Ebix: Not a Chinese Fraud, But a House of Cards Nonetheless, Part III. Below is Part III of our EBIX report.

Please see part one and two published earlier. 8) History of Auditor Turnover, Shockingly Low Audit Fees and Accounting Red Flags. Www-stat.wharton.upenn.edu/~steele/Courses/434/434Context/Momentum/MomentumStrategiesJF2001.pdf. The Innovator Invests: Clayton Christensen's Stock Picks. Clayton Christensen is a giant in the world of technology innovation.

The Harvard Business School professor (who stands 6 feet 8 inches tall) came up with the influential theory of disruptive technology and this year was crowned by Forbes magazine as “the world’s most influential business thinker.” Less well known is that Christensen, 59, has staked his personal wealth, and that of his large family, on his academic ideas. The Boston hedge fund he owns, called Rose Park Advisors, operates a “Disruptive Innovation Fund” that has invested more than $100 million into companies fitting his theories about how technology disrupts markets.

The investment company is led by Christensen’s 34-year-old son, Matthew, himself a Harvard Business School graduate and former management consultant. Father and son began investing together in 2002, Matt Christensen says, “and we did really well—so we thought we could take the show on the road.” The Correlation Between P/E10 Values and Long-Term Returns Is Stronger Than Most Realize. Valuation-Informed Indexing #90 by Rob Bennett The premise of the Valuation-Informed Indexing model is that the P/E10 value that applies today is a good indicator of the long-term stock return that will be obtained on the purchase of an index fund made today.

Quality investing. Quality investing is an investment strategy based on a set of clearly defined fundamental criteria that seeks to identify companies with outstanding quality characteristics.

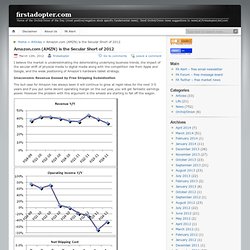

The quality assessment is made based on soft (e.g. management credibility) and hard criteria (e.g. balance sheet stability). Quality Investing supports best overall rather than best-in-class approach. History[edit] Benjamin Graham, the founding father of value investing, was the first to recognize the quality problem among equities back in the 1930s. Graham classified stocks as either quality or Low quality. Amazon Short. I believe the market is underestimating the deteriorating underlying business trends, the impact of the secular shift of physical media to digital media along with the competition risk from Apple and Google, and the weak positioning of Amazon’s hardware tablet strategy.

Uneconomic Revenue Goosed by Free Shipping Subsidization The bull case for Amazon has always been it will continue to grow at rapid rates for the next 3-5 years and if you put some decent operating margin on the out year, you will get fantastic earnings power. However the problem with this argument is the wheels are starting to fall off the wagon. Back in the dot.com bubble there was a company called Kozmo.com that offered free 1 hour shipping of array of small goods like books, videos, magazines, etc. To my amazement, I tried the service and ordered a pack of gum. Amazon is doing a similar thing by subsidizing free shipping.

If you sell $1.00 of value for 99c, you will show amazing revenue growth. David Dreman Articles. Bernanke's Last Stand June 29, 2011 Forbes Magazine dated July 18, 2011 Chinese counterfeiting sucks away jobs. Debunking Beta September 09, 2010 Forbes Magazine dated September 27, 2010. Workplace Confidence. Finance - Scholarly Papers. Economics to Forecast Profit Margins. How To Actually Win A Fist Fight. Ok, well, with the response from yesterday's post, I felt compelled to go ahead and do this.

Without further ado: An Inside Look At ETF Construction. Some people are happy to simply use a range of devices like wrist watches and computers and trust that things will work out.

Others want to know the inner workings of the technology they use, and understand how it was built. If you fall into the latter category and as an investor have an interest in the benefits that exchange-traded funds (ETFs) offer, you'll definitely be interested in the story behind their construction. Tutorial: Exchange-Traded Fund Investing How an ETF Is Created The creation and redemption process for ETF shares is almost the exact opposite of that of mutual fund shares. When investing in mutual funds, investors send cash to the fund company, which then uses that cash to purchase securities and in turn issue additional shares of the fund.

When investors wish to redeem their mutual fund shares, the shares are returned to the mutual fund company in exchange for cash. ETFs minimize this scenario by paying large redemptions with shares of stock. The Empire Strikes Back. It has been a long time since anyone considered Xerox an innovation powerhouse.

On the contrary, Xerox typically serves as a cautionary tale of opportunity lost: many obituaries of Steve Jobs described how a fateful visit by Jobs to the Xerox Palo Alto Research Center in 1979 inspired many of the breakthroughs that Apple built into its Macintosh computer. Back then, Xerox dominated the photocopier market and was understandably focused on improving and sustaining its high-margin products.