VinegarHill-FinanceLabs. VH-Labs is a resource we plan to develop over time to assist academics and practitioners in the area of applied research on financial instruments and to promote technological solutions and app development that advance transparency and market efficiency.

VH-Labs will publish C++, C#, Python, Javascript, VBA, and R code that will have a blend of pedagogic and practitioner themes. We will try to follow the example somewhat of the late Fabrice Rouah who developed online repositories with extremely useful code for pricing. Unfortunately, Fabrice's Volopta website has now become defunct but his books are still very popular and highly practical. In addition, to providing practical help to price financial instruments, we also apply some operations research techniques to the field of option pricing. Money Tutorials at thismatter.com: Fundamental Tutorials on Personal Finance, Investments, and Economics. Principles of Economics – Open Textbook. Opciones Financieras (9 horas FC) - Fikai.

Estrategias, Valoración y Medidas de Sensibilidad Válido por 9 horas de Formación Continua (FC) Objetivos del curso Recordar los conceptos básicos de los productos derivados.Conocer las principales coberturas con opciones.Analizar diferentes estrategias de volatilidad y de tendencia con opciones.Identificar tipologías de opciones exóticas.Recordar las variables que influyen en la prima de las opciones.Identificar si las opciones están ITM, OTM, ATM y determinar el Valor Intrínseco y el Valor Temporal de las opciones.Valorar las opciones con el modelo de Black & Scholes y con el modelo binomial.Relacionar la prima de la Call con la de la Put a través de la paridad Put-CallAnalizar las diferentes medidas de sensibilidad (las griegas).Determinar los signos de indicadores de gestión.

Rginversiones. Curso de bolsa. Hay que señalar que este criterio para decidir la forma de especular con opciones es muy subjetivo ya que las dos variables que entran en esta función son a criterio del inversor.

A random mathematical blog. Aswath Damodaran: Valuation, Books, Blog, Articles, Videos. ARPM Lab. OptionsTrading.org - A Complete Guide to Successful Options Trading. Free Probability Calculator. Calculate stock market probabilities with this easy to use Monte Carlo simulation program.

Get more results using McMillan's Probability Calculator Software. Simulate the probability of making money in your stock or option position. McMillan’s Probability Calculator is low-priced, easy-to-use software designed to estimate the probabilities that a stock will ever move beyond two set prices—the upside price and the downside price—during a given amount of time. The program uses a technique known as Monte Carlo Simulation to produce estimates that assess the probability of making money in a trade, but can also be used by traders to determine whether to purchase or sell stock, stock options, or combinations thereof. Simply The Web's Best Financial Charts. AnnualReports.com.

Investor Home - The Home Page for Investors on the Internet. Investor Home - Fundamental Anomalies. Gary Karz, CFA (email) Host of InvestorHome Principal, Proficient Investment Management, LLC Value Value investing is probably the most publicized anomaly and is frequently touted as the best strategy for equity investing.

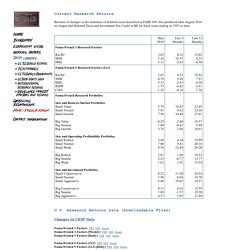

There is a large body of evidence documenting the fact that historically, investors mistakenly overestimate the prospects of growth companies and underestimate value companies. Kenneth R. French - Data Library. Because of changes in the treatment of deferred taxes described in FASB 109, files produced after August 2016 no longer add Deferred Taxes and Investment Tax Credit to BE for fiscal years ending in 1993 or later.

U.S. Corporate finance. Investment analysis (or capital budgeting) is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with equity or debt capital.

Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and current liabilities; the focus here is on managing cash, inventories, and short-term borrowing and lending (such as the terms on credit extended to customers). [citation needed] The terms corporate finance and corporate financier are also associated with investment banking. The typical role of an investment bank is to evaluate the company's financial needs and raise the appropriate type of capital that best fits those needs. Modern portfolio theory. Economist Harry Markowitz introduced MPT in a 1952 essay,[2] for which he was later awarded a Nobel Prize in Economics.

Mathematical model[edit] Risk and expected return[edit] Marginal REVOLUTION - Small Steps Toward A Much Better World. Tipos de interés e indicadores económicos actuales e internacionales. Bivariate Sampling Statistics. This site is a part of the JavaScript E-labs learning objects for decision making.

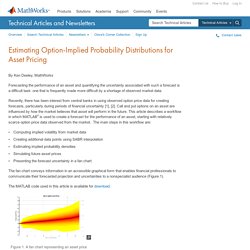

Other JavaScript in this series are categorized under different areas of applications in the MENU section on this page. Enter (by replacing) your up-to-42 two samples paired-data sets where measurements are made jointly on two random variables (X, Y) per subject, and then click the Calculate button. Blank boxes are not included in the calculations but zeros are. 20 million INDICATORS FROM 196 COUNTRIES. Matter of Stats. Estimating Option-Implied Probability Distributions for Asset Pricing. After interpolation in (K, σ)-space, we obtain enough data points to estimate the implied strike price density functions at each expiry time.

To do this we use a computational finance principle developed by Breeden and Litzenberger [4], which states that the probability density function f(K) of the value of an asset at time T is proportional to the second partial derivative of the asset call price C = C(K). We first transform the data to the original domain ((K, C)-space) for each expiry time using the blsprice function: T0 = unique(D.T); S = D.S(1); rf = D.rf(1); for k = 1:numel(T0) newC(:, k) = blsprice(S, fineK, rf, T0(k), sigmaCallSABR(:, k)); end Here, fineK is a vector defining the range of strike prices used for the interpolation and sigmaCallSABR is the matrix created using SABR interpolation in which the columns contain the interpolated volatility smiles for each expiry time.

We then compute the numerical partial derivatives with respect to the strike price. OCC: The Options Clearing Corporation. Chicago Board Options Exchange. Options and Futures — Table of Contents. Investment Fundamentals: Table of Contents. The Calculating Investor. Portfolio Visualizer. BlackLitterman.org.

Business Finance Online: Home. This web site is an interactive learning tool for the Corporate Finance Student. The emphasis of this site is on the quantitative areas of Corporate Finance. Several applications and tools have been developed to help the student obtain an understanding of these concepts. The site also serves as a universal and quick reference for the Corporate Finance student. The buttons on the bar at the top of this page provide links to web pages which cover the core areas of Corporate Finance. In each of these sections, there are several pages related to the particular topic. Concepts These pages provide an introduction to the key concepts related to the particular subject. Tools & Problems These pages present financial calculators, algorithmically generated practice problems, and quizzes.

RSI - Relative Strength Index. Relative Strength Index (RSI) is a popular momentum oscillator developed by J. Welles Wilder Jr. and detailed in his book New Concepts in Technical Trading Systems. The Relative Strength Index compares upward movements in closing price to downward movements over a selected period.

Wilder originally used a 14 day period, but 7 and 9 days are commonly used to trade the short cycle and 21 or 25 days for the intermediate cycle. Relative Strength Index (RSI) Introduction Developed J. Welles Wilder, the Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Varsity by Zerodha – Markets, Trading, and Investing Simplified. Why We Sell Option Premium. The Put Option selling – Varsity by Zerodha.

Opción financiera. Una opción financiera es un instrumento financiero derivado que se establece en un contrato que da a su comprador el derecho, pero no la obligación, a comprar o vender bienes o valores (el activo subyacente, que pueden ser acciones, bonos, índices bursátiles, etc.) a un precio predeterminado (strike o precio de ejercicio), hasta una fecha concreta (vencimiento). Modern Portfolio Theory - MPT. What is 'Modern Portfolio Theory - MPT' Modern portfolio theory (MPT) is a theory on how risk-averse investors can construct portfolios to optimize or maximize expected return based on a given level of market risk, emphasizing that risk is an inherent part of higher reward. According to the theory, it's possible to construct an "efficient frontier" of optimal portfolios offering the maximum possible expected return for a given level of risk. This theory was pioneered by Harry Markowitz in his paper "Portfolio Selection," published in 1952 by the Journal of Finance.

Opción financiera. Modern portfolio theory. Rankia. Trading Stock Options - Options Trading Example of How to Trade Stock Options. Trading stock options is essentially the buying and selling of options contracts. Logically that makes no sense nor helps you see how you can make so much money doing so, but stick with me for a second and let me walk you through an example. An options contract is an agreement made between two parties in regards to buying or selling a stock. "Real estate investors" buy and sell homes "Stock Traders" buy and sell shares of stock "Option traders" buy and sell contracts.

Options Glossary. Module 5 User. Chicago Board Options Exchange. Exclusive IBD Ratings. Covered Call Writing- Using the Multiple Tab of the Ellman Calculator. Selling stock options is all about generating a cash flow. The Lucas Asset Pricing Model. The Lucas Asset Pricing Model – Quantitative Economics.