Where are you on the global pay scale? Common Chart Indicators. Congratulations on making it to the 5th grade!

Each time you make it to the next grade you continue to add more and more tools to your trader’s toolbox. “What’s a trader’s toolbox?” You ask. Simple! Let’s compare trading to building a house. Japanese Candlesticks Cheat Sheet. Financial News - SharePrice.com. Your Do-It-Yourself Tax Cut Guide - 06/10. The Chancellor won't cut taxes before 2014, but you can trim your own tax bill today!

At the Conservative Party conference in Manchester, Chancellor of the Exchequer George Osborne said this in his speech on Monday to the Tory faithful: "Each day, people suggest to me things we should be doing differently. Some say borrow more for more spending. Or they say borrow more for temporary cuts in tax -- so you'd have to put taxes up even more later. I'm a believer in tax cut… DIY tax cuts In other words, with the government borrowing around £10 billion a month more than it earns, the Chancellor has ruled out any possibility of tax cuts before the next Parliament. While George Osborne has no plans to cut personal taxes before 2014 or 2015, there's nothing to stop you from introducing a few personalised tax cuts of your own.

DIY Income Investor: Investing in Commercial Property: 8% Yield and 20% Discount! Commercial property is in the doldrums in the UK.

But in time this is sure to change, as the economy recovers. OK, this won't be tomorrow but could this be a medium-term opportunity for the DIY Income Investor? Now, I'm not suggesting buying property - that would be too much like hard work, as well as being risky. But is there another way to buy in to property - and one route currently offers an 8% yield and a 20% discount. 6%-Plus Yields You Can Trust - 20/10.

BG. share price - BG GROUP PLC (BG.,BG..L) - trade for £10. A Blue-Chip Starter Portfolio - 04/10. How do the UK's ten industry giants shape up as a starter portfolio?

Here at The Motley Fool, we've long extolled the virtues of low-cost index trackers as a one-stop shop for equity investment. Tracker funds simply replicate an index, such as the FTSE 100 or FTSE All-Share. However, index tracking isn't everyone's cup of tea. Some people prefer to invest directly in the shares of individual companies. Shares vs trackers One reason some investors… Petrofac LD ORD USD0.02 (PFC) Interactive Investor. Morning Star. UK Share Net - UK Shares, quotes, graphs, charts, news, analysis, market news, bulletin board, investing, investment club, stocks, realtime, share prices. Big pullback leaves choice opportunities in oil and gas sector, says Citi. The big pullback by markets in recent days has resulted in some appetising opportunities in the oil and gas sector, with broker Citi citing Premier Oil ( LON:PMO ), Soco ( LON:SIA ), Cove Energy ( LON:COV ) and Afren ( LON:AFR ) as particularly attractive in the wake of the sell-off.

Citi’s Michael Alsford says a key factor affecting his post-pullback analysis is the outlook for oil prices. He sees the oil and gas sector discounting a modest decline in oil prices towards US$80/barrel over the next 12 months, which would suggest a soft landing for the economy or a willingness of OPEC to defend prices if global economic growth slows off significantly. However, a more material slowdown in the global economy would likely impact crude prices more significantly. That in turn would inhibit growth plans for the oil and exploration sector given the corresponding squeeze on operating cashflows and less access to equity-risk capital. Economics and Investment Articles. Neptune Investment Management. Stock Prices, Financial Markets News, FTSE 100 Index. CSS Partners LLP, Private Investment for Private Investors.

We offer a weekly stock recommendation service based on technical analysis.

We review the FTSE 350 universe of stocks because it offers good liquidity and small trading spreads. In addition to our technically-driven recommendations, we also provide an overview of the business, the investment rationale, financial ratios and a comparison with the FTSE index on each recommendation. Our recommendations are based on a study of technical indicators and chart patterns on the stocks. In light of the current high volatility and uncertain market situation, we recommend hedging by taking an opposite position on the same stock in the spread trading markets. The hedge is typically 20% to 35% of the target profit, depending upon the volatility of the stock and the spread in the spread trading market. Caparo Energy - Ravi Kailas. Determined to cash in on India's hunger for electricity is Ravi Kailas, head of AIM-quoted wind power play Caparo Energy (CEL).

The company, which came to AIM last autumn with a £50.2m placing at 115p, has raised £70m in mezzanine finance in India for wind power projects in that country and targets 5,000 megawatts of capacity by 2016. Based in Hyderabad, India, and registered in Guernsey, Caparo, which is poised to change its name to Mytrah (approximately meaning 'energy source'), is so far funded for 700 megawatts of capacity, most to be delivered by major turbine-maker Suzlon. Entrepreneur Kailas, who founded and runs the company as chairman and chief executive, argues that cash flow from operating power stations will pay for most of the rest, pointing out that India's climate enables wind power generators to operate predictably for eight months a year. Caparo's tightly held shares have fallen to 86p since flotation.

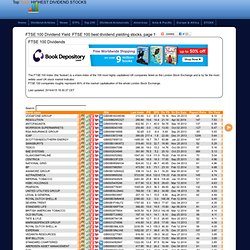

Common Chart Indicators. Japanese Candlesticks Cheat Sheet. Dividends. FTSE 100 best dividend yielding stocks. TopYields FTSE 100 best dividend yielding stocks, page 1 FTSE 100 Dividends The FTSE 100 Index (the 'footsie') is a share index of the 100 most highly capitalised UK companies listed on the London Stock Exchange and is by far the most widely used UK stock market indicator.

FTSE 100 companies roughly represent 80% of the market capitalisation of the whole London Stock Exchange. Last updated: 2014/4/15 18:30:37 CET. Wealth Management Collaboration Platform - welcome. THE GLOBAL FINANCIAL CRISIS. Markets data. Stock-Picking Strategies: Growth Investing. In the late 1990s, when technology companies were flourishing, growth investing techniques yielded unprecedented returns for investors.

But before any investor jumps onto the growth investing bandwagon, s/he should realize that this strategy comes with substantial risks and is not for everyone. Value versus Growth The best way to define growth investing is to contrast it to value investing. Value investors are strictly concerned with the here and now; they look for stocks that, at this moment, are trading for less than their apparent worth. Growth investors, on the other hand, focus on the future potential of a company, with much less emphasis on its present price. Unlike value investors, growth investors buy companies that are trading higher than their current intrinsic worth - but this is done with the belief that the companies' intrinsic worth will grow and therefore exceed their current valuations. 1. 2. The big problem with forward estimates is that they are estimates. Yahoo! Finance UK - FTSE, Stock Exchange, Mortgages, Loans &