Fait désormais partie de Verizon Media. Yahoo fait partie de Verizon Media.

Nos partenaires et nous-mêmes stockerons et/ou utiliserons des informations concernant votre appareil, par l’intermédiaire de cookies et de technologies similaires, afin d’afficher des annonces et des contenus personnalisés, de mesurer les audiences et les contenus, d’obtenir des informations sur les audiences et à des fins de développement de produit. Données personnelles qui peuvent être utilisées Informations sur votre appareil et sur votre connexion Internet, y compris votre adresse IP Navigation et recherche lors de l’utilisation des sites Web et applications Verizon Media Position précise Découvrez comment nous utilisons vos informations dans notre Politique relative à la vie privée et notre Politique relative aux cookies.

High Short Interest Stocks. Short Squeeze: Why They Happen and How to Profit. A short squeeze is a trading term that happens when a stock that is heavily shorted all of a sudden gets positive news or some kind of catalyst which brings a lot of new buyers into the stock.

When this happens, the stock is being bought up and the shorts are now forced to cover their positions (getting squeezed out), which then results in more buying that can cause a stock to go up very quickly and by a lot. You can find short information on stocks through most financial sites like Yahoo and Google Finance. They list the short interest and the percentage short of the float along with the short interest ratio. The short interest ratio (SIR) measures the amount of shares short divided by the average daily trading volume. So if the SIR is 3, then that means it would take 3 days at the average volume levels for shorts to buy back their shares. The important part to remember is that when a short squeeze is underway, you don’t want to be caught on the wrong side of it. Short Interest Stock Short Selling Data, Shorts, Stocks: Short Squeeze. How Do I Find a Stock's Number of Shorted Shares? For general shorting information—such as the short interest ratio, the number of a company's shares that have been sold short divided by the average daily volume—you can usually go to any website that features a stock quotes service, such as the Yahoo Finance website in Key Statistics under Share Statistics.

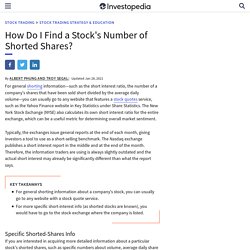

The New York Stock Exchange (NYSE) also calculates its own short interest ratio for the entire exchange, which can be a useful metric for determining overall market sentiment. Typically, the exchanges issue general reports at the end of each month, giving investors a tool to use as a short-selling benchmark. The Nasdaq exchange publishes a short interest report in the middle and at the end of the month. Therefore, the information traders are using is always slightly outdated and the actual short interest may already be significantly different than what the report says. MarketBeat: Stock Market News and Research Tools. IPOs - Latest & Upcoming IPOs - Taking a Company Public. Biotech Stocks for investors and traders. Alzheimer's Disease Stocks List for 2021.

Alzheimer's disease (AD), also referred to simply as Alzheimer's, is a chronic neurodegenerative disease that usually starts slowly and worsens over time.

It is the cause of 60–70% of cases of dementia. The most common early symptom is difficulty in remembering recent events (short-term memory loss). As the disease advances, symptoms can include problems with language, disorientation (including easily getting lost), mood swings, loss of motivation, not managing self care, and behavioural issues. As a person's condition declines, they often withdraw from family and society. Gradually, bodily functions are lost, ultimately leading to death. 3 Stocks Not to Spend Your $1,400 on. The next round of stimulus checks will likely bring a new surge of retail investor participation, and investors who back the right companies could wind up turning a $1,400 check into a much larger amount.

Of course, doing so will involve taking on some risk, and it's fair to say that the stock market is looking volatile. With that in mind, we asked three Motley Fool contributors to profile a hot, high-flying stock that they believe investors should stay away from right now. Read on to see why they think backing GameStop (NYSE:GME), Tesla (NASDAQ:TSLA), and Sundial Growers (NASDAQ:SNDL) with your stimulus money would be a bad move. Image source: Getty Images. Don't try to recapture the magic Keith Noonan (GameStop): The comeback rally for GameStop over the last year has been nothing short of incredible.

What happened next is a story for the history books. Bitcoin Skyrockets to a New All-Time High After Tesla Invests $1.5 Billion in the Popular Cryptocurrency. Tesla (NASDAQ:TSLA) made a game-changing disclosure on Monday.

The electric-vehicle (EV) leader purchased $1.5 billion worth of bitcoin (CRYPTO:BTC) in a move that could bring legitimacy to the digital currency markets and pave the way for more companies to adopt the cryptoasset as a key part of their treasury-management strategies. Essential Options Trading Guide. Options trading may seem overwhelming at first, but it's easy to understand if you know a few key points.

Investor portfolios are usually constructed with several asset classes. These may be stocks, bonds, ETFs, and even mutual funds. Options are another asset class, and when used correctly, they offer many advantages that trading stocks and ETFs alone cannot.

Icelandair. Bitcoin. Fait désormais partie de Verizon Media. Yahoo fait partie de Verizon Media.

Nos partenaires et nous-mêmes stockerons et/ou utiliserons des informations concernant votre appareil, par l’intermédiaire de cookies et de technologies similaires, afin d’afficher des annonces et des contenus personnalisés, de mesurer les audiences et les contenus, d’obtenir des informations sur les audiences et à des fins de développement de produit. Données personnelles qui peuvent être utilisées Informations sur votre appareil et sur votre connexion Internet, y compris votre adresse IP Navigation et recherche lors de l’utilisation des sites Web et applications Verizon Media Position précise Découvrez comment nous utilisons vos informations dans notre Politique relative à la vie privée et notre Politique relative aux cookies.

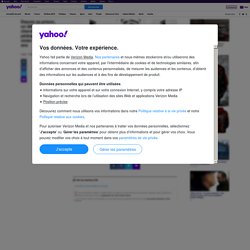

Varar við offjárfestingu. Sætanýtingin í Bandaríkjafluginu batnaði ekki þrátt fyrir brotthvarf Delta og WOW air – Túristi. Icelandair Group hf.: First day of trading in warrants Iceland Stock Exchange:ICEAIR. Warrants were issued to all investors that got allotted shares in the Company’s Offering that concluded on 17 September 2020.

The Warrants have been delivered to investors and will start trading on the Nasdaq Iceland Main Market today 13 October under the following ticker symbols: ICEAIRW130821, ICEAIRW180222 and ICEAIRW120822 Investors will be able to trade the Warrants independently of the shares until the start of their respective exercise periods which are as follows: 'Don't confuse day traders with serious investors': Warren Buffett and Howard Marks will win over time, Princeton economist says. Paul Morigi / Stringer / Getty Images Day traders are mindlessly buying and most are throwing their money away, Wealthfront's investment chief Burton Malkiel said in a blog post this week.

"Legions of new day traders have poured new money into stocks without a care for the risks involved, clearly unaware of Buffett's maxim that 'It's only when the tide goes out that you learn who's been swimming naked.'"Their "frenzied buying" includes driving up the share prices of FANGDD - a Chinese company unrelated to FANG stocks - and bankrupt car-rental company Hertz, the Princeton economist and author of ""A Random Walk Down Wall Street" said. "I don't confuse day traders with serious investors," Malkiel added. "Don't be misled with false claims of easy profits from day trading. " Bored day traders are making reckless bets and terrible decisions, and the vast majority will underperform the market or lose money, Wealthfront's investment chief Burton Malkiel warned on the robo-adviser's blog this week.

‘La la land?’ The stock market is ‘insanely disconnected’ and due for a ‘reckoning,’ Warren Buffett buff warns. Those betting against this “absurdly overvalued” stock market are about to get paid, if Kevin Smith, Crescat Capital’s chief investment officer, has it right in his gloomy assessment. “Speculation is rampant and being championed by a bold new breed of millennial day traders,” he said. “The mania is based on a widespread hope in Fed money printing. The catalysts for reckoning are numerous as a major cyclical economic downturn has only just begun.” Smith, who recently talked about learning the ropes from a stack of Berkshire Hathaway BRK.A, BRK.B, shareholders letters his dad gave him long ago, said, in a very un–Warren Buffett fashion, that shorting stocks “is worthy of a significant allocation today.”

Smith used this chart of plunging S&P 500 SPX, profit margins to show “how insanely disconnected equity prices are from their underlying fundamentals.” How I Stopped Losing Money in Trading - The Startup - Medium. Fait désormais partie de Verizon Media. (Bloomberg) -- About a third of large institutional investors own digital assets such as Bitcoin, according to a survey from Fidelity Investments.

Across the U.S. and Europe, 36% of the survey’s 774 respondents said they own cryptocurrencies or derivatives. In the U.S., 27% of institutions -- including pension funds, family offices, investment advisers and digital and traditional hedge funds -- said they own digital assets, up from 22% about a year ago, when Fidelity surveyed 441 institutions just in the U.S. In Europe, 45% of respondents are invested in digital assets. Over a quarter of the respondent hold Bitcoin, while 11% hold Ether, the survey found.

Bitcoin is up 36% since the beginning of the year, and has rallied as many traditional assets tumbled during the Covid-19 pandemic. “Europe is perhaps more supportive and accommodating,” Tom Jessop, president of Fidelity Digital Assets, said in an interview. Icelandair Group Annual Report 2019. Auðveldasta leiðin til þess að kaupa Bitcoin á Íslandi í dag.

Fait désormais partie de Verizon Media. One minor positive amongst the coronavirus fueled stock market carnage that has wiped away $6 trillion in global equity value since Jan. 20: Stocks are starting to look insanely oversold. The percentage of stocks that are internally oversold in the S&P 500 is now the fourth highest since 1957, according to Jefferies strategist Jeff deGraaf. The unwelcome metric follows a 4.42% drubbing for the S&P 500 on Thursday, marking its worst one-day return since Aug. 18, 2011.

Meanwhile, the percentage of S&P 500 stocks making negative volatility alerts are the highest dating back to the early 2018 lows. “By all standards, the market is now in historic oversold territory. These deep oversold conditions have historically created strong forward returns especially when the trends are this solid,” deGraaf says. But one would be foolish to think the extreme oversold conditions right now means to back up the truck on stocks. Perhaps, but maybe not yet. Subscribe to read. The Little Book of Fundamental Indicators: Hands-On Market Analysis with Python: Find Your Market Bearings with Python, Jupyter Notebooks, and Freely Available Data eBook: Manuel Amunategui, Lucas Amunategui: Kindle Store.

Medium. Valréttarsamningur - Wikipedia, frjálsa alfræðiritið. Lokaverkefni: "Skattlagning söluréttarsamninga í tengslum við hlutabréfakaup starfsmanna" Top 5 Books on Becoming an Options Trader. For many people, options trading is a strange and mysterious investment practice. Fortunately, there are numerous educational books on the subject that demystify options and help traders profit from them. Staðgreiðsla 2019. Options hlutabréf. Buffett yfirgefur fjölmiðlaheiminn - Sigurður Már Jónsson. Super Bundle - Get All 3 Tracts - Applied ML, Market Analysis, MVP. The ViralML Show! Home of the Weekend Entrepreneur - Let's Show Your Machine Learning Applications to the World! Fait désormais partie de Verizon Media. Friday, February 14, 2020 Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe. Secondary Offerings: What You Need to Know. When a company goes public, it's usually cause for celebration for investors.

But when companies return to the capital markets to do secondary offerings of stock, the shares often get a lot less fanfare -- and the results for existing shareholders can be much less profitable. Recently, a number of companies have announced plans to make secondary offerings, and investors have responded to the news by sending their stock prices downward. - Um Creditinfo.

- Are you a robot? Key Opinion Leader Discussion of Additional Cohort 1 Data from the OPTIC Trial. Incredible Charts: Stock Trading Diary: Predicting recessions. By Colin Twiggs September 20, 2019 9:30 p.m. EDT (11:30 a.m. AEST) First, please read the Disclaimer. New format Dear Friends, I have been writing the Trading Diary newsletter for almost 20 years. For Private Investors- How to start investing - Nasdaq. Flag, Pennant [ChartSchool] American reams: why a ‘paperless world’ still hasn’t happened. Old Mohawk paper company lore has it that in 1946, a salesman named George Morrison handed his client in Boston a trial grade of paper so lush and even, so uniform and pure, that the client could only reply: “George, this is one super fine sheet of paper.” And thus Mohawk Superfine was born. What Can We Do About Bitcoin’s Enormous Energy Consumption? Bitcoin is based on the blockchain pipe dream. Incredible Charts: Market Volatility and the S&P 500.

The Value of Market Panic. Stock Exchange: Extreme Market Strength, What Does It Tell Us? – Dash of Insight. Keep Your Active Eyes on Twitter, Inc. (TWTR) with Unusual Volume Alert. Adverum Bio adds to rally, up 8% - Adverum Biotechnologies, Inc. (NASDAQ:ADVM) $5,421.92 - CoinDesk BPI. Login. Incredible Charts: Stock Trading Diary: PEMAX since 1900. The Basics: How To Analyze A Stock's Cup With Handle. Python for Finance: Investment Fundamentals & Data Analytics. Jvns/pandas-cookbook. Can Juno Therapeutics Outmaneuver Its CAR-T Competitors? Why Juno Therapeutics Shares Are Going Up 21.2% Today. Here's Why Voyager Therapeutics Gained as Much as 24.9% Today. ACH Transfers: How They Work.

Autochartist. Statista - The Statistics Portal for Market Data, Market Research and Market Studies. Almanac Trader — Will Coffee buzz fade this summer? Heikin Ashi candlesticks. How history's most successful investors think about wild market swings. US economy adds a whopping 287,000 jobs. Investment Idiocy: A simple breakout trading rule (pysystemtrade) Government Reports from Big-Money Investors: Three Things You Need to Know (but don't) Crazy - A Story of Debt, by Grant Williams. Try On The Decision For 30 Days. Subscribed. How your brain gets in the way of making smart money decisions. Connect Stocks to hundreds of apps. Stock alerts in Yahoo Finance. Chaikin Money Flow [ChartSchool] Investment Guidelines. 300.000 INDICATORS FROM 196 COUNTRIES. Surging Emini Update and Fibonacci Grid Targets May 10.

International Coffee Report - A key information source for coffee market news, analysis, comment, prices and statistics.