Capitalism's Future Is Already Here - Steve Denning. By Steve Denning | 10:00 AM September 10, 2014 On September 13, 1970, The New York Times published an article by Milton Friedman castigating any managers of businesses who were “spending someone else’s money for a general social interest” – in other words, requiring customers to pay more, employees to be paid less, or owners to accept smaller profits so that the firm could exhibit some amount of social responsibility beyond the requirements of the law.

Already, in his 1962 book Capitalism and Freedom Friedman had declared that “there is one and only one social responsibility of business–to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.” The tight focus on generating returns drove many gains. It hurried along the formation of global supply chains with ever greater efficiency and economies of scale. Mauldin: The Costs Of Code Red. Wave Of Chinese Trust Defaults Coming. How China Can Cause The Death Of The Dollar And The Entire U.S. Financial System. Submitted by Michael Snyder of The Economic Collapse blog, Because Of The Fed "Mortgage Market Liquidity Is As Bad As When Bear Stearns Failed"

David Stockman: "The Born-Again Jobs Scam" Submitted by David Stockman, author of The Great Deformation, No, last week’s jobs report was not “strong”.

It was just another edition of the “born again” jobs scam that has been fueling the illusion of recovery during the entire post-crisis Bernanke Bubble. In fact, 120,000 or 62 percent of the June payroll gain consisted of part-time jobs in restaurants, bars, hotels, retail and temp agencies. The average pay check in this segment amounts to barely $20,000 per year, which is a sub-poverty level income for a family of four, and compares to upwards of $50,000 per year for goods producing jobs in the BLS survey.

Key Trends in Globalisation: Behind China's liquidity crisis. In June, China suffered its worst liquidity crisis in over a decade.

Some sections of the U.K. and U.S. media exploded with wild comparisons to the US financial crisis in 2008. Such comparisons were nonsense, however, based on an elementary economic mistake. The U.S. did not suffer a liquidity crisis in 2008. It faced an insolvency crisis. David Stockman's Non-Recovery Part 4: The Bernanke Bubble. From Part 1's post-2009 faux prosperity to Part 2's detailed analysis of the "wholy unnatural" recovery to the discussion of the "recovery living on borrowed time" in Part 3 (of this 5-part series), David Stockman's new book 'The Great Deformation" then takes on the holiest of holies - The Fed's Potemkin village.

The long-standing Wall Street mantra held that the American consumer is endlessly resilient and always able to bounce back into the malls. In truth, however, that was just another way of saying that consumers were willing to spend all they could borrow. That was the essence of Keynesian policy, and to accept the current situation as benign is also to deny that interest rates will ever normalize. The implication is that Bernanke has invented the free lunch after all - zero rates forever. Implicitly, then, Wall Street economists are financial repression deniers. Business Insider. The phrase “this time is different” doesn’t usually spark very positive reactions.

But I don’t care because there’s one thing about the market these days that makes me think that something is strange when compared to previous bond market sell-offs. If you follow me on twitter you will have noticed that lately I have been talking a lot about asset swaps (ASW). This is a pretty technical concept but I will try to be as straightforward as possible. If you are still reading this then you probably know that in the fixed income market we have two broad groups of instruments – cash bonds and swaps. In theory, their yields (prices) should be moving more or less in a parallel fashion because they are interest rates instruments. I have learnt to pay a close attention to moves in ASWs, just like I very closely monitor moves in cross currency basis because they can reveal pretty significant market developments.

Why I Invested in Bitcoin The weeks of speculation about whether JPMorgan Chase & Co.

Chairman and Chief Executive Officer Jamie Dimon would be forced to give up one of his titles has ended. I didn't take a side in the battle, if only because I couldn't get beyond the threshold questions: “Why does anyone even care, and why do we believe we are still beholden to people like this?” Since the 2008 financial crisis, we have seen a massive decline in trust in the financial services industry: Lehman Brother, Bear Stearns, American International Group, the "London Whale," Cyprus and a host of lesser scandals have prompted consumers to say one thing loud and clear: “I don’t trust you.”

Or "You're only in it for yourself.” Or “Who made you king?” Will It Be Inflation Or Deflation? The Answer May Surprise You. Submitted by Michael Snyder of The Economic Collapse blog, Is the coming financial collapse going to be inflationary or deflationary?

Are we headed for rampant inflation or crippling deflation? The Rout In Spain. From Mark Grant, author of Out Of The Box There Are Those Weeks The Rout in Spain Overnight the shares of Bankia plunged 51.4%.

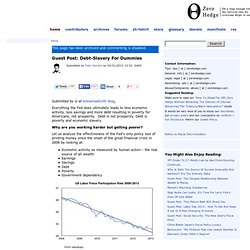

This, by any definition, is a rout. The citizens of Spain had bought preferred shares, hybrid bonds on the basis of an "implied guarantee" from the sovereign. No such luck. “There are decades where nothing happens; and there are weeks where decades happen.” Watch out for those weeks! Debt-Slavery For Dummies. Submitted by G at Knowmadiclife blog, Everything the Fed does ultimately leads to less economic activity, less savings and more debt resulting in poverty for Americans, not prosperity.

Debt is not prosperity. Debt is poverty and economic slavery. David Stockman Is Outraged. A few years ago I walked around David Stockman’s backyard.

I was admiring his stone walls. We fell into a conversation about rocks and masons. David has a good eye for stone, and he knows the proper way to lay it up (A balance of symmetry and chaos, with the least amount of mortar possible). I was pleased to learn that he holds stone masons (all artists) in much higher regard than lawyers, bankers and politicians. My kinda guy. How the Banking System Is Destroying America.

Reclaiming the Founding Fathers’ Vision of Prosperity To understand the core problem in America today, we have to look back to the very founding of our country. The Founding Fathers fought for liberty and justice. But they also fought for a sound economy and freedom from the tyranny of big banks: “[It was] the poverty caused by the bad influence of the English bankers on the Parliament which has caused in the colonies hatred of the English and . . . the Revolutionary War.” - Benjamin Franklin “There are two ways to conquer and enslave a nation. Hyperinflation? No. Inflation? Yes.

Why the Euro Is Doomed in 4 Steps. (Reuters) We're going to need a bigger acronym. Fraudulent Guarantees; Fictional Reserve Lending; Comparison of US to Cyprus; What About New Zealand? Reader "MB" who lives in New Zealand is concerned about confiscation of deposits. He writes ... Hi MishApparently articles are appearing in a NZ newspaper editorials saying that the NZ government has the same policy of confiscation as that being used on Cyprus by the EU. In the event of a banking crisis, the government will be able to take deposit funds to bail out a bank.MB Theft?

A letter to the Reserve Bank of New Zealand states Reserve Bank policy looks like theft. Open Bank Resolution (OBR) Policy. 10 Examples Of The Clueless Denial About The 'Real' Economy. Submitted by Michael Snyder of The Economic Collapse blog, Denial Is Not Just A River In Egypt: 10 Hilarious Examples Of How Clueless Our Leaders Are About The Economy They didn't see it coming last time either. Back in 2007, President Bush, Federal Reserve Chairman Ben Bernanke and just about every prominent voice in the financial world were all predicting that we would experience tremendous economic prosperity well into the future.

In fact, as late as January 2008 Bernanke boldly declared that "the Federal Reserve is not currently forecasting a recession. " A Sudden Rumbling In The Repo-sphere Sends 10 Year Treasury Shorts Scrambling. Kyle Bass Warns "The 'AIG' Of The World Is Back" Kyle Bass, addressing Chicago Booth's Initiative on Global Markets last week, clarified his thesis on Japan in great detail, but it was the Q&A that has roused great concern. America's Tragic Future In One Parabolic Chart. Seeking Alpha. Views are sharply divided amongst economic analysts regarding whether inflation poses any serious threat to the US economy. One group argues that Fed "money printing" through QE is certain to cause inflation. Currency Wars Return, 1930s Style: Who Will Lose Out?

"Ask Questions Like a Child" I received an interesting email the other day on debating Paul Krugman. I did a search on the topic and found a post with that exact name: How to debate Paul Krugman. Welcome to Forbes. This Is What 1,230 Days (And Counting) Of Explicit Market Support By The Federal Reserve Looks Like. The Treasury Has Already Minted Two Trillion Dollar Coins. A Bold Dissenter at the Fed, Hoping His Doubts Are Wrong. 20 Facts About The Collapse Of Europe That Everyone Should Know. James Buchanan (1919-2013): He Saw Our Present Spending Disaster Coming. PIMCO's Gross On Free Money And Inflation. Mr. William H. Gross, the founder, managing director and co-CIO of PIMCO discussed in an article his investment outlook, views on Bernanke, inflation and investment conclusions. The Federal Reserve Has No Practical Option To End QE. Dear CIGAs, Such an announcement has been part of QE either from MSM or some Fed board member since it began.

Fed Exit Plan May Be Redrawn as Assets Near $3 Trillion. A decision by the Federal Reserve to expand its bond buying next week is likely to prompt policy makers to rewrite their 18-month-old blueprint for an exit from record monetary stimulus. The Keynesian Revolution Has Failed: Now What? EC391 >>>>>> EC101. Fed won’t bend if bond vigilantes attack U.S. Inflation Targeting And Fed-Sponsored Bubbles. No Undue Fallout From Money Printing. What Fiscal Cliff? Obama Planning Another "Tax Cut" Fiscal Stimulus. GDP - The Warning Signs From Exports. Why Did The Bundesbank Secretly Withdraw Two-Thirds Of Its London Gold? Top Client Question: Can Central Banks Just Cancel Sovereign Debt. Bernanke Set To Unveil Number Larger Than "Eternity"

Will Central Banks Cancel Government Debt? Hyperinflation Is A Myth. This Is Why, To An Economist, QE Refuses To Work. Destroying The Myths Of Bernanke's Brave New World Of QEtc. Are Businesses Quietly Preparing For A Financial Apocalypse?

Energy Prices Caused the Recession? Real Estate Center at Texas A&M University. US to Experience Stagflation Worse Than 1970s: Jim Rogers. Art Cashin Offers A Huge Lesson On Weimar Hyperinflation, And The Roots Of Today's Crisis. MARK CUBAN: 'Tax The Hell Out Of Wall Street And Give It To Main Street' How To Gain Market Access If Your Business Idea Is Ahead of Its Time. Goldman Tells Clients To Short US 10 Year Treasurys. WTF Did All That Printed Money Go? Canada’s pension funds: Maple revolutionaries.

Guess Who's Buying All the Bonds? (It's Not the Fed) David Kotok: I'm Worried. Air Cargo Volume Points To A Sharp Decline In Global Industrial Production. The economic ignorance gap between liberals and conservatives. How Much Lower Can Treasury Yields Go? The Most Important Charts In The World. The Most Important Charts In The World. UBS Issues Hyperinflation Warning For US And UK, Calls It Purely "A Fiscal Phenomenon" Falling Interest Rates Destroy Capital. The Global Financial System Can and Will Collapse Thanks to Europe... Are You Prepared? ART CASHIN: We Are At Risk Of Hyperinflation. The Credit Illusion. A Radical Way To Build New Companies (Not Just Web Startups), Create Jobs And Boost The Economy. Is the Market Rally Just a Set-Up for a Bigger 'Collapse'? - Business News.

El-Erian Says Be Wary of Steepening Yield Curve: Tom Keene. Deleveraging Needed In Next 4 Years: $28 Trillion. In A Paper System, All Assets Are Backed by the Treasury Bond. A new breed of tax-efficient cross-border income trusts. Hedge funds are betting on disaster. Fed Wants Inflation Now, Will Clean Up 'Mess' Later: El-Erian. Fed Virtually Funding the Entire US Deficit: Lindsey. Fed Watchers Join QE Debate With Scathing Words. Pay Inequality Makes for Better Science. U.S. downgrade seen as upgrade as $4 trillion debt dissolved. Steve Wynn Attacks Fed Monetary Policy.