Résumé. Nelson W. Aldrich. JPM. Abby Aldrich Rockefeller. Abigail Greene "Abby" Aldrich (October 26, 1874 — April 5, 1948) was an American socialite and philanthropist.

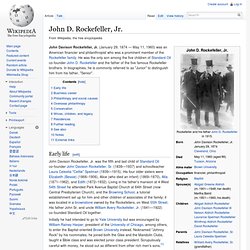

Through her marriage to financier and philanthropist John D. John D. Rockefeller, Jr. John Davison Rockefeller, Jr.

(January 29, 1874 — May 11, 1960) was an American financier and philanthropist who was a prominent member of the Rockefeller family. He was the only son among the five children of Standard Oil co-founder John D. Rockefeller and the father of the five famous Rockefeller brothers. In biographies, he is commonly referred to as "Junior" to distinguish him from his father, "Senior". Early life[edit] Henry Pomeroy Davison. Henry Pomeroy Davison, Sr.

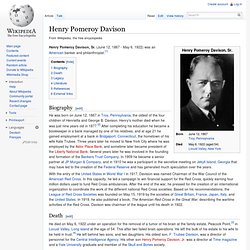

(June 12, 1867 - May 6, 1922) was an American banker and philanthropist.[1] Biography[edit] With the entry of the United States in World War I in 1917, Davision was named Chairman of the War Council of the American Red Cross. In this capacity, he led a campaign to win financial support for the Red Cross, quickly earning four million dollars used to fund Red Cross ambulances. Henry P. Davidson & Charles D. Norton. Benjamin Strong, Jr. Benjamin Strong, Jr.

(December 22, 1872 – October 16, 1928) was an American banker. He served as Governor of the Federal Reserve Bank of New York for 14 years until his death. BenStrongJr.jpg 743 × 1'024 pixels. George Fisher Baker. George Fisher Baker (March 27, 1840 – May 2, 1931) was a U.S. financier and philanthropist.

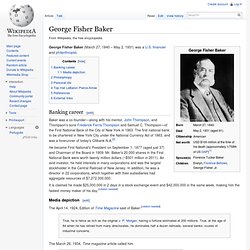

Banking career[edit] He became First National's President on September 1, 1877 (aged just 37) and Chairman of the Board in 1909. Mr. Baker's 20,000 shares in the First National Bank were worth twenty million dollars (~$501 million in 2011). George_F_Baker.jpg 833 × 1'623 pixels. Frank A. Vanderlip. Frank Arthur Vanderlip, Sr.

(November 17, 1864 – June 30, 1937) was an American banker. He was Assistant Secretary of the Treasury and was president of the National City Bank from 1909 to 1919.[2] Vanderlip created the Scarborough School at his property, the Beechwood Estate in Briarcliff Manor, New York.[3] Biography[edit] Kuhn, Loeb & Co. In the years following Schiff's death in 1920, the firm was led by Otto Kahn and Felix Warburg, men who had already solidified their roles as Schiff's able successors.

However, the firm's fortunes began to fade following World War II, when it failed to keep pace with a rapidly changing investment banking industry, where Kuhn, Loeb's old-world, genteel ways, did not seem to fit; the days of the gentleman-banker had passed. William Rockefeller. William Avery Rockefeller, Jr.

(May 31, 1841 — June 24, 1922) was an American businessman and financier. He was a co-founder of Standard Oil along with his older brother John Davison Rockefeller (1839—1937). Frank_A._Vanderlip.jpg 363 × 554 pixels. Abram Andrew. Abram Piatt Andrew Jr.

(February 12, 1873 – June 3, 1936) was an economist, an Assistant Secretary of the Treasury, the founder and director of the American Ambulance Field Service during World War I, and a United States Representative from Massachusetts. Early life and education[edit] He was born in La Porte, Indiana, on February 12, 1873.[1] He attended the public schools and the Lawrenceville School. He graduated from Princeton College in 1893, studied at the Harvard Graduate School of Arts and Sciences from 1893 to 1898, graduating with a master's degree in 1895 and a doctorate in 1900.[2] He later pursued postgraduate studies in the Universities of Halle, Berlin, and Paris.[3] Early career in economics[edit] He moved to Gloucester, Massachusetts, and was instructor and assistant professor of economics at Harvard University from 1900 to 1909.[3] In January 1907, Andrew published a paper that anticipated the economic panic that hit in the fall of that year.

Lt. Congressman[edit] National Monetary Commission. Background[edit] Following the panics of the late 1890s and early 1900s, the American people were aroused to the need for basic reforms.

One of the most painful aspects of the economic crisis before World War I was the rush by individuals and businesses, as they became apprehensive about the economic future, to the banks to convert their deposits into cash. A common way to mitigate these "bank runs" was to suspend cash payments during crises, either by imposing a maximum daily withdrawal or complete suspension. ln the Southeast and Midwest, the resulting shortage of cash was so serious that local clearinghouses issued emergency notes against collateral pledged by cooperating banks so that people could carry on business.

Suspending cash payments and issuing clearinghouse certificates were better than allowing a panic to continue, but the public wanted a reform that would prevent suspensions altogether. Functions[edit] Paul Warburg. Un article de Wikipédia, l'encyclopédie libre. Paul Warburg Paul Moritz Warburg, né à Hambourg le et mort à New York le , est un banquier germano-américain, surtout connu pour son rôle dans la création de la Réserve fédérale des États-Unis. Biographie[modifier | modifier le code] Paul Warburg est né à Hambourg dans une famille de banquiers juifs dont les descendants sont toujours en activité aujourd'hui.

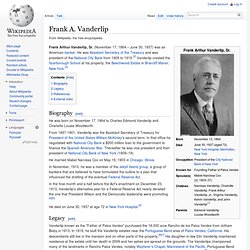

Ses parents étaient Moritz et Charlotte (Esther) Warburg. En 1891, Warburg entre dans la banque familiale MM Warburg & Company, qui avait été fondée en 1798 par son arrière-grand-père. Le 1er octobre 1895, Warburg se marie à New-York à Nina J. Max Warburg. Max Moritz Warburg (5 June 1867 – 26 December 1946) was a German-born, American banker and scion of the wealthy Warburg family of German bankers. Early life[edit] Max Warburg was one of seven children born to Moritz Warburg, the director of the family's Hamburg bank, and his wife Charlotte Oppenheim. His siblings were the art historian and cultural theorist, Abraham Warburg; the chief architect of the Federal Reserve Board of the United States Paul Warburg; Felix; Olga; Fritz; and Louisa. Career[edit] Hjalmar Schacht. Hjalmar Horace Greeley Schacht (22 January 1877 – 3 June 1970) was a German economist, banker, liberal politician, and co-founder in 1918 of the German Democratic Party.

He served as the Currency Commissioner and President of the Reichsbank under the Weimar Republic. He was a fierce critic of his country's post-World War I reparation obligations. He became a supporter of Adolf Hitler and the Nazi Party, and served in Hitler's government as President of the Reichsbank and Minister of Economics. As such, Schacht played a key role in implementing the policies attributed to Hitler.[1] Since he opposed the policy of German re-armament spearheaded by Hitler and other prominent Nazis, Schacht was first sidelined and then forced out of the Third Reich government beginning in December 1937,[2] therefore he had no role during World War II.

Haavara Agreement. The Haavara Agreement (Hebrew: הסכם העברה Translit.: heskem haavara Translated: "transfer agreement") was signed on 25 August 1933 after three months of talks by the Zionist Federation of Germany, the Anglo-Palestine Bank (under the directive of the Jewish Agency) and the economic authorities of Nazi Germany. The agreement was designed to help facilitate the emigration of German Jews to Palestine. While it helped Jews emigrate, it forced them to give up most of their possessions to Germany before departing. Those assets could later be obtained by transferring them to Palestine as German export goods.[1][2]

Reichsbank. A 10000 Mark banknote issued by the German Reichsbank in 1922. A watermark is present, but not visible in scanned image. The The history of the Reichsbank was volatile. Until World War I it produced a very stable currency called the Goldmark. The expenses of the war caused inflationary pressure and the mark started to decrease in value. Council on Foreign Relations. Un article de Wikipédia, l'encyclopédie libre. Le Council on Foreign Relations ou CFR est un think tank non partisan américain, ayant pour but d'analyser la politique étrangère des États-Unis et la situation politique mondiale. Fondé en 1921, il est composé d'environ 5 000 membres issus du milieu des affaires, de l'économie et de la politique. Son siège se situe à New York avec un bureau à Washington D. C.. Le CFR est considéré comme l'un des think tanks les plus influents en politique étrangère[1],[2],[3].

À ne pas confondre avec le Committee on Foreign Relations (Comité des affaires étrangères du Sénat des États-Unis).