Board Observers Weekly - May 13th, 2014. Board Observers: Will Apple eat Beats with a LaFourchette style ? Two recent consumer tech acquisitions caught my attention because of a couple of similarities in their stories : French restaurant reservation service LaFourchette being acquired by TripAdvisor and the most discussed Apple/Beats upcoming deal.

This may seem counterintuitive because of the differences in terms of sector, business model and scale of the two companies but their product stories sound a bit alike. Both companies established themselves as category-defining market leaders. LaFourchette was a first mover in the online restaurant booking business. Kissing Goodbye to the O’Hare Test — Dream Team. The Current State of the Consumer Internet Market. Last week, we reviewed the state of the public SaaS market and observed the average company had lost 33% of its value from their highs.

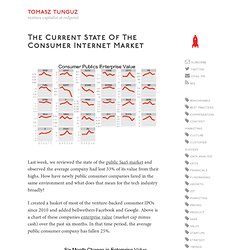

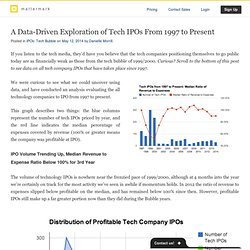

How have newly public consumer companies fared in the same environment and what does that mean for the tech industry broadly? I created a basket of most of the venture-backed consumer IPOs since 2010 and added bellwethers Facebook and Google. Above is a chart of these companies enterprise value (market cap minus cash) over the past six months. In that time period, the average public consumer company has fallen 25%. But this fall isn't broadly distributed across categories. Social has been powered by Facebook's growth driven by their phenomenal mobile ad success, which is offsetting Twitter's decline. Below is a chart showing the difference from peak enterprise value by stock. Quantifying Private Company Growth for Startup Investors. If you listen to the tech media, they’d have you believe that the tech companies positioning themselves to go public today are as financially weak as those from the tech bubble of 1999/2000.

Curious? Scroll to the bottom of this post to see data on all tech company IPOs that have taken place since 1997. We were curious to see what we could uncover using data, and have conducted an analysis evaluating the all technology companies to IPO from 1997 to present. This graph describes two things: the blue columns represent the number of tech IPOs priced by year, and the red line indicates the median percentage of expenses covered by revenue (100% or greater means the company was profitable at IPO). IPO Volume Trending Up, Median Revenue to Expense Ratio Below 100% for 3rd Year The volume of technology IPOs is nowhere near the frenzied pace of 1999/2000, although at 4 months into the year we’re certainly on track for the most activity we’ve seen in awhile if momentum holds. So… Is There A Bubble? Some Reflections on VC Investment Decisions. I was having dinner with a friend last night and we were chatting about venture capital and a bit about what I’ve learned.

I started in 2007 with a thesis that my primary investment decision would be about the team (70%) and only afterward about the market opportunity (30%). I was telling him that it was much easier when I started because there were fewer deals, life was less public and somehow the world seemed to be spinning more slowly.

A year into my tenure the world went into economic collapse and that seemed to dominate the consciousness more than which deals one was chasing. Today we’re in a world where 10 accelerators are bombarding you with emails to meet their 10-15 companies. Seed investors are aplenty and of course they need downstream money to fuel their early-stage bets. And we live in public so many people are able just to reach out. And there’s conferences. Don’t even get me started on Demo Days. I don’t. You have to deal with CEOs who resign.

Bonus. What Startups Are Really Like. October 2009 (This essay is derived from a talk at the 2009 Startup School.)

I wasn't sure what to talk about at Startup School, so I decided to ask the founders of the startups we'd funded. What hadn't I written about yet? I'm in the unusual position of being able to test the essays I write about startups. I hope the ones on other topics are right, but I have no way to test them. So I sent all the founders an email asking what surprised them about starting a startup.

I'm proud to report I got one response saying: What surprised me the most is that everything was actually fairly predictable! The bad news is that I got over 100 other responses listing the surprises they encountered. There were very clear patterns in the responses; it was remarkable how often several people had been surprised by exactly the same thing. 1. Reddit secret plan for world domination. Blinded by the Light – The Epiphany. Epiphany e·piph·a·ny noun /iˈpifənē/ A moment of sudden revelation or insight We now know how to teach entrepreneurs how to think about business models and use customer development to turn hypotheses into facts.

But there is no process to teach how to get an epiphany. We can only try to create the conditions where this might occur. It All Just Came to Me In a Flash Luis, one of the CEO’s from our first National Science Foundation class, came in to speak to our next class. We had a couple of minutes to catch up between sessions and the conversation got strangely awkward when I asked him how their startup was going.