Lessons for Asia’s financial development. Author: Barry Eichengreen, UC Berkeley The Asian financial crisis of 1997–98 and then the global credit crisis of 2008–09 raised new questions about the connection between financial development and economic growth.

The Asian crisis caused observers to ask whether the region’s bank-based financial systems maximised brute-force capital accumulation at the cost of efficiency and stability. This then led to a push to develop securities markets at the national and regional levels. The 2008–09 crisis centred on the advanced economies then cast doubt on securities markets as efficient allocators of resources and on the efficacy of universal banks combining commercial and investment-banking functions.

Yi Gang: China's Forward-Thinking Forex Chief - Asia Bond Monitor - November 2013. Description Bond markets in emerging East Asia have regained some of their recent losses as global financial markets have stabilized.

China’s rising stature in global finance. China, as the world’s largest saver, has a major role to play in the global financial rebalancing toward emerging markets.

Today, these countries represent 38 percent of worldwide GDP but account for just 7 percent of global foreign investment in equities and only 13 percent of global foreign lending. Their role seems poised to grow in the shifting postcrisis financial landscape, since the advanced economies face sluggish growth and sobering demographic trends. As a lead player in that shift, China could become a true global financier and, with some reform, establish the renminbi as a major international currency. Yet a long-closed economy—even one with more than $3 trillion in foreign reserves—can’t swing open its doors overnight. China’s domestic financial markets will have to deepen and develop further, and returns earned by the government, corporations, and households must rise if the country is to attract and deploy capital more effectively.

Exhibit 1 Enlarge Exhibit 2. China’s rising stature in global finance. This one number explains how China is taking over the world. Financial powerhouse?

Just maybe. (CATHERINE HENRIETTE/AFP/Getty Images)) An announcement Tuesday by the obscure-sounding Society for Worldwide Interbank Financial Telecommunication, better known as SWIFT, may not get much ink. China's currency, it reported, was used in 8.66 percent of global trade finance transactions in October, the group said. It's now the No. 2 most widely used currency for trade finance, supplanting the euro. But that is a lot more important than it might sound.

Let's back up. For decades, that has meant you finance this trade in dollars, and only dollars. The Chinese Yuan May Become the Next Global Reserve Currency. The Chin. Susanne Posel (OC),- The Chinese Yuan is growing in strength on the global market to become the 3rd strongest currency traded by 2015, according to HSBC.

Patrick Young of Derivatives Vision explains: “The hermit is ready to come out of its shell and the sooner the better for China to play a major role in the global economy. The Yuan will take its place as a leading global currency; it is not likely to challenge the dollar’s hegemony for some time.” Young goes on: “The world’s reserve currencies are distributing away from dollar centrality to a broader spread of currencies.

Op-ed: China's Currency Rises in the US Backyard. By Arvind Subramanian, Peterson Institute for International Economics and Martin Kessler, Peterson Institute for International Economics Op-ed in the Financial Times October 21, 2012 © Financial Times The Republican presidential candidate Mitt Romney last week repeated his promise to declare China a currency manipulator on his first day in office.

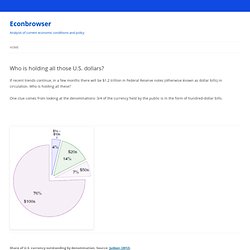

Even discounting the "get tough on China" bluster of the campaign season, this remark encapsulates American distance from, and denial about, changing economic realities. Who is holding all those U.S. dollars? If recent trends continue, in a few months there will be $1.2 trillion in Federal Reserve notes (otherwise known as dollar bills) in circulation.

Who is holding all these? Currency Composition of Official Foreign Exchange Reserves (COFER) P:\IN2010\Final Report 2010.doc - shla2012r.pdf. Asian holding of US Treasury securities: Trade integration as a threshold. Renminbi: Soon To Be A Reserve Currency? Mfh. Shift From U.S. Dollar As World Reserve Currency Underway - What Will This Mean for America? So says Michael T.

Snyder (www.theeconomiccollapseblog.com) in edited excerpts from his original article* entitled 10 Reasons Why the Reign of the Dollar as the World Reserve Currency I About to Come to an End. [NOTE: This post is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the free Intelligence Report newsletter (see sample here – register here). The article may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.] Asia Seeks to Diversify Record Foreign-Exchange Reserves as Dollar Falls.

Asian nations are pooling funds to strengthen regional investment, in a step toward diversifying record foreign-exchange holdings as the U.S. dollar declines.

Ten Southeast Asian nations, along with China, Japan and South Korea, plan to discuss an infrastructure fund to boost investment in roads, ports and utilities at a meeting of finance officials that started today in Hanoi. Policy makers have agreed to look for “new avenues” for reserves, the Philippine central bank chief said last month, urging greater use of China’s yuan. More than a decade after the 1997-98 Asian crisis depleted reserves and forced countries from Indonesia to South Korea to seek bailouts, the region’s holdings have risen to about $6 trillion, half held by China.

Barry Eichengreen on The Renminbi Challenge. Exit from comment view mode.

Click to hide this space SEOUL – Last month, China unveiled its first aircraft carrier, and is gearing up to challenge the United States in the South China Sea. By initiating a plan to internationalize its currency, China is similarly seeking to challenge the dollar on the international stage. Asia's Financial Sector: 12 Things to Know. Allowing free capital flows is fast going out of fashion. Hopes are high that when Premier Li Keqiang launches Shanghai's new free-trade zone this weekend, he will announce a major opening up of the mainland's financial system. But if Li is indeed planning a big relaxation of Beijing's strict controls on cross-border capital flows, he will be swimming against the tide of international economic thought.

For decades economic orthodoxy dictated that emerging economies should open up their financial systems. Any backsliding was roundly condemned, as in 1998 when in the depths of the Asian currency crisis Malaysia banned free capital flows to stabilise its currency, the ringgit. Recently, however, orthodox opinion has reversed. In the future, capital controls could prove not just useful, but essential, for some markets.

Hong Kong: The future of Asia's financial hub - Counting the Cost. Hong Kong is the global financial centre which just keeps booming despite regional and global financial crises and all the speculation that its future was in jeopardy. Nearly 15 years after the transition to Chinese rule, Hong Kong still reigns in Asia as the financial hub of choice. But few foresaw its staying in power. The 1995 Fortune magazine cover announced "The Death of Hong Kong". It assumed the "one country two systems" idea was doomed to fail, that influence from Beijing would end the business-friendly climate and financial freedom that made Hong Kong work as a regional hub.

Hong Kong has been very lucrative during China's boom years and as such its status as a gateway is secure. But it is not tension free, especially with the election of a new leader this week, the chief executive of Hong Kong.