50 Smartest Companies 2017. Commentary Why hedge funds may never be able to beat the market again. Where has all the alpha gone?

One of the biggest factors that investors have to deal with when turning their philosophy into a strategy is trying to figure out where their opportunity set lies. Competition in the markets has never been stronger, making it harder than ever to earn the elusive market outperformance that so many institutional investors actively seek. Forbes Welcome. Lew. Everything You Need to Know About Bonds. What is a bond?

The bond market is by far the largest securities market in the world, providing investors with virtually limitless investment options. Many investors are familiar with aspects of the market, but as the number of new products grows, even a bond expert is challenged to keep pace. Once viewed as a means of earning interest while preserving capital, bonds have evolved into a $100 trillion global marketplace that can offer many potential benefits to investment portfolios, including attractive returns.

EconomPic: A Dynamic Approach to Factor Allocation. Everything You Need to Know About Bonds. Re-reading is inefficient. Here are 8 tips for studying smarter. Bernanke, in First Crisis, Rewrites Fed Playbook. Searching for a Summer Internship? Mod Note (Andy): Bumped this back up from winter 2010 and it is still useful, but even more companies and banks are listed in the WSO Company Database (with e-mail formats) If you're still on the internship hunt, no worries - lots of boutique investment banks wait to do their hiring until the Spring.

Check-out the list of banks that I put together for potential leads and a Q&A video below. Original Post: I recently joined the WSO team in September to run Wall Street Mentors, and our goal is to provide the members of WSO the ability to receive personalized job search help, mentoring, interview prep from professionals that have 10+ years at top finance firms (Goldman Sachs, Bain Capital, Morgan Stanley, McKinsey, etc.).

How much do changes in interest rates affect the profitability of the insurance sector? Interest rate risk for insurance companies is a significant factor in determining profitability.

Although rate changes in either direction may affect insurance company operations, insurance company profitability typically rises and falls in concert with interest rate increases or decreases. Changes in interest rates can affect the assets and the liabilities of an insurance company. Insurance companies have substantial investments in interest-rate-sensitive assets, such as bonds, as well as market interest rate-sensitive products for their customers.

Drops in interest rates can decrease an insurance company's liabilities by decreasing its future obligations to policyholders. CFO Journal - Chief Financial Officer News - Wall Street Journal - Wsj.com. Yield: Investopedia.com. Discount Bond Definition. Bond Yields: Current Yield And YTM Share Video undefined What is a 'Discount Bond' A bond that is issued for less than its par (or face) value, or a bond currently trading for less than its par value in the secondary market.

A bond is considered a discount bond when it has a lower interest rate than the current market rate, and consequently is sold at a lower price. A deep-discount bond is sold at a significantly lower price than par value, usually 20% or more. Advanced Bond Concepts: Yield and Bond Price. Everything You Need to Know About Bonds. Forget Politics: These Are the 2 Biggest Questions the Market Has to Answer... - The Daily Reckoning. Valuation Methods. A company can be separated into its operating businesses or assets and its non-operating assets.

Operating assets are typically the principal sources of a company's revenues, cash flow, and income. Valuation: A Conceptual Overview. In this chapter we will introduce the reader to some key, high-level concepts required to understand valuation and how it’s done on Wall Street.

We will cover three key topics: G Spread for a corporate bond. Differentiating Between Spreads - CFA Level 1. The nominal spread is simply the difference in basis points between the Treasury and non-treasury security.

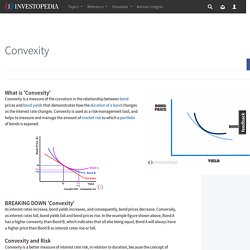

Convexity Definition. Negative convexity exists when the shape of a bond's yield curve is concave.

A bond's convexity is the rate of change of its duration, and it is measured as the second derivative of the bond's price with respect to its yield. Most mortgage bonds are negatively convex, and callable bonds usually exhibit negative convexity at lower yields. BREAKING DOWN 'Negative Convexity' Typically, when interest rates decrease, a bond's price increases. For bonds that have negative convexity, prices decrease as interest rates fall. Wealth Management, Capital Markets, Private Equity, Investment Banking Offered by Baird. Global Investment Outlook Q4 2016 - Insights.

Valeant's stock soars after Morgan Stanley analyst turns bullish. Morgan Stanley's 30 Best Stocks to Own for the Next 3 Years - TheStreet. This story has been updated from April 15 with the additional 22 stocks on Morgan Stanley's list.

Which stocks are best to own for the long term? Morgan Stanley's "30 for 2019" list encompasses 30 quality stocks for investors to own for at least three years, the investment firm said in a research note to clients on Thursday. As investors wade through "numerous cross-currents" currently affecting the markets, such as slow U.S. economic growth, weakness in key overseas economies, low oil prices and negative policy rates from a growing number of central banks, individual equity opportunities are present, Morgan Stanley said. The firm asked its U.S. analysts to identify the "highest-quality" companies in each sector that are "likely to strengthen their sustainable competitive advantage. " Could a Fed Rate Hike Actually Boost Stocks?

The views and opinions are those of the author as of the date of publication and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all portfolio managers at Morgan Stanley Investment Management (MSIM) or the views of the firm as a whole, and may not be reflected in all the strategies and products that the Firm offers. Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors.

MCUs to Power IoT and Semiconductor Growth. Our already hyperlinked world is about to get even more connected. Microcontrollers (MCUs), the tiny sensors that enable connectivity and control in all the “things” around us, have now become so inexpensive—at around $1 apiece—that they can be incorporated in just about everything, from industrial machinery and home appliances to wearable devices and even clothing. In a recent survey of more than 100 key decision-makers who represented automotive, consumer electronics and industrial manufacturing companies, Morgan Stanley Research found that more than 90% of them are baking connectivity technologies into their designs.* This marks a coming inflection point for the Internet of Things (IoT), the next generation of personal computing, which will connect objects and enable them to communicate and interact with each other, users and their environment.

Drivers of Semiconductor Growth, 1960-2030e Sources: Company data, Morgan Stanley Research. Breaking Economic Stagnation. In 2013, Harvard University economist Larry Summers warned that the global economy was in danger of entering a period of “secular stagnation”—a concept created in the 1930s to describe a period of low or nonexistent growth due to a glut of savings and diminished investing. In the past few years, investors have taken this theory to heart, believing that perpetually slow economic growth, low interest rates and subpar investment returns are inevitable. Generations Change How Spending is Trending. Personal consumption is the largest pillar of U.S.

Market Outlook: Less Macro, More Micro. Value Investing 2016: 3 Stocks to Put on Your Radar.