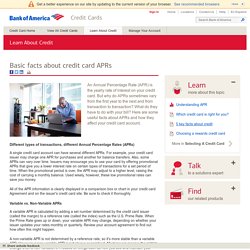

Understanding Credit Card APR (Annual Percentage Rate) Remember that different rates can be applied to different types of transactions made with the same card.

This means that transferring a balance from another card may be more or less expensive over time than purchases made with the same card, when considering the overall cost of carrying a balance. Perhaps your APR for balance transfers is zero, and your APR for new purchases is 15%. When you make a payment against the outstanding balance, your credit card issuer will apply any amount you pay above your total minimum payment toward your balance with the higher rate (in this case, your new purchases). However, if you pay only the total minimum payment, your credit card issuer may apply it to the balance with the lowest rate first. This should motivate you to pay more than the minimum payment, since the higher rate portion of any outstanding balance will grow faster over time. Remember: If you make a late payment or miss a payment entirely, you may be subject to a Penalty APR. Credit Cards - What You Need To Know - Training Manual.

Updated: February 14, 2011 View mobile-friendly version This training manual, written in question-and-answer format, will help give trainers the background they need to help participants understand how credit cards work and that the way they use credit cards can have an important impact on their overall credit.

2012 Fall Issue: Credit Card Comparison Site Survey. Click here for the press release.

Table of Contents Credit Card Comparison Site Survey For more than two decades, Consumer Action conducted its annual Credit Card Survey, compiling the interest rates, fees and obscure terms and conditions that cardholders are subject to. This annual overview and “pulse point” on the industry helped consumers choose credit cards and served as a record of the growth of anti-consumer practices in the industry. The evidence we collected helped get the CARD Act—one of the most successful consumer protection updates—signed into law in 2009. With the rise of the Internet, comparing credit cards has become a business model for dozens of companies.

So, instead of conducting another survey of individual credit cards this year, we take a look at the plethora of card comparison sites to determine which ones offer the most useful and complete information. About the survey. Student Credit Cards - Expert Rated Credit Cards for College Students. If you were a college student in the 2000s, you could get multiple credit cards just by signing your name to the applications.

The Credit CARD Act, which went into effect in 2010, changed the rules, so college students today either need some income or a co-signer to get a credit card. Understanding Credit Card APR (Annual Percentage Rate) Credit card agreement database search result. Credit card agreement from your issuer. By Connie Prater Beginning Feb. 22, 2010, credit card companies were required under the Credit CARD Act of 2009 to make copies of all credit card agreements available to the public, and the major card issuers have begun doing so on their websites (see credit card agreement chart).

What is a card member agreement? It is a contract that spells out the terms and conditions of using a credit card, and penalties that may apply if you miss payments or violate other terms of the agreement. NearPrime_Combined_it. Predatory Lending – How to Recognize It & Laws Protecting Your Rights. Young Adults. Why Reading Disclosures Is Important. A disclosure details all material facts relevant to a transaction.

Federal or state laws require financial institutions to provide disclosures containing information on terms to their customers. Reading disclosures can seem like deciphering a bunch of mumbo jumbo. But, disclosure statements contain the critical information you need to make an informed decision about which financial institution, and its products and services to choose. Disclosure statements are legal documents. You should read the disclosures you receive when you open an account at your credit union. Opening an Account The key sections in a disclosure document at account opening are: Credit Transactions (Loans) The key sections in a disclosure document when taking out a loan are: Disclosure statements provide you with all of the facts that you need to make an informed decision.

Managing Your Credit. To get the most from your credit card, do your homework.

Review your income and expenses, estimate how much money you might have available to pay down your credit card debt, and consider cutting back on, or eliminating, optional expenses. If you've fallen behind, are using cash advances from one credit card to pay off another, or your credit cards are maxed out--that is, at or near your credit limit--there are steps you can take to help yourself.