If You Don't Like Capitalism or State Socialism, What Do You Want? By Gar Alperovitz The very first book I wrote—my Ph.D. thesis, basically—was on the bombing of Hiroshima.

An odd place to start. The puzzlement for me was why this country and its leaders, knowing there were alternatives—which is now established as fact—nevertheless went ahead with those bombings. What was the nature of our culture, the expansionism that created it, and the system that had driven it, which led us to do that? Vietnam and Korea, Iraq and Afghanistan, the World Bank and the IMF—what were they all about? The flaw is an odd kind of imperialism. I've worked at high levels of the U.S. government, including the Senate. This situation has led me to the kinds of questions that I think are being posed by Occupy Wall Street and the young people who have spoken here today.

It's Time For Breakthrough Capitalism. There are periods of creative destruction when an old, dying order comes apart at the seams, opening up the space for a new order currently struggling to be born.

That’s what the Austrian economist Joseph Schumpeter told us, mapping the cycles. And now here we go again. A decade or two from now, the "long year" straddling 2011 and 2012 will likely be seen as one of those pivotal transitions, like when the development of "breakthrough" steam engines fueled the Industrial Revolution. The question is whether our incrementalist mindsets (think of the disappointingly weak outcomes of this year’s Rio+20 summit) will trigger a vicious downward spiral toward breakdown--as seems possible in the Eurozone crisis or with oceanic fisheries--or whether the crisis will spark a positive spiral of innovation which delivers breakthrough business solutions and, ultimately, true system change. Supply, Demand, and Unemployment Benefits. Ben Casselman points out that we’ve had a sort of natural experiment in the alleged effects of unemployment benefits in reducing employment.

Extended benefits were cancelled at the beginning of this year; have the long-term unemployed shown any tendency to find jobs faster? And the answer is no. Let me parse this a bit more, and ask, how was it, exactly, that reduced benefits were supposed to encourage employment in the first place? Making the unemployed miserable arguably increases labor supply, as workers become less choosy and more willing to take whatever job they can find. But the US labor market in 2014 isn’t constrained by supply, it’s constrained by demand: given what firms can sell, they have no need for as many hours of work as workers are willing to give. Dodd-Frank is 3. So why isn’t it ready yet? If that were your report card, you'd fail.

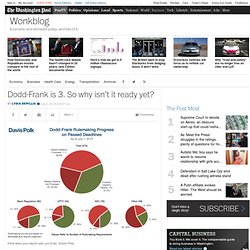

(Davis Polk) Davis Polk, a law firm that tracks rulemaking mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act, is out with its latest progress report, and the results sound pretty dismal. About 70 percent of the 398 deadlines have passed, and out of those, 62.7 percent have been missed. So as the law's third anniversary approaches, less than half of it has been actually implemented. Location Data Is Transforming Mobile. The 'Yuppie Overdraft' Hidden Bank Fee.

Want To Get Bitcoins? This ATM Will Turn Your Banknotes Into Bitcoins. Converting the cash in your wallet to Bitcoin is one of the biggest hurdles to getting some skin in the digital crypto currency game.

Time was when you had to meet a scruffily-dressed Bitcoin owner in person, at a corner street cafe, to get your hands on a few Bitcoins. Bitcoin’s times are changing though. Startup Lamassu Bitcoin Ventures is aiming to simplify the process with its Bitcoin ATM machine (left). It’s showing off a prototype of its tablettop-sized ATM at the Bitcoin London conference taking place today.

Its snappy tagline is ‘fiat to Bitcoin in 15 seconds’ – and in keeping with that promise the process is designed to be as simple as possible. “With our Bitcoin machine… you don’t need the bank’s approval to start running these Bitcoins machines. In keeping with the nascent Bitcoin ecosystem, the first prototype of the machine was only created in the founders’ garage back in February.

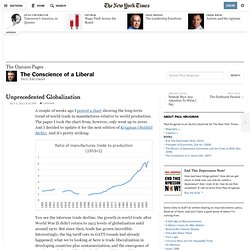

Banks & Money. Unprecedented Globalization. A couple of weeks ago I posted a chart showing the long-term trend of world trade in manufactures relative to world production.

The paper I took the chart from, however, only went up to 2000. And I decided to update it for the next edition of Krugman Obstfeld Melitz. And it’s pretty striking: You see the interwar trade decline; the growth in world trade after World War II didn’t return to 1913 levels of globalization until around 1970.

Economists. Robert Shiller on Human Traits Essential to Capitalism. Your last three picks are all very recent books.

Tell me about Nudge. We’re now coming up to 2008, when Richard Thaler and Cass Sunstein published this book. It looks quite a bit different from the first two in that it reflects much more modern psychology. Economics. Economics. World Economy. Paul Krugman: War On the Unemployed.