Going past what is sustainable… Another market failure. There are quite a few shifts happening in the global and domestic economy.

I have been observing for the past week. So many people are getting confused. Here is a list of concerns… China is slowing down.Some emerging markets are facing capital outflows and are tempted to raise their central bank interest rates. Argentina is all over the news now, but we saw in early December here on Angry Bear that there was trouble brewing.Inflation exists in emerging markets leading to more temptation to raise CB interest rates.US stocks have sent a psychological message that their is serious concern for further advancement in the economy. Economic philosophy on the strength of community… One reason earnings might look better… labor share dropped. The stock market is rising again on some positive earnings being reported.

One reason for the nice earnings could be found in another number… the labor share index. The number for the labor share index, 4th quarter 2013, came out today. Pressure to lower prices… Across the Curve has a post about pressure to lower prices… The culprit is the weakness of labor’s income to bolster prices.

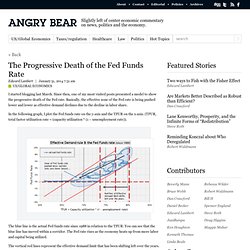

So now many companies are maneuvering to do whatever to cut prices. The last half of 2013 made this clear. Yet, some companies are not going to be successful at this game. These “cost-cutting challenged” companies are hiding in the woodwork… and they will progressively infect economic growth. Jamie Dimon's Raise Proves U.S. Regulatory Strategy is a Joke. The Progressive Death of the Fed Funds Rate. I started blogging last March.

The Ultimate Transparency for Capitalism. Barry Ritholtz is talking about the Bull market coming to an end.

It is no surprise to me. My equations of effective demand may finally be cracking the code of the business cycle. But I want to say that knowing where the business cycle ends is the ultimate transparency in capitalism. Barry, as usual, makes intriguing comments… “Why the sudden shift, from excess bullishness and exuberant expectations of more double-digit gains, to a recognition that perhaps the party won’t go on forever? How the Fed can raise Fed rate without unwinding excess reserves. Comparing methods to determine the Output Gap. David Beckworth made a determination of nominal interest rates using the Output Gap from this paper…Measuring potential output: Eye on the financial cycle, by Claudio Borio, Piti Disyatat, Mikael Juselius.

Determining the output gap correctly in real-time is very important for determining the nominal interest rate and many other factors. It is not good to get the output gap wrong. In the paper they present this graph of output gaps determined by various methods, real-time and ex-post. The red lines are what was given in real-time. The blue lines show what was determined later by looking backward (ex-post).

A study of Financial Repression, part 5… Sneaking into United States policy. The United States does not have the traditional type of financial repression where savers are household consumers who primarily deposit their savings in banks.

And where borrowers are producer firms that primarily borrow at banks. These constraints apply mostly to emerging economies. The key with these constraints is to tie consumption to the return on savings and the cost of borrowing to bank lending rates. In the United States, households have access to a number of different saving options with varying return rates greater than returns on bank savings’ accounts.

A study of Financial Repression, part 4… Ultimately Unstable. From part 3, financial repression expresses in positive ways.

Examples, relative government debt is reduced, economic growth speeds up and exports become more competitive. Then why do most advanced countries steer away from it? Or at least why did they in the past? …Financial Repression eventually leads to an Unstable Economy. Advanced countries know better than to go down this road.

Weak Domestic Demand creates Unrest. A study of Financial Repression, part 3… How does it manifest? When a central bank keeps its base interest rate low, financial repression can manifest.

Well… how does it manifest? What changes do we see in the economy? And what happens when you combine low interest rates with a falling labor share? A study of Financial Repression, part 2… looking for evidence in the US. In part 1, a basic model of financial repression was presented.

Now I apply the model to look for evidence of financial repression in the United States. First I need to give the equations of the lines. Graph #1… Basic model of financial repression. Path of nominal Fed rate = z * (N^2 + T^2) – (1 – z) * (N + T) Natural real interest rate = Path of nominal natural interest rate – inflation target Natural real GDP (N)… where e * (e – T)/(1 + T) goes to zero using regression line. TFUR = capacity utilization * (1 – unemployment rate) z = (2N – w + i)/(2N * (N – w +1) + w * (w – 1))Measure of financial repression = natural real interest rate – (Fed rate – current inflation) A study of Financial Repression, part 1… a basic model.

A study of Financial Repression, part 1… a basic model.