Global MF Global made a massive leveraged bet on European debt, and then it died. That seems to be the conventional wisdom at this point, but it’s a bit oversimplified. A more accurate story would be to say that MF Global got involved in a complex liquidity-management trade, and that it didn’t have risk managers with the power or ability to cap the trade before it got too big. Izabella Kaminska has the wonky details of MF Global’s repo-to-maturity trade. It’s not easy to follow, but here’s the general gist. MF Global buys a bunch of European debt. In order to understand what that means, you first need to understand that banks like MF Global used to do nearly all their borrowing on an unsecured basis. So as soon as MF Global bought those bonds, it turned around and pledged them as collateral when it was borrowing money. Now here’s the trade: the rate at which it was borrowing money was lower than the coupon payments on the European sovereign bonds. There were two risks with this trade.

Kalle Lasn on OWS, the Israel lobby & the New York Times Kalle Lasn in front of the Adbuster’s corporate flag of America. (Photo: Globus) When the Occupy Wall Street protests began to attract attention in the fall, everyone wanted to know where the idea to set up a permanent protest at the heart of Manhattan’s financial district came from. The answer was the mind of Kalle Lasn, the co-editor (along with Micah White) of the anti-consumerist “culture jamming” magazine Adbusters. It was Adbusters, calling for an American “Tahrir moment,” that originally put out the call to occupy Wall Street on September 17. But not all the attention Lasn and his magazine received was positive, though. “For me, the New York Times is really important right now, because it was one of the most ugly experiences of my year, where they took a couple of quick swipes at my magazine and me personally,” Lasn told Mondoweiss in a recent phone interview. Alex Kane: Tell me about yourself, I’ve read some, but details about your life and what you’re doing at Adbusters. KL: Yes.

Why This Harvard Economist Is Pulling All His Money From Bank Of America A classicial economist... and Harvard professor... preaching to the world that one's money is not safe in the US banking system due to Ben Bernanke's actions? And putting his withdrawal slip where his mouth is and pulling $1 million out of Bank America? Say it isn't so... From Terry Burnham, former Harvard economics professor, author of “Mean Genes” and “Mean Markets and Lizard Brains,” provocative poster on this page and long-time critic of the Federal Reserve, argues that the Fed’s efforts to strengthen America’s banks have perversely weakened them. Is your money safe at the bank? Last week I had over $1,000,000 in a checking account at Bank of America. Why am I getting in line to take my money out of Bank of America? Before I explain, let me disclose that I have been a stopped clock of criticism of the Federal Reserve for half a decade. Let me explain: Currently, I receive zero dollars in interest on my $1,000,000. They will not be able to return my money if: What is the solution?

Too Big to Stop: Why Big Banks Keep Getting Away With Breaking the Law - James Kwak - Business For the country's biggest financial institutions, it's still worth it to break the law, because the government has no way to make the banks pay for acting illegally Reuters Move along, nothing to see here. That's been the Wall Street line on the financial crisis and the calamitous behavior that caused it, and that strategy has been spectacularly successful. Occasionally, a news event brings the need for financial reform momentarily into the partial spotlight, like last week when Judge Jed Rakoff rejected a proposed settlement between the SEC and Citigroup over a complex security called a CDO (actually, a CDO-squared) that the bank manufactured and pushed onto investor clients solely so it could bet against it. The issue in the Goldman case was whether the bank properly disclosed that John Paulson, a hedge fund manager, was involved in the selection of securities for the deal, because he wanted to bet against them.

MF Global Accounting Gimmick By Bethany McLeanThe opinions expressed are her own. On Monday morning, MF Global, the global brokerage for commodities and derivatives, filed for bankruptcy. The firm’s roots go back over two centuries, but in less than two years under CEO Jon Corzine, whose stellar resume includes serving as the chairman of Goldman Sachs, as New Jersey’s U.S. Senator, and as New Jersey’s governor, MF Global collapsed, after buying an enormous amount of European sovereign debt. The instant wisdom is that he made a big bet as part of his plan to transform MF Global into a firm like Goldman Sachs, which executes trades on behalf of its clients, and also puts its own money at stake. Although the size of the wager has received a great deal of scrutiny, the accounting and the disclosure surrounding it have not–and may have played a role in the firm’s demise. At the root of MF Global’s current predicament was a simple problem: the profits in its core business had declined rapidly.

Defense Authorization Bill Would Move America Toward A Military State Senators Carl Levin and John McCain are behind the Defense Authorization Bill, which would give the military too much power to detain American citizens, as Senator Mark Udall of Colorado points out. …the provisions would require the military to dedicate a significant number of personnel to capturing and holding terrorism suspects — in some cases indefinitely — even those apprehended on U.S. soil. And they authorize the military to do so regardless of an accused terrorist’s citizenship, even if he or she is an American captured in a U.S. city… Additionally, the requirement that the military — not civilian law enforcement — take suspected terrorists into custody threatens to undo much of the progress the FBI and state and local law enforcement have made to stop terrorists plotting in the United States and overseas. Udall is offering an amendment to the bill that would eliminate the detention provisions.

The Federal Reserve Explained in 7 Minutes Have you ever caught yourself wondering how nearly every country on earth can be in debt to outside sources? In my world, if I owe a friend $10 and he owes me $5 then I simply give him $5 and we call it “even.” But that’s not how the world of international banking works. If you have a minute, Wikipedia tries to keep an updated National Debt List. The reason that nearly every nation on earth has external debt is simple. Even in cases like China, where they own more of our debt than anyone, the Chinese still ultimately answer to the world banking elite. We hear a lot of talk about our National Debt and “debt ceilings” coming out of Washington D.C. but very few talk about the real issues. As long as privately held banks like The Federal Reserve rule the world, then people will always be debt slaves. Furthermore, until people truly start to understand the world banking system and get mad enough to force their will then nothing will change. Every American should watch this but very few will.