Britain's Economy Is a Disaster and Nobody Is Entirely Sure Why - Matthew O'Brien. Britain's GDP fell again in the fourth quarter of 2012, raising the specter of a triple-dip recession.

What explains poor growth in the UK? The IMF thinks it's fiscal policy. The Austerity Delusion? The macroeconomic magic button. In a recent post on the Eurozone, I talked about an idea from Greek economist Yanis Varoufakis, where he imagined leaders were presented with a magic button that would end their countries macroeconomic woes.

He said that leaders in the US and UK would surely press the button, but he was doubtful about Germany. I commented as an aside that I thought he was wrong about the UK, because that button exists, and it is called balanced budget fiscal expansion. (I think he is right about the US, if the only hand needed to press the button was the President. However my arguments below probably also apply to many Republicans.) The idea is to temporarily increase government spending, and pay for it completely by temporarily raising taxes.

UK Growth reveals a major macroeconomic policy error. It's not too late to change course: Macbeth and fiscal policy. Austerity Doesn’t Pay as Debt Markets Ignore Rating Cuts. Britain is forcing Stephen Jobling and his stroke patients to defend the nation’s AAA credit rating.

Staffing at the National Health Service hospital ward where Jobling works was reduced by about half in the U.K.’s deepest drive since World War II to shrink its deficit. The goal was to avoid losing the top credit score, which might risk higher interest expenses, according to the government of Conservative Prime Minister David Cameron.

“If they could see these people suffering while we have two members of nursing staff running round trying to wash, dress and feed 20 patients, they would think twice,” says Jobling, 27, a nurse at Lincoln County Hospital in eastern England. “You should be looking after your people. You shouldn’t be bothering about some credit agency from somewhere else.” George Osburne and Crowding-out. Paul Krugman reminds us of a June 22, 2010 speech by George Osburne where he made his case for fiscal austerity.

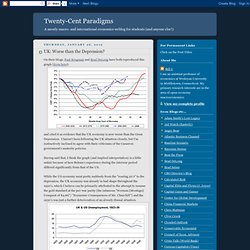

These words jumped out at me: Higher interest rates, more business failures, sharper rises in unemployment, and potentially even a catastrophic loss of confidence and the end of the recovery ... An economy where the state does not take almost half of all our national income, crowding out private endeavour. The entirety of this speech reads like standard Republican fare with its call for cuts in government spending but no new taxes. To be fair, however, the advice given by the members of the Council of Economic Advisors to President Lyndon Johnson back in 1966 worried about higher interest rates and crowding-out. The politics and economics of Austerity. Worse than the Depression? On their blogs, Paul Krugman and Brad DeLong have both reproduced this graph (from here):

Is austerity self-defeating? Of course it is. Both Osborne and Balls get it wrong. The reaction of politicians to Moody's decision to put the UK's AAA rating on "negative outlook" was predictable - and predictably tendentious. The Chancellor described it as "proof that, in the current global situation, Britain cannot waver from dealing with its debts" while the Shadow Chancellor said it was a "significant warning. " They are both wrong. It proves nothing and signifies less. What’s wrong with Britain? First a small point.

Why is it so hard to find NGDP data for Britain? There’s been lots of press coverage of the 0.8% (annual rate) decline in RGDP during the 4th quarter, but I can’t find the NGDP data. Without NGDP data, RGDP is hard to interpret. “Never reason from a quantity change.” The 2007/8 financial crisis. ACEVO%20Youth%20Unemplyment_lo_res. Sovereign ratings when default can come explicitly or via inflation. Charles A.E.

Goodhart, 2 February 2012 Inflation in the UK is now more than double that of France, but only one country has had its credit rating downgraded. This column argues that government credit ratings should be aided by a second rating measuring the potential loss of real value, whether by inflation or default. The authorities in Britain are proud of the fact that over the last three centuries there has been no default on British government debt, despite debt-to-GDP ratios climbing to high levels (near or over 200%) after each of the three main wars. Pound Rallies, Gilts Slump After BOE Says Inflation to Reach 5% UK Inflation Set to Start Rising Again. Posted in UK on March 8, 2012TopicsBank of EnglandinflationUKWeimar UK inflation has been falling, driven mainly by a fall in consumer demand, and last year’s VAT increase falling out of the year-on-year comparisons.

Looking under the bonnet, however, reveals a disconnect between inflation of ‘necessary’ and ‘discretionary’ goods. The inflation of ‘necessary’ goods is falling, while that of ‘discretionary’ continues to steadily rise. When people perceive that inflation will erode their savings, they are more likely to spend now, even on items that are not essential.