Ecobonds - About Ecotricity. Property websites: 15 great alternatives to Rightmove. If you’re looking for somewhere new to live you’ll be well aware of the main property websites such as Rightmove and Zoopla.

But while they carry more than a million listing, you may miss out on your perfect home if you make them your only port of call. If you aren’t sure where you want to live, want to take on a renovation project or dream of living somewhere truly unique, there are other sites to help you in your search. Here are 15 of the best alternatives for buyers and tenants. 1. Find a Hood Designed to help you work out where to live, this site asks you to describe your “perfect hood” using 10 different criteria. 2. 3. 4. 5. Zoopla has a similar facility. 6. 7. 8. 9.

iCompareFX - CurrencyFair. Fruitful. Burnley Savings and Loans. Portman Asset Finance. Personal loans and Online Investing - Peer to Peer Bitcoin Lending - BTCJam.

Rivetz. Peer To Peer Lending (P2P) Platform For The UK. UK Property Crowdfunding Investments. Crowdfunding business finance from angel investors and 'Armchair Dragons' Types Of Early Stage Funding. Finding Seed Capital Many entrepreneurs need just a bit of seed money to start turning their idea into the beginnings of an actual business.

Depending on the business, this seed capital might allow you to build a minimum viable product, buy equipment, lease space and acquire inventory. As the costs of starting a business have come down drastically due to the Internet and other technological innovations, an increasing number of entrepreneurs find that a little bit of seed capital - often £150,000 or less - can go a long way. Sources of Seed Funding Some entrepreneurs start with lots of spare savings and "bootstrap" their business, but for those who can't do that your options are actually pretty limited. Banks. Vfg. Bitcoin Block Explorer - Blockchain.info. Personal loans and Online Investing - Peer to Peer Bitcoin Lending - BTCJam. Home - Wellesley & Co Peer to Peer Lending.

UK Peer to Peer Loan Provider. Largest UK P2P lender - RateSetter.com. Funding Circle - The Peer to Peer lending marketplace for small business loans. How it works. Bank grade security Your personal and financial data is encrypted and protected on our secure servers to guard against any unauthorized transactions.

More about security Use Venmo with anyone Pay pretty much anyone with a phone number or email, whether or not they have Venmo. Find friends automatically by syncing your Facebook or phone contacts. Free for everyone Sending money is free when it comes from your Venmo Balance, bank account, or major debit card. More about pricing. Crowdfunding, Business Loans, P2B, P2P, Lending, Investment - Money&Co.

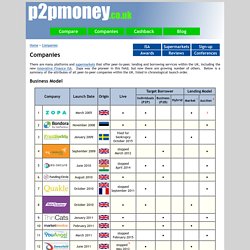

The Safest Peer to Peer Lender. Peer-to-peer companies. Home > Companies There are many platforms and supermarkets that offer peer-to-peer, lending and borrowing services within the UK, including the new Innovative Finance ISA.

Zopa was the pioneer in this field, but now there are growing number of others. Below is a summary of the attributes of all peer-to-peer companies within the UK, listed in chronological launch order. Business Model Loan Terms There are a wide range of loan terms available. 1 Interest defined as interest only with capital repaid at end of loan term2 Term defined as capital and interest repaid at end of loan term 3 6 weeks 4 Tracks bank of England base rate Company Size Detailed company loan size are now shown in statistics. Payment Attributes Companies support various payment mechanisms for lenders and borrowers. Lending Types All P2P companies covered on the P2P money website will allow lending by individuals, but some will allow lending by businesses, provided their business isn't money lending. Features. The whole stack With clean, composable, and complete APIs, Stripe’s thoughtful interfaces and abstractions can handle your company’s needs — from storing cards and processing subscriptions to powering marketplaces and everything in between.

Stripe’s also got you covered if you just need to accept payments quickly and easily. Recurring billing With Stripe’s subscription APIs and webhooks, storing customers’ cards on file or even implementing complex functionality like metered billing or annual plans is easy. Companies like Rackspace, Parse, and Squarespace use Stripe to manage subscriptions and recurring revenue. Explore subscriptions Flexible billing periods Yearly, monthly, weekly, or custom intervals. Coupons. What is the typical Australian’s income in 2013? A couple of years ago, the government changed the rules so that families on $150 000 a year or more wouldn’t be eligible to receive family payments.

There were the predictable cries of ‘class warfare’, but there were also claims that $150 000 in Australia leaves you struggling to make ends meet. The Daily Telegraph found a couple on $150k who said “you can survive on $150,000 but you definitely aren’t doing well,” while in The Australian, a couple on $200 000 said “the government are making it bloody hard.” I don’t think most people have much of a sense of what the typical Australian’s income is. Research backs this up – low income earners tend to overestimate their own position in the income distribution, while high-income earners tend to underestimate theirs. Remember the Poor. Buy $GOOG Google stock on eToro OpenBook. Send Money Abroad with TransferWise.