IDEAS Every big idea can be customized for: Keynote speechesEvent emcee and hostingCustom videosVideo anchorExecutive strategy sessionsRound table discussionsCustom webinarsResearch reports To connect with a Constellation Client Services team member, please contact Sales . Dominate Digital Disruption Before It Dominates You Since 2000, 52 percent of the companies in the Fortune 500 have either gone bankrupt, been acquired, ceased to exist, or dropped out of the Fortune 500. Digital Business Reference Architecture Learn’s the right architecture as we move from systems of engagement to systems of experience and then to mass personalization at scale. Five Steps To Digital Business Transformation Over the past 12 months, Constellation has interviewed, researched, or assisted more than 50 market leaders and fast followers crafting a digital transformation strategy. From P2P To Authentic Business Ignore the shift to authentic business at the risk of your company – and potentially your career.

Attention city slickers: Startup accelerator wants to make your life better When Clara Brenner and Julie Lein first came up with the term ‘urban impact entrepreneur,’ they were recent graduates of MIT’s Sloane School of Management. With degrees in hand and years of experience working in real estate, politics, non-profits, and community organizing, they touched down in the Bay Area ready to have an impact themselves. Brenner and Lein are the founders of Tumml, a new ‘urban ventures’ accelerator program that empowers entrepreneurs to solve urban problems. Eighty-one percent of Americans are now living in cities, and yet many entrepreneurs and investors are hesitant to get involved with companies focused on improving city life. “At the same time that more people than ever are living in cities, the fiscal climate means that cities are less able to provide certain services and quality of life,” Lein said in an interview with VentureBeat. The investigation yielded some interesting results. Another challenge is expansion.

Homeland Security warns to disable Java amid zero-day flaw The U.S. Department of Homeland Security has warned users to disable or uninstall Java software on their computers, amid continuing fears and an escalation in warnings from security experts that hundreds of millions of business and consumer users are vulnerable to a serious flaw. Hackers have discovered a weakness in Java 7 security that could allow the installation of malicious software and malware on machines that could increase the chance of identity theft, or the unauthorized participation in a botnet that could bring down networks or be used to carry out denial-of-service attacks against Web sites. "We are currently unaware of a practical solution to this problem," said the DHS' Computer Emergency Readiness Team (CERT) in a post on its Web site on Thursday evening. Java users should disable or uninstall Java immediately to mitigate any damage. The latest flaw, as earlier reported by ZDNet, is currently being exploited in the wild, security experts have warned.

Top tips on developing your Employee Social Network strategy There is a real problem facing the architects of social intranets and Employee Social Networks which has been neatly thrown into relief by our on-going SMiLE survey. It’s a problem anticipated by Gartner when, back in 2013, they said that “80 percent of social business efforts will not achieve their intended benefit through 2015”. The SMiLE survey to date is confirming that those companies attracting more than 50% of regular users are in the minority. What proportion of staff are active (regular monthly) users? When asked what companies were looking to achieve from their new platforms we received a broad catalogue of desirable new capabilities from exchanging knowledge to breaking down silos. However where a company actually asks the staff what they want from a social intranet the wish list is very different. Staff do want to collaborate more - but the emphasis is on sharing burdens rather than sharing knowledge. He believes that to create sustainability in your platform, you need:

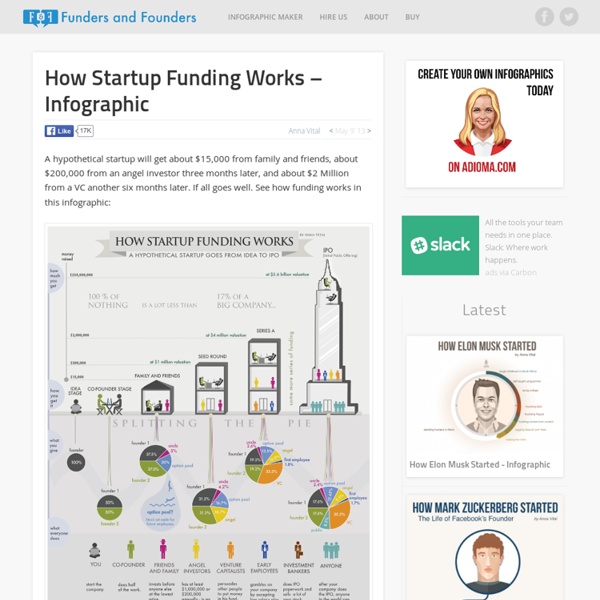

» The “Foundry” Investment Model Startup Rob It’s a great time to be an entrepreneur. The pace of change is continuing to accelerate and startups all over the world are disrupting industries to make processes more efficient. With this trend, we are seeing an incredible uptick in the diversity of ways to fund a startup. Previously, an entrepreneur’s choices were limited: bootstrap or raise funding. Raising funding could be done by going to a bank, seeking out the three Fs (family, friends and fools) or raising the money from an external investor such as an angel or a venture capitalist (VC). These options have been analyzed to death so I’ll quickly skip to the newer (and more interesting) models that are starting to take hold. First off, we’ve seen the advent of crowd-funding sites like Seedrs that allow masses of people to invest in startups that interest them in exchange for equity. While there are negatives to this system it’s a fantastic alternative for startups and investors.

Snake Oil? The scientific evidence for health supplements See the data: bit.ly/snakeoilsupps. See the static versionSee the old flash version Check the evidence for so-called Superfoods visualized. Note: You might see multiple bubbles for certain supplements. This visualisation generates itself from this Google Doc. As ever, we welcome your thoughts, crits, comments, corrections, compliments, tweaks, new evidence, missing supps, and general feedback. » Purchase: Amazon US or Barnes & Noble | UK or Waterstones » Download: Apple iBook | Kindle (UK & US) » See inside For more graphics, visualisations and data-journalism:

Trends Show Crowdfunding To Surpass VC In 2016 – Crowdfunder Blog Read on Forbes The crowdfunding industry is on track to account for more funding than venture capital by 2016, according to a recent report by Massolution. Just five years ago there was a relatively small market of early adopters crowdfunding online to the tune of a reported $880 million in 2010. Fast forward to today and we saw $16 billion crowdfunded in 2014, with 2015 estimated to grow to over $34 billion. In comparison, the VC industry invests an average of $30 billion each year. Meanwhile, the crowdfunding industry is doubling or more, every year, and is spread across several types of funding models including rewards, donation, equity, and debt/lending. And now under new laws enacted in 2013, equity crowdfunding has sprung forth as the newest category of crowdfunding and is further accelerating this growth and disruption. Finance Meets The Collaborative Economy Many of these collaborative economy companies reached over $1 billion valuations within four years or less. VCs can’t scale.

Fancy 6 Months Free In The Italian Alps Building Startups? Check Out TechPeaks A new kind of tech accelerator has launched in one of the more unlikely places: the Italian Alps. TechPeaks (see what they did there?) calls itself a “People Accelerator” because individuals and teams will be able to join it without an idea but a desire to build something. TechPeaks says it will have connections to the local tech university in Trento and its research centre, as well as up to €200,000 equity matching funds post-programme. Individuals or teams with “deep technical or design” expertise can apply before April 5th and – if selected – get six months free housing, free food and a free office in the Italian Alps, plus support to get visas there if needed. In terms of funding, it’s low, but comes in the form of a €25,000 grant, not equity, which might be attractive to some given that none of it needs to go for costs like office space. Drew Nagda, Director of Corporate Partnerships for Lean Startup Machine – a partner – says the programme will use using lean methodologies.

Hollywood Studio Jobs As webmaster of Seeing-Stars.com, I'm frequently asked how to go about getting a job at a Hollywood movie studio. Quite a few people, who are not necessarily interested in becoming actors, still like the idea of landing a job at Warner Bros, Disney, Paramount, Fox, Sony, Universal, Warner Bros. or one of the other major studios. Fortunately, getting information about studio jobs isn't as difficult as you might imagine. Most of the major Hollywood studios have employment sections right on their websites, which list available jobs - from secretarial work to Vice Presidents, and everything in between. Below is a list of links to studio employment pages. When you're finished, come back and take a look around my Hollywood website.