Steve Hilton: 'Pay bankers the same as civil servants' - BBC News. Maps show what major U.S. cities would look like if world's glaciers melted. Seattle-based Jeffrey Linn created maps showing what cities look like submerged in hundreds of feet of waterU.S.

Geological Survey estimates that if all of the world's glaciers melted, sea level would rise by more than 260 feetSome coastal cities have already been affected by global climate change and warming ocean waters But the extreme sea-level rise is not predicted to happen for at least 1,000 yearsLinn gave names to islands, inlets and landmarks that cities would become when flooded with waterThe place names often have humorous ties to what they used to be, such as Ex-LAX and Yankee Aquarium He's created maps for U.S., Canadian and UK cities and hopes to make a world atlas By Kelly Mclaughlin For Dailymail.com Published: 22:39 GMT, 8 February 2015 | Updated: 16:15 GMT, 9 February 2015. The Future of Financial Reform: Conceiving the Financial System of the 21st Century. Mark Carney, Governor of the Bank of England (BoE) and Chairman of the Financial Stability Board (FSB), may well be the man of the hour.

When he gives a speech entitled “The Future of Financial Reform” as he recently did at the Monetary Authority in Singapore, people listen. In his remarks, Carney emphasized curbing bankers’ compensation. It is little surprise that these particular remarks made all the headlines – this is kind of news the public has been waiting for. The fact that bankers received a record $140 billion in 2009 after banks received bailouts should enrage anyone. Radical cures for unusual economic ills. Understanding Overproduction. The key to understanding the recurrent crises of capitalism is the term ‘overproduction’.

Capitalism produces not to meet human needs first & foremost, but to make a profit. It produces commodities to sell for more money than initially spent purchasing the required inputs. Money, at its core, is nothing more than that special commodity that acts as the universal equivalent. In otherwords, one particular commodity becomes the measure of value of all other commodities. Gold & silver have traditionally played the role of commodity money. Long Finance Spring Conference 2012.

Many critics claim that the problem with economics is that it has no "theory of value".

From early economists, such as Smith, Ricardo and Marx, to later economists, pinning value to economics has proved disputatious. In turn problems with understanding value reverberate to problems with money, problems with the long term and problems with sustainability. This conference explored some suggested reforms that touch on value, ranging from new thinking on the international monetary system to better reporting standards to refocused government policies. Martin Wolf, Financial Times: Stop banks from creating money (Video) Book review — Money and Sustainability: The Missing Link. A Report from the Club of Rome – EU Chapter to Finance Watch and the World Business Academy By Bernard Lietaer, Christian Arnsperger, Sally Goerner and Stefan Brunnhuber Triarchy Press 2012 This report by WAAS Fellow Bernard Lietaer and his associates addresses important theoretical and practical issues regarding modern monetary systems.

The central thesis of the report is that effective monetary systems must optimize performance on two complementary goals — efficiency of transactions and resilience in the face of destabilizing forces and events. National monetary systems maximize efficiency, but they lack the resilience to prevent catastrophic events such as those that have plagued the global financial markets and global economy over the past four years. The 1930′s Chicago Plan Vs. The American Monetary Act. Ideas Archive - The Lab. A call for ideas was announced in May 2014 and sent directly to almost 400 individuals and organizations, including government representatives, private investors and project developers, development finance institutions, and civil society organizations.

The Lab’s members and analytical service providers consulted widely to source the best ideas for financing instruments. The Lab Secretariat received more than 80 submissions from all over the world, far exceeding Lab members’ expectations in terms of quality and quantity. The Lab Secretariat screened these ideas to assess whether they aligned with the Lab's objective of being innovative (either in terms of newness, or in encouraging scale up of existing approaches to new technologies or geographies), actionable, potentially transformative, and catalytic. 48 ideas complied with all four of these criteria.

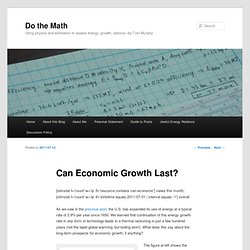

Can Economic Growth Last? [slimstat f='count' w='ip' lf='resource contains can-economic'] views this month; [slimstat f='count' w='ip' lf='strtotime equals 2011-07-01 | interval equals -1'] overall As we saw in the previous post, the U.S. has expanded its use of energy at a typical rate of 2.9% per year since 1650.

We learned that continuation of this energy growth rate in any form of technology leads to a thermal reckoning in just a few hundred years (not the tepid global warming, but boiling skin!). What does this say about the long-term prospects for economic growth, if anything? World economic growth for the previous century, expressed in constant 1990 dollars. For the first half of the century, the economy tracked the 2.9% energy growth rate very well, but has since increased to a 5% growth rate, outstripping the energy growth rate. Www.paecon.net/PAEReview/issue57/Trainer57.pdf. Adair Turner: The Consequences of Money Manager Capitalism.

In the wake of World War II, much of the western world, particularly the United States, adopted a new form of capitalism called “managerial welfare-state capitalism.”

The system by design constrained financial institutions with significant social welfare reforms and large oligopolistic corporations that financed investment primarily out of retained earnings. Private sector debt was small, but government debt left over from financing the War was large, providing safe assets for households, firms, and banks. Reports. Videos - The Future of Finance - Session 1: Ethics and Finance.

Scribd. Mark Carney: most fossil fuel reserves can't be burned. The governor of the Bank of England has reiterated his warning that fossil fuel companies cannot burn all of their reserves if the world is to avoid catastrophic climate change, and called for investors to consider the long-term impacts of their decisions.

According to reports, Carney told a World Bank seminar on integrated reporting on Friday that the “vast majority of reserves are unburnable” if global temperature rises are to be limited to below 2C. Carney is the latest high profile figure to lend his weight to the “carbon bubble” theory, which warns that fossil fuel assets, such as coal, oil and gas, could be significantly devalued if a global deal to tackle climate change is reached. The movement has gained traction in recent weeks, with the World Bank leading an initiative with 73 national governments, 11 regional governments, and more than 1,000 businesses and investors to build support for a global price on carbon emissions during the United Nations climate summit in New York.

Videos - The Future of Finance - Session 1: Ethics and Finance. Green Bonds Attract Private Sector Climate Finance. Issuers ranging from other development banks to states, cities and corporates have looked to the World Bank and IFC for leadership and guidance in how to issue bonds to raise financing for climate-friendly activities.

Both issuers are sharing their knowledge and experience to help grow the market – in addition to building the fundamentals for the market through their own green bond programs. For example, in April 2014, the World Bank signed the first advisory services agreement with the Dubai Supreme Council of Energy (DSCE) to design a funding strategy for Dubai’s green investment program. At the World Economic Forum in Davos in early 2014, World Bank Group President Jim Yong Kim urged more investors to get involved and called for doubling 2013's annaul green bond market issuances by the UN Secretary-General's Climate Summit in September. The market, with $11 billion in bonds issued in 2013, passed that goal in July, and was over $32 billion in October.

Investors worth US$2trn back green bonds at NY Climate Week. Pension funds, insurers and asset managers show an appetite for low risk, climate-friendly investments Trains and windfarms are the kind of low carbon projects green bonds can finance(Pic: Flickr/Windwärts Energie/Mark Mühlhaus) By Megan Darby The fledgling green bond market got some wind beneath its wings this week as investors worth US$2 trillion gave it their backing. Pension funds, insurers and asset management firms signed a statement confirming their appetite for investment in climate change solutions.

Zurich, Barclays and Aviva were among those promising to sink more money into green bonds, which offer a fixed return on capital put into climate-friendly projects. And there were warm words for the growing market from World Bank president Jim Yong Kim, speaking as part of New York’s Climate Week. Environmental Finance. The Chicago Plan Revisited.

Natural Capitalism. Honeybee Capital. Navigating the Shift to Our Shared Prosperity.