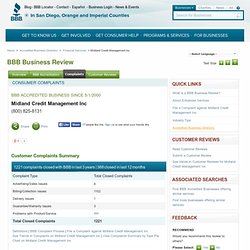

Consumer Complaints for Midland Credit Management Inc - BBB serving San Diego, Orange and Imperial Counties. Additional Notes Complaint: Midland Funding LLC, a.k.a.

Midland Credit Management continues to report an invalidated and unverified debt on my Credit Report. In August 2013, I disputed the Midland tradeline, reflecting account # ****** (as reported on my credit reports). Per all 3 credit bureaus, in September 2013, Midland verified the accuracy of this tradeline and its reporting. Therefore, in December 2013, I followed the advice of the credit bureaus to contact Midland directly (see copy of letter attached with valid proof of delivery from the United States Postal Service EXHIBITS A & B). In this letter, I specifically cited the ***** Finance Code and Business and Commerce Code. **********: Account Type listed false, also being reported as an installment loan (and no installment agreement ever entered with Midland), Last Payment Made inaccurate, Original Amount reported inaccurate, Loan Type being reported inaccurately, Date Paid inaccurate, Date of First Delinquency discrepancy.

Dealing with Debt Collectors - getoutofdebtfree.org. Three Options for Dealing with Debt Collectors Info - Please read carefully. Make sure you've read Getting Startedand also read Hints and Tips in the right margin. 1 Option one- Address Unknown Stickers the 'easy option' - very simple and effective The Getoutofdebtfree Addressee Unknown stickers, work very effectively with debt collectors.

As the name on the envelope will have Mr/Mrs/Miss/Ms etc. this is referring to your 'person' or corporate fiction/strawman. (for a simple explanation of your 'person' watch 'Strawman, The Nature of the Cage' Click here to see it) Tip - They should be the right size for the Avery L7163 label format making it easy to stick on your envelopes. If you do not have a Word installed, get a copy of OpenOffice for Windows users, or LibreOffice if you are using a Mac.

You can order the sticky label from Amazon here amazon.co.uk/Avery-Printer-Labels Download Addressee Stickers 2 Option two- Standard Template Letters The three letter process for Debt Collectors Bill. A4V. You Can Discharge Almost Any Debt with Proper Use of the UCC. You Can Discharge Almost Any Debt with Proper Use of the UCC You can discharge Secured Loans, Credit Card Debt, Student Loans, Auto Loans, Assessments, Citations, Debts, Demands, Fines, Penalties, Tax Liens and Judgments.

Debt Discharge and “Accepted for Value” is based on understanding how you've been mislead and learning what to do about it. You just have to know How to Do It! The History of How We Were Put Into the “Commerce Game” On April 5, 1933, then President Franklin Delano Roosevelt, under Executive Order, issued April 5, 1933, declared: "All persons are required to deliver on or before May 1, 1933 all Gold Coin, Gold Bullion, and Gold Certificates now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal Reserve System. " James A. Criminal Penalties for Violation of Executive Order $10, 000 fine or 10 years imprisonment, or both, as provided in Section 9 of the order. Section 9 of the order reads as follows: We Were Never Told STRAWMAN.

CHARGE BACK ORDER 10-03-08_001. Start To Finish Winning Against Midland Funding Aka Jdb! - Is There a Lawyer in the House - Credit InfoCenter Forums. Do It Yourself Credit Card, Secured & Unsecured Debt Elimination, Redemption Program & More. Do It Yourself Credit Card, Secured & Unsecured Debt Elimination, Redemption Program & More.

In the Do It Yourself Program you will get a DVD ROM disc approx 4.5 gigs of data with all the instructions and forms you will need to eliminate almost anything in your life from credit cards to traffic tickets to IRS tax liens and more. Take control of your life by taking your identity back from the state and federal governments. This DVD Disc will give you things that your lawyer/attorney most likely does not know or cannot do since attorneys are officers of the court first and legal counsel to you second, meaning they must follow the judges instruction over your instruction, and many were most likely not taught these things in law school. all this is 100% legal and ethical and conforms to the constitution of the united States as it was meant to be by the founding fathers.

Take control and live with greater freedom A sample of the things found on this disc are: Bond forms and instructions. 1. 2. Life, Law, and the UCC. Consumer Complaints for Midland Credit Management Inc - BBB serving San Diego, Orange and Imperial Counties. Use Debt Validation to Make Debt Collectors Verify Alleged Debts. Has a debt collector ever contacted you about a debt that you weren’t sure was yours?

Under the Fair Debt Collection Practices Act, a federal law regulating debt collectors, you can request the debt collector to send proof of the debt through a process called debt validation. Why Request Validation Instead of Just Paying? Debt collectors have been known to send bills for bogus debts so don't assume that a bill from a debt collector is legitimate. The letter may look legitimate, but in this information age, it's easy to obtain enough information about a person and their financial dealings to create a fake debt collection notice. What if you already paid the debt? Understand the Fair Debt Collection Practices Act (FDCPA) - 15 USC 1692 - Fair Debt Collection Practices Act (FDCPA) Explained. If a credit card sold a partial debt to someone then sold the entire debt to a collector what do you do? at DuckDuckGo. Credit card agreement database search result. BBC5.tv. Cease and desist - Mashpedia, the Video Encyclopedia.

Cease and Desist Letter Delbert McClinton - Cease and Desist.wmv Will a Cease and Desist Letter Stop a Collector Z-Ro Cease & Desist FLUORIDATION: CEASE AND DESIST (1/7) (2014 Documentary) Pawn Shop Chronicles Soundtrack - Some Will Be Saved - Cease & Desist.

Debt Collectors Killing Your Credit? Here's What To Do. “I want to clean up my credit.

How do I take care of collection accounts?” It’s a question we hear often, often from readers like Kim, who wrote on the Credit.com blog: I have to admit that I have a few collection accounts… Until a year ago, I just stuck my head in the sand and completely ignored the debt because it seemed too overwhelming to tackle. But now I’m trying to face my fears and eventually reclaim my “good/excellent” credit score standing.

If your credit report lists one or more collection accounts, here’s how to tackle them in five steps. [Credit Score Tool: Get your free credit score and report card from Credit.com] Step 1: Figure Out Who You Owe This may sound simple enough, but if more than one of your accounts has gone into collections, or if any of those accounts are older, it can get confusing. He suggests several approaches to tracking down what you owe: Contact the original creditor to find out whether they have placed it with a collection agency. Step 3: Pay What You Can.