CFTC APPROVES TULLETT PREBON’S SWAP EXECUTION FACILITY. Tullett Prebon plc, one of the world’s leading interdealer brokers, today announces that the Commodity Futures Trading Commission (“CFTC”) has granted temporary registration of Tullett Prebon’s swap execution facility (“SEF”), tpSEF Inc.

CFTC Approves Tullett Prebon's Swap Execution Facility (26. September 2013, 09:33 Uhr) TpSEF is headquartered in New Jersey and is a wholly owned subsidiary of Tullett Prebon.

It has been established to ensure the Company's compliance with Dodd-Frank legislation, enacted on July 21, 2010. Tullett Prebon's SEF is a multi-asset SEF which will offer SEF compliant execution services in the five asset classes covered under Dodd-Frank legislation. The SEF will utilize Tullett Prebon's established electronic broking platforms: tpSWAPDEAL and tpMATCH for rates; tpCREDITDEAL for credit indices; tpFORWARD DEAL, tpMATCH NDF and tpMATCH FXO for FX; tpEQUITYTRADE for equity derivatives; and tpENERGYTRADE for commodities.

Shawn Bernardo is Chief Executive Officer of tpSEF and Chairman of the Wholesale Markets Brokers' Association Americas (WMBAA). CFTC Approves Tullett Prebon's Swap Execution Facility. NEW YORK, NEW YORK--(Marketwired - Sept. 26, 2013) - Tullett Prebon plc, one of the world's leading interdealer brokers, today announces that the Commodity Futures Trading Commission ("CFTC") has granted temporary registration of Tullett Prebon's swap execution facility ("SEF"), tpSEF Inc.

("tpSEF"). tpSEF is headquartered in New Jersey and is a wholly owned subsidiary of Tullett Prebon. It has been established to ensure the Company's compliance with Dodd-Frank legislation, enacted on July 21, 2010. Tullett Prebon Plc : CFTC Approves Tullett Prebon's Swap Execution Facility. Tullett Prebon Gains Most Number One Category Positions in Risk's Interdealer Rankings 2013 for Fourth Consecutive Year. LONDON, UNITED KINGDOM and NEW YORK, NEW YORK and SINGAPORE, SINGAPORE--(Marketwired - Sept. 18, 2013) - Tullett Prebon, one of the world's leading interdealer brokers, has for a fourth consecutive year been voted number one in more categories than any other single broker in Risk magazine's 2013 Annual Interdealer Rankings.

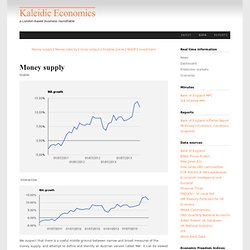

Tullett Prebon gained a total of 34 number one positions. Yet again, the Company dominated in FX with 15 category wins out of 24 and also performed strongly in the Interest Rate and Credit categories, with 12 and 6 number one rankings respectively. FX category wins: Economics - DATA. Money supply | Money velocity | Gross output | Shadow prices | NGDP | Investment Money supply Stable: Interactive: MA growth We suspect that there is a useful middle ground between narrow and broad measures of the money supply, and attempt to define and identify an Austrian version called 'MA'.

Our special report (released in June 2011) explains in more detail the composition, but note than in January 2012 we made some important updates (see here for an overview). Bank of England: Money velocity Data available: quarterly | Last updated: 2011 Q1 Our measure of money velocity comes from the equation of exchange and is defined as (PY)/M. Velocity Gross output Data available: annually | Last updated: 2008 By only focusing on final goods and services GDP has two major limitations: (i) it underestimates the amount of economic activity in the economy (by ognoring the full structure of production); (ii) it overestimates the role of consumption as a driver of recovery.

Shadow prices. The nature of UK austerity. YCAC - Footy Japan Competitions. Back row:Neil Shonhard, Shin Fukagawa, TBN, Dickie Philo, TBN, Kaname Shoot, TBN, Joe Takeda.

Front row: Orlando Torres, Anthony Savage, TBN, TBN, TBN. Sponsor(s): Tullet Prebon Inter Dealer BrokersHonours: TML Division 1 Champions 2008/9, FJ Magnificant Summer 7? S League Champions 2009, FJ Cup Runners up 2010/2011Colours: Navy blue shirt, navy blue shorts, navy blue socks OR Grey shirt, navy blue shorts, navy blue socksAbout: Originally founded in 1868, YCAC is generally reckoned to have played the 1st football match in Japan vs Kobe in 1888, a fixture still played annually. YCAC have played at their current site in Yamate since 1912 and have survived the 1923 Kanto Earthquake, being bombed by the USAF and the 1st 8 seasons of the TML.Captain: Anthony SavageURL:

Tullett Prebon. Tullett Prebon plc is an inter-dealer money broker.

It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. History[edit] The company was founded by Derek Tullett in 1971 as a foreign exchange broker trading as Tullett & Riley.[3] During the 1970s and 1980s it opened a number of overseas offices. In 1999 the Company merged with Liberty Brokerage to create Tullett Liberty.[3] In early 2003 the Company was bought by Collins Stewart plc, a financial services company, creating Collins Stewart Tullett plc.[3][4] In October 2004 the company acquired Prebon Yamane, a broking business formed in 1990 following the merger of three leading London-based money broking businesses—Babcock & Brown, Kirkland-Whittaker and Fulton Prebon[3]—and which had adopted that name in acknowledgement of the firm's close business alliance with the Tokyo-based Yamane Group.[3] Operations[edit] The company operates as an intermediary in wholesale financial markets.

Competition[edit] Don’t believe the hype about the US ‘recovery’ The bulls have a new story for investors to get excited about.

Don’t worry about Greece and don’t worry about China, because the US is on the mend. Sure, things still look ugly out there – unemployment is high and house prices are still falling – but Federal Reserve chief Ben Bernanke can sort all that out with a bit of money-printing. After all, with all this deleveraging going on, we won’t need to worry about inflation for a long, long time. Sounds good. And as we’re seeing right now, the promise of more quantitative easing is certainly enough to give markets another sugar rush.

But don’t get carried away. America is more indebted than during the Great Depression Feeling optimistic about the outlook for America? Swap Execution Facility. Swap Execution Facility (SEF) is a regulated platform for swap trading that provides pre-trade information (bids and offers) and an execution mechanism for swap transactions among eligible participants.[1] The regulated trading of certain swaps is a result of requirements in the United States by the Dodd–Frank Wall Street Reform and Consumer Protection Act.[2] Note in particular Title VII.

Following the CFTC's certification of Javelin SEF LLC's Made Available to Trade Submission (MAT Submission) on January 16th, 2014, certain swaps are now mandatory to trade on Swap Execution Facilities as of February 15th, 2014.[3] The swaps business is very well established worldwide and swaps are routinely traded in quite robust over-the-counter (OTC) markets. Recent regulatory changes are driving reporting, clearing and settlement functions to much more tightly regulated Swap Execution Facilities.