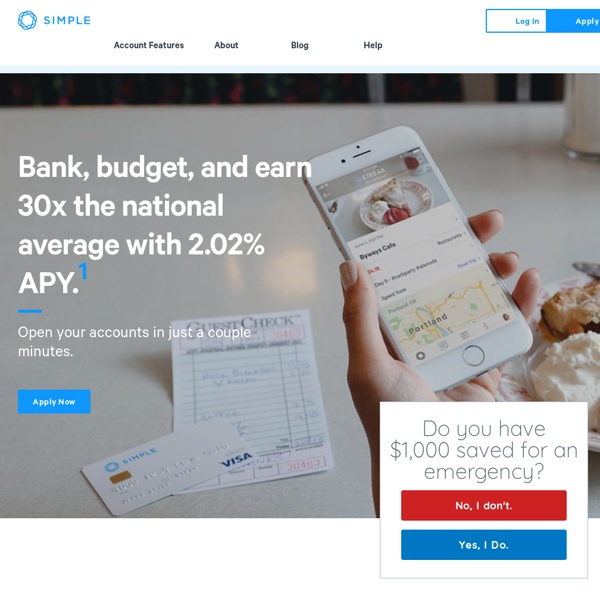

Worry-free Alternative to Traditional Banking

Startup Europe - A manifesto for entrepreneurship and innovation to power growth in the EU

Waspit

Soon

Isaac Paavola

Open Bank Project | Home

20 Fantastic Examples of Flat UI Design In Apps

Flat design is here to stay and this year it’s been a massive trend when it comes to apps. It’s not just because it’s aesthetically pleasing, it’s also because it provides a better user experience for users – if implemented correctly of course. Flat UI design is also brilliant when it comes to responsiveness and trying to fit multiple screen sizes – like with an Android app. Because Android works on so many different screen sizes, it’s actually a good idea to follow flat design, they’re much more responsive. Here are 20 fantastic examples of flat UI design in apps. Author: Oliur Rahman All posts by Oliur Rahman

Lab Partners

A day in Big Data - For Smarter Customer Experiences - OgilvyOne

Related:

Related: