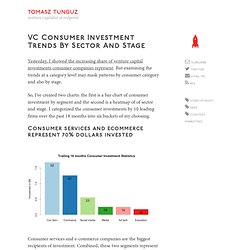

VC consumer investment trends by sector and stage. Yesterday, I showed the increasing share of venture capital investments consumer companies represent.

But examining the trends at a category level may mask patterns by consumer category and also by stage. So, I’ve created two charts: the first is a bar chart of consumer investment by segment and the second is a heatmap of of sector and stage. I categorized the consumer investments by 10 leading firms over the past 18 months into six buckets of my choosing. Consumer services and ecommerce represent 70% dollars invested Consumer services and e-commerce companies are the biggest recipients of investment.

Data on the “seedpocalypse” Call it what you like.

Micro VC’s and Super Angels Two Years Later – Looking Back and Some Predictions for the Future - peHUBpeHUB. I was surprised to find that it has been more than two years since my post summarizing the state of the seed stage market, and trying to bring a balanced view on the rise of Super Angels and Micro-VC’s.

See that original post here. The venture capital market continues to be in transition, and a lot of changes have occurred in the early stages of the market. In some ways, many of the forces that drove the rise of MicroVC’s are as strong as ever. But there are also a whole host of new questions that have arisen. Here’s my take on the state of things as they stand at the end of 2012. THE DEDICATED SEED STRATEGY CONTINUES TO HAVE STRONG BENEFITSI call “dedicated seed funds” ones that at their core, make seed investments. Given this definition, we continue to see dedicated seed funds providing strong benefits for founders, including: - Minimal signaling risk at the next round of financing.

The Evolution of Angels into VC's - robgo.org. The Evolution of Angels into VC’s June 21, 2011 We’ve been witnessing an institutionalizing of angel investing in recent years.

For the most part, it’s good. There continues to be a gap in the market for stage appropriate seed investors, especially in the East Coast. There Aren't Many Exits Over $100mm. I was reading Mark Suster's latest blog post (actually its a presentation embedded into a blog post) and I came across this slide.

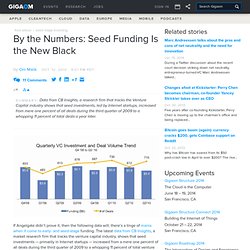

I don't know what the source of this data is and I don't know if this is just M&A exits or if it includes IPOs as well. It really doesn't matter for the basic point that Mark is making with this slide. By The Numbers: Seed Funding is The New Black: Tech News « If Angelgate didn’t prove it, then the following data will; there’s a tinge of mania when it come to early- and seed-stage funding.

The latest data from CB Insights, a market research firm that tracks the venture capital industry, shows that seed investments — primarily in Internet startups — increased from a mere one percent of all deals during the third quarter of 2009 to a whopping 11 percent of total venture investment deals during that period in 2010. The sharp increase in seed-stage investments is the sole reason the total number of venture investments jumped during the third quarter of 2010 even though overall funding dropped. Nearly $5.4 billion was invested in 715 deals during that time frame, CB Insights’ data reveals. All that essentially made for one hot summer. Here is some salient data from CB Insights’ latest report covering the July – September time frame: Nearly $1.253 billion was invested in 233 Internet related deals. Related content from GigaOM Pro (sub req’d): The $4 Million Line. I wrote about two startups today that raised angel-sized financing rounds of around $1 million each: Hipmunk and Alphonso Labs.

What caught my eye about both deals is this – neither had involvement from the so called “super angels” (except Hipmunk, which took an investment from SV Angel). Hipmunk raised from traditional individual investors. Alphonso Labs raised money from venture capitalists. Super Angels are investors who previously invested only their own money but at some point raised small funds and started investing third party money. VC 'Super Angels': Filling a Funding Gap or Killing 'The Next Google'?

Venture capital firms are in the business of funding promising entrepreneurs.

The conventional wisdom, which some say has fallen by the wayside as older firms have matured, is that returns are better when VC firms are entrepreneurial — nimble, forward-looking, well connected and armed with an appetite for risk. A new crop of investors — dubbed “super angels” — are trying to bring that model back into vogue, making deals that now giant firms like Kleiner Perkins Caufield & Byers and Sequoia Capital might have done in their younger days. Filling a funding gap between so-called “angel” investors and VC firms, super angels combine the traits of both, while also putting a timely, web-savvy stamp on the process of starting and building companies. Super angels are often former entrepreneurs themselves; several came out of companies like Google and Paypal. They are exceedingly well connected among techies, conventional angels, larger VCs and most of all, each other. VCs And Super Angels: The War For The Entrepreneur. It’s a lot like the Cold War – most of the really interesting fights among startup investors – and there are lots of them – occur behind the scenes.

Publicly everyone gets along just great. But declining returns, too much capital and the disruptive force of a new breed of angel investors has created enough tension in the system that some frustrations are beginning to boil over. And in some cases, the gloves are coming off. And entrepreneurs can and do get caught in the cross fire. Pick the wrong investor and you’ve closed the door on others. Until very recently there was an established pecking order with venture capitalists. Today things are much more complicated. But the last several years have seen the rise of the cheap startup. The Future of Startup Funding. August 2010 Two years ago I wrote about what I called " The opportunity is a lot less unexploited now.

Some Thoughts on the Super Angel Funding Discussion - Continuati. Some Thoughts on the Super Angel Funding Discussion. [Updated] The Coming Super-Seed Crash. Unnoticed by almost no-one, the startup financing landscape has been transformed: a combination of ease of entry, lower capital requirements, failing incumbent venture capital (VC) firms, and general fervor has driven the emergence of a host of new “super-seed” firms.

These small-ish outfits — usually running less than $20m — specialize in seeding a bazillion companies, following on in very few, and generally trying to be fast-moving and networked. Now, however, the super-seed crash is coming. We have silly numbers of companies being seeded — I had someone at a well-known, larger venture fund tell me yesterday in San Francisco that they were seeing dozens of Series A-seeking newly angel-funded companies a week. It’s not that seed investors are smarter – it’s that entrepreneurs are cdixon.org – chris dixon's blog. Some Thoughts On The Seed Fund Phenomenon. There have been quite a few posts written about this meme in the past few weeks.

I think that Paul Kedrosky got the discussion started with this post. Chris Dixon wrote an interesting response. And yesterday John Boyd wrote a thoughtful post on the topic. The Rush to Early Seed Stage: Later Stage Implications and Top 7 Mature Themes. It’s Still Expensive to Build a Great Product. Making Sense of Micro-VC's and Super Angels - A Primer - robgo.org. Making Sense of Micro-VC’s and Super Angels – A Primer June 29, 2010 For better or worse, Micro-VC’s and Super Angels seem to be the new intriguing sub-segment within Venture Capital. Funds like First Round Capital, Floodgate, Lowercase, Founder Collective, IA Venture Partners, Harrison Metal, and Felicis and individuals like Ron Conway, Keith Rabois and others show up multiple times a day on TechCrunch and seem to be behind every high profile investment in the internet world.

How did this happen? MoneyBall for Startups: Invest BEFORE Product/Market Fit, Double-Down AFTER. My apologies... this is a long piece (~2500 words). Not for the faint of heart. If you want the short story, read the abstract below & 3 core assertions, then cut to the conclusions at the bottom. Abstract: VC funds are getting smaller (good), & angel investors are growing (also good), but both need to get smarter & innovate.

Startup costs have come down dramatically in the last 5-10 years, and online distribution via Search, Social, Mobile platforms (aka Google, Facebook, Apple) have become mainstream consumer marketing channels. Meanwhile acquisitions are up, but deal sizes are down as mature companies buy startup companies ever earlier in their development cycle. Dave McClure's Investment Thesis. Greylock Gives Super Angel-Turned-VC Reid Hoffman A $20 Million Seed Fund. LinkedIn co-founder Reid Hoffman is undoubtedly one of the Valley’s most prolific angel investors. Hoffman has made angel investments in Digg, One King’s Lane, Facebook, Flickr, Last.fm, Ning, Six Apart and Zynga.

Last November, Hoffman joined VC firm Greylock as a partner, making all his future angel and seed investments through the VC fund. Today at TechCrunch Disrupt, Greylock Partners and Hoffman have announced a $20 million fund solely for seed and angel investments. ‘Super angel’ Aydin Senkut raises $40M fund. Felicis Ventures, the firm created by early Googler (and VentureBeat investor) Aydin Senkut, just announced that it has raised $40 million. It’s the firm’s first institutional fund. Felicis says it will continue to focus on early-stage mobile and Internet investments.

Senkut has invested in more than 60 startups, and 15 of them have already been acquired.