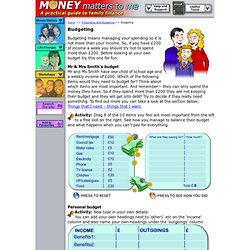

SPENT USA based but interesting activity. Buy-rent-calculator USA but principals apply in UK. Personal Finance and Economics Education USA. SPENT spending simulation USA. Hands on Banking® with Wells Fargo. Nationwide Education - Home. Banking Simulator. MoneySense. Consumer Rights. Interactive workshops. Budgeting. Budgeting means managing your spending so it is not more than your income.

So, if you have £200 of income a week you should try not to spend more than £200. Before looking at your own budget try this one for fun. Mr & Mrs Smith's budget Mr and Ms Smith have one child of school age and a weekly income of £200. Which of the following items would they need to budget for? Interactive ATM - cash machine simulator. Online banking simulator. Welcome to our online banking simulator, which aims to help you get to grips with online banking.

Each bank and building society offering online banking has its own website. These will differ from the Money Matters to Me online banking simulator but most should be easy to understand and use once you have practiced with our simulator. Log in details When you bank online your bank or building society will give you all the information you need to access your account.