Corporate credit. Bonds rating. Early Metrics – 1st rating agency of startups and innovative SMEs. Business & Economy - Russia’s national rating agency Akra to focus initially on domestic market — CEO. Welcome. We would like to welcome you at the website of the European Association of Credit Rating Agencies ("EACRA").

EACRA has been established as a platform of cooperation and discussion for Credit Rating Agencies across Europe in November 2009 and currently counts 21 Members (11 ESMA registered CRAs, 2 ESMA certified CRAs, 4 CRAs registered or recognized outside of the European Union and 3 Members active in credit scoring activities). The Members of the association have very different business models while assigning ratings. All are deeply rooted in their respective markets, enjoy a high market share and a good reputation with local investors. You may find our position papers here. If you would like to get the latest news on the industry and the main stakeholders of credit ratings (such as Regulations, International Standards and positions from International Authorities) please visit the News section. Scope Ratings. Fact of the week: Norway is the safest place on Earth.

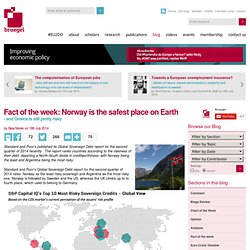

Standard and Poor’s published its Global Sovereign Debt report for the second quarter of 2014 recently .

The report ranks countries according to the riskiness of their debt, depicting a North-South divide in creditworthiness, with Norway being the least and Argentina being the most risky. Standard and Poor’s Global Sovereign Debt report for the second quarter of 2014 rates Norway as the least risky sovereign and Argentina as the most risky one. Norway is followed by Sweden and the US, whereas the UK climbs up to to fourth place, which used to belong to Germany.

The four “eurozone core”’s members (Germany, Austria, Finland and the Netherlands) make up almost half of the top ten, whereas only two “eurozone periphery”’s countries are still among the worst ten. Greece and Cyprus are classified as the 5th and 6th most risky sovereigns, down 2 places and up 1 place respectively. Source: BBVA research Fiscal space rating Financial sector risk Republishing and referencing. France - Baromètres économiques régionaux 2013. Les baromètres économiques régionaux 2013 Chaque semestre, Creditsafe, en partenariat avec Histoire d'Adresses, établit les baromètres économiques de chaque région.

Créations d'entreprises, défaillances, indices sectoriels,... découvrez les chiffres clés, région par région, qui compléteront vos analyses et participeront à vos prises de décisions. La France comptait en 2013, 4 795 582 entreprises actives, soit 496 934 de plus qu’en début d’année, mais une diminution de 4,31 % par rapport à 2012. 24,94 % de ces créations ont été enregistrées en Ile-de-France, championne des régions les plus créatrices avec 123 929 entreprises nouvelles. Suivie par les régions Rhône-Alpes et PACA respectivement en deuxième et troisième positions avec respectivement 10,30% et 10% du nombre total de créations. Spread Research. Preface (online) ARC Ratings.

17.01.2014 - 11:12 - Finance et Investissement Cinq agences de notation provenant de quatre continents s’unissent pour créer ARC Ratings SA qui tentera d’exploiter la perte de crédibilité qu’ont subie Moody’s, Standard & Poors et Fitch durant la crise financière aux Etats-Unis, rapporte Bloomberg Businessweek.

ARC Ratings a été créée jeudi à Londres. Les cinq agences fusionnées proviennent du Brésil, du Portugal, de l'Inde, de la Malaisie et de l'Afrique du Sud. La nouvelle compagnie attribuera des notes aux dettes souveraines, aux compagnies et aux produits structurés. « Les méthodes d'évaluation actuelles sont inadéquates pour évaluer les éléments d'information imprévus qui pourraient changer la façon dont le risque est évalué », a déclaré le chef de notation d'ARC Ratings, Uwe Bott. Les dirigeants de la firme internationale comptent couvrir davantage les entreprises de taille moyenne dans les marchés émergents. Selon Bloomberg Business week. Riskergy. List of registered and certified CRA's. Esma. Cofacerating. Carte des notations pays par Coface.

Egan-Jones. Moody's Analytics. Moody's Analytics helps capital markets and credit risk management professionals worldwide respond to an evolving marketplace with confidence.

Through its team of economists, Moody's Analytics is a leading independent provider of data, analysis, modeling and forecasts on national and regional economies, financial markets, and credit risk. Through its team of economists, Moody's Analytics is a leading independent provider of data, analysis, modeling and forecasts on national and regional economies, financial markets and credit risk. If you ask our clients what distinguishes us from our competitors, the first thing they'll tell you is that Moody's Analytics client service is far and away the best in the industry. Home - GeoEconomica - Political Risk Management.