The Environment and Health Atlas. National Insurance. Cundalls. Residential Sales From our prominently situated town centre offices we offer a friendly and professional service, backed up by many years of experience.

Old fashioned values of honesty and integrity are coupled with modern methods of marketing and communication to ensure our clients of the best independent advice from professionals who have a profound understanding of the local property market. We have hundreds of applicants registered on our mailing list, looking for all types of property from flats and terraced cottages to substantial country houses and smallholdings. We do not just give standard advice, but tailor our service to meet the requirements of our client, their property and their objectives. We have successfully sold thousands of property throughout Yorkshire by private treaty, informal tender (best and final offers) and public auction and can recommend the best marketing approach for each client.

Exclusive: Blow for young house hunters in remote Dales. HUNDREDS of remote communities across the Yorkshire Dales are in danger of missing out on affordable homes because they are due to be excluded from a pioneering strategy to counter a critical lack of housing for families and young couples.

Decaying farm buildings and miners’ cottages dating back to the 15th century in some of the most isolated settlements in the Yorkshire Dales National Park will not qualify to be converted into homes under the blueprint to address the lack of properties. A Government planning inspector, David Vickery, will be urged to revise the first planning document of its kind when he considers a draft version drawn up by the Yorkshire Dales National Park Authority at a three-day public hearing from tomorrow. The national park authority’s member champion for planning, Coun John Blackie, said it is crucial the planning strategy is overhauled to permit building conversions in the remotest settlements in the Dales. Namensänderungen: Britische Paare mixen ihre Nachnamen. Es gibt kaum etwas, das Claudia Duncan noch nicht gehört hat.

Und kaum etwas, das sie nicht möglich macht. Doch sie hat ihre Prinzipien. Ein Junge namens Jesus ist okay. Jesus Christ nicht. Über Jesus Chris müsste man nachdenken. Claudia Duncan arbeitet für den UK Poll Service, so etwas wie die Namensänderungsbehörde des Vereinigten Königreichs. Www.ifs.org.uk/bns/bn09.pdf. Starflats.co.uk – Househunt flatshare flat to rent flatshare room Looking for a flatshare Offer a flatshare short term rent flatshare. Private rents in England unaffordable, says Shelter. Private rents are now unaffordable in 55% of local authorities in England, the housing charity Shelter has said.

Homes in these areas cost more than 35% of median average local take-home pay - the level considered unaffordable by Shelter's Private Rent Watch report. The charity said 38% of families with children who rent privately have cut back on buying food to help pay rent. Housing Minister Grant Shapps said it had curbed red tape "which would have pushed up rents and reduced choice". Shelter's research found rents had risen at one-and-a-half times the rate of incomes in the 10 years up to 2007. 'Dramatic impact' It said private rents in 8% of England's local authorities were "extremely unaffordable" - with average rents costing at least half of full-time take-home pay.

Just 12% of areas were affordable, it added. Shelter analysed two-bedroom homes because they were so widely found and used Valuation Office Agency and Office for National Statistics data. UK PAYE Salary Wage Income Tax Calculator 2012 / 2013 / 2014. Updated for 2012 / 2013 HMRC inland revenue tax year. Calculate wages pension national insurance and student loan repayments online. What is My Tax Code? - The Tax Guide (UK) Author: J.A.J Aaronson - Updated: 26 September 2012| Comment Every taxpayer in the UK has a tax code.

This short series of numbers and letters is used by whoever pays your income (whether that is an employer or a pension provider) in order to ascertain how much tax you should be paying. Tax Code Format. UK tax codes explained BR basic rate tax new tax code 603L and 647L. Income Tax percentage rates for Employees All employers in the UK pay employees through the inland revenue tax PAYE system and are required to deduct both tax on income and national insurance contributions from the gross wages.

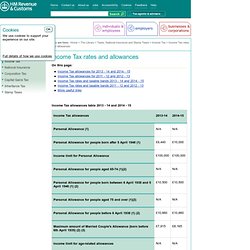

The net wages received are by the employee after the PAYE deductions. Gross pay is the total amount the employee has earned in that pay period including the basic wages plus any tips or bonuses received but excluding non taxable expenses. The gross pay on which an employee is assessed from tax and national insurance includes taxable benefits received by that employee such as private medical care or the provision of a company car. Non taxable expenses being business expenses the employee has incurred carrying out the duties which are reimbursed by the employer. Income Tax allowances. On this page: Top The Personal Allowance reduces where the income is above £100,000 - by £1 for every £2 of income above the £100,000 limit.

This reduction applies irrespective of age or date of birth. These allowances reduce where the income is above the income limit by £1 for every £2 of income above the limit. This applies until the level of the personal allowance for those aged under 65, or from 2013-14, for those born after 5 April 1948, is reached. Income Tax rates, allowances and tax bands for 2008-09 to 2010-11 (Opens new window) PAYE/NI Net Salary Tax Calculator.