ecash In the United States, only one bank implemented ecash, the Mark Twain bank and the system was dissolved in 1997 after the bank was purchased by Mercantile Bank, a large issuer of credit cards.[2] Similar to credit cards, the system was free to purchasers, while merchants paid a transaction fee. In Australia ecash was implemented by St.George Bank, but the transactions were not free to purchasers. In June 1998, ecash became available through Credit Suisse in Switzerland. It was also available from Deutsche Bank in Germany, Bank Austria, Finland's Merita Bank/EUnet,[3][4] Sweden's Posten, and Den norske Bank of Norway. "ecash" was a trademark of DigiCash, which went bankrupt in 1998, and was sold to eCash Technologies, which was acquired by InfoSpace in 2002,[citation needed] currently know as Blucora. Plaintiff sued alleging trademark infringement and unfair-competition claims. The court rejected defendant's argument in denying plaintiff's motion to dismiss defendant's counterclaim.

Time for a New Theory of Money by Ellen Brown By understanding that money is simply credit, we unleash it as a powerful tool for our communities. posted Oct 28, 2010 The reason our financial system has routinely gotten into trouble, with periodic waves of depression like the one we’re battling now, may be due to a flawed perception not just of the roles of banking and credit but of the nature of money itself. Money as Relationship In an illuminating dissertation called “Toward a General Theory of Credit and Money” in The Review of Austrian Economics, Mostafa Moini, Professor of Economics at Oklahoma City University, argues that money has never actually been a “commodity” or “thing.” In the payment system of ancient Sumeria, prices of major commodities were fixed by the government. The concept of money-as-a-commodity can be traced back to the use of precious metal coins. In the payment system of ancient Sumeria, goods were given a value in terms of weight and were measured in these units against each other. The Credit Revolution

Bitcoin: de la révolution monétaire au Ponzi 2.0 Derrière l'idée révolutionnaire, libertarienne et anti-banques Bitcoin ne fait que reproduire un système injuste. Toucher aux règles monétaires n’a rien d’anecdotique. Lorsque nous dépensons, que nous travaillons, tous les jours, ce que nous faisons a un rapport avec la monnaie, sans même que nous y pensions. Que se passe-t-il alors lorsque des geeks créent une monnaie universelle, décentralisée, sécurisée, anonyme ? Lorsque ceux-ci peuvent faire du commerce en dehors de toute forme de contrôle, qu’il soit bancaire, étatique, ou fiscal ? En apparence, une révolution. Qu’est-ce que bitcoin ? Bitcoin est une monnaie virtuelle créée en 2009 par Satoshi Nakamoto, un personnage mystérieux dont personne ne connait la véritable identité. Bitcoin est donc deux choses à la fois : il s’agit tout d’abord d’un outil très basique de gestion de portefeuille, un logiciel open-source que tout le monde peut télécharger et lancer depuis son ordinateur. Comment ça marche ? Y-a-t-il une « bulle bitcoin » ?

Banques éthiques, monnaies libres… et toi, tu fais quoi après la crise ? Pas besoin d'un plan de sauvetage à 140 milliards pour moraliser le capitalisme : monnaies libres, banques éthiques et autres outils existent pour donner un peu de sens à la finance. Doté de seulement deux banques éthiques, la France paie le prix d’une stratégie de concentration en géants mondiaux, pas très raccord avec les aspirations de moralisation du capitalisme. 5 millions d’euros de fonds propres, plus de 26 000 sociétaires / actionnaires… « D’un point de vue purement réglementaire, nous avons le droit d’être une banque de plein exercice », annonce Marc Favier, responsable du projet de développement et d’innovation de la banque éthique La Nef. Seulement voilà : la Banque de France ne veut pas. Partie de la loi de 1984, la concentration du secteur bancaire orchestré par la Banque de France a certes livré des mastodontes internationaux au secteur bancaire français, mais la prive aujourd’hui de tout réseau de banque éthique indépendant. La crise des grands condamne les petits

The Blog: Symbionomics Themes What follows is a synopsis of the major themes we are exploring with the Symbionomics project (see kickstarter link on the right). Obviously, this is just a starting point. We are open to these concepts growing and evolving as this process unfolds. With each theme, we are seeding an online video discussion (as linked to in the titles). New Media: In the last twenty years, a wave of new tools has transformed the way we communicate. La COFIDES - Coopérative Financière pour le Développement de l’Economie Solidaire Nord Sud | COFIDES Nord Sud

Création Monétaire Quatre alternatives au Bank Run de Cantona » Article » Ownipolitics, Bilan, débats et enjeux La Nef pour une economie plus humaine [APP] une autre monnaie est possible : une BD augmentée L'argent ne fait pas le bonheur... sauf si on le fabrique soi-même! Avec notre BD augmentée, apprenez les principes de la création monétaire et découvrez comment élaborer des monnaies libres auxquelles donner du sens. Philippe Derudder fait partie de ceux qui voient en l’alternative économique une chance à saisir. Ancien entrepreneur qui a tout plaqué en 1992 pour ne plus cautionner un système monétaire qui ne lui convenait pas, il cherche alors des solutions pour concilier monnaie et équilibre écologique. Maintenant animateur au sein d’une association, l’Association Internationale pour le Soutien aux Economies Sociétales ou AISES, il milite pour la création de monnaies complémentaires et offre ses conseils auprès de communautés ou de villages souhaitant franchir le pas. Quel est votre rôle dans les étapes de la mise en place d’une monnaie complémentaire? Pouvez vous nous expliquer par quelles étapes est passée la création de l’Abeille à laquelle vous avez participé?

5 Reasons NOT to Pay Your Credit Cards Are you one of the millions of Americans trying to decide between paying your credit card bills and eating? John Galt -- Activist Post We live in a matrix that goes to unspeakable expense to nurture us from the teat to be good consumers. You are issued a tax collection number at birth (SS#), another artificial number for your credit worthiness (FICO), and then you're extended a certain amount of tokens to play "life" based on those numbers. It is a brilliantly designed game: the banksters create a unit of money out of thin air; lend it to people with interest attached; get them to buy real items; then raise the rates, force people to work harder, hover like a vulture until expected default occurs, and rake in the forfeited assets. Sure, you get to "rent" a flat-screen TV, a car, or a home from them, making life in the matrix almost worth it. Here are the top five reasons not to pay your credit cards:

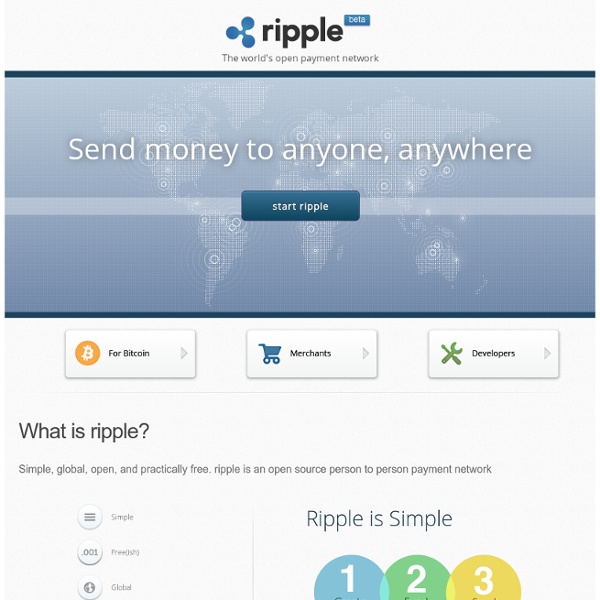

Open Bank