"Captured Europe" by Simon Johnson. Exit from comment view mode.

Click to hide this space WASHINGTON, DC – Europe’s policy elite – the people who call the shots at the national and eurozone level – are in serious trouble. They have mismanaged their way into a deep crisis, betraying all of the lofty promises of unity and prosperity issued when the euro was created. The currency union may survive, but, for millions of people, the euro has already failed in its mission of sustaining growth and ensuring stability. How did this happen? The Greek, Portuguese, Irish, and Italian economies are reeling under fiscal austerity – with budget cuts and higher taxes as far as the eye can see. But that is only part of the problem. There is a simple way to deal with a debt overhang: reduce payments by restructuring the debt.

Cleaning up the mess: Bank resolution in a systemic crisis. The diabolic loop between the solvency of the banking system and the sovereign fiscal position is now apparent (Lane 2012).

In Greece, it is the insolvency of the government that has sunk the banks;In Spain, the banks are sinking the government. What is common in both countries is that savers are running away when they see the banks and the sovereign propping each other up. Europe's Cash-For-Trash LTRO-'Scam' And The Indentured Servitude Of The Citizenry. GMO - You Can Bank on It: European Banks Need Tons of Money. More BullSweet Stress-Free Tests of European Banks. Ho Hum.

EU officials have announced the results of more Stress-Free bank tests in Europe. 20 banks were expected to fail, only 8 did. Please consider 8 Banks Fail EU 'Stress Tests' Eight banks flunked the European Union's "stress tests," with a combined shortfall of €2.5 billion ($3.54 billion) in capital under a simulated worst-case economic scenario, the European Banking Authority said.The EU regulator said Friday that another 16 banks narrowly passed the tests, which examined the abilities of 90 top lenders across Europe to endure a deteriorating economy and strained financial system.By awarding a relatively clean bill of health to the vast majority of Europe's banking industry, the tests are likely to be greeted with skepticism. Did the stress tests include a Greek default? What about Irish, Portuguese, or Spanish defaults. The answer to those questions is no.

Eight banks fail EU stress test with 16 in danger zone. 15 July 2011Last updated at 20:34 Banks both inside and outside the eurozone were tested. Eight out of 90 European banks have failed stress tests designed to ensure they can withstand another financial crisis. Economics focus: Default settings. IN DECEMBER 2001 Argentina defaulted on $81.8 billion of sovereign debt, after months of turmoil in the country's banking system.

That led to the abandonment of its exchange-rate regime and a sharp devaluation of the peso. Argentina's GDP plummeted by 10.9% that year. It has been locked out of international capital markets ever since. In Greece such tales now have a worrying resonance. Despite raising $6.7 billion on bond markets on March 29th, the scale of the country's financing needs means that an eventual default cannot be ruled out. In theory, default should be costly. Sovereign Default Risk and Bank Fragility in Financially Integrated Economies. The Eurozone crisis has thrown into relief the dangers of financial contagion.

The authors of CEPR DP8358 analyze the causes and consequences of sovereign debt crises in zones with financial integration. They conclude that without fiscal integration, the supply of government debt in these areas reaches an inefficient equilibrium, with safer governments inefficiently issuing too little of their high-quality debt and riskier governments issuing too much. Vox users can download CEPR Discussion Paper 8358 for free here. To learn more about subscribing to CEPR's Discussion Paper Series, please visit the CEPR website. Journalists are entitled to free DP downloads on request; please contact pressoffice@cepr.org.

Has The Imploding European Shadow Banking System Forced The Bundesbank To Prepare For Plan B? While much has been said about the vagaries in the European repo market elsewhere, the truth is that the intraday variations of assorted daily metrics thereof indicate three simple things: a scarcity of quality assets that can be pledged at various monetary institutions in exchange for cash or synthetic cash equivalents, a resulting lock up in interbank liquidity, and above all, a gradual freeze of the shadow banking system.

As we have been demonstrating on a daily basis, we have experienced all three over the past several months, as the liquidity situation in Europe has gotten worse, morphing to lock ups in both repo and money markets. As a reminder, both repo and money markets (for a full list see here), are among the swing variables in shadow banking. Why The UK Trail Of The MF Global Collapse May Have "Apocalyptic" Consequences For The Eurozone, Canadian Banks, Jefferies And Everyone Else.

Reposting by popular demand, and because everyone has to understand the embedded risks in this market, courtesy of the shadow banking system.

In an oddly prescient turn of events, yesterday we penned a post titled "Has The Imploding European Shadow Banking System Forced The Bundesbank To Prepare For Plan B? " in which we explained how it was not only the repo market, but the far broader and massively unregulated shadow banking system in Europe that was becoming thoroughly unhinged, and was manifesting itself in a complete "lock up in interbank liquidity" and which, we speculated, is pressuring the Bundesbank, which is well aware of what is going on behind the scenes, to slowly back away from what will soon be an "apocalyptic" event (not our words... read on). Why was this prescient? But first, a detour to London... MF Global and the great Wall St re-hypothecation scandal. Back to Current Awareness Your source for up-to-the-minute insights and analysis that matter to you.

From a single page on WestlawNext, access the practice area-specific information you need to stay focused, and stay in the know. THE EUROPEAN BANK RUN. Crunch de crédit continu (et collateral) Global Financial Disaster Looms: European Banks Face Bankruptcy. Lloyd’s of London Pulls Euro Bank Deposits; Dollar Swap Premium Highest in 3 Years. Major mistrust of European banks continues.

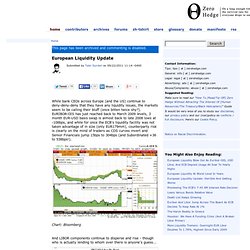

Since the ECB will not publish banks needing emergency cash, all banks might be considered suspect. Then again, it's hard to keep stories quiet, and most know which banks have received emergency funding. Regardless, the run continues as Lloyd’s of London Pulls Euro Bank Deposits Lloyd’s of London, concerned European governments may be unable to support lenders in a worsening debt crisis, has pulled deposits in some peripheral economies as the European Central Bank provided dollars to one euro-area institution. European Liquidity Update. While bank CEOs across Europe (and the US) continue to deny-deny-deny that they have any liquidity issues, the markets seem to be calling their bluff (once bitten twice shy?).

EURIBOR-OIS has just reached back to March 2009 levels, 3 month EUR-USD basis swap is almost back to late 2008 lows at -106bps, and while for once the ECB's liquidity facility was not taken advantage of in size (only EUR179mm), counterparty risk is clearly on the mind of traders as CDS curves invert and Senior Financials jump 15bps to 304bps (and Subordinated +36 to 538bps!). Chart: Bloomberg And LIBOR components continue to disperse and rise - though who is actually lending to whom over there is anyone's guess...

Morgan Stanley's Exposure To French Banks Is 60% Greater Than Its Market Cap... And More Than Half Its Book Value. With French banks now a daily highlight in the market's search for the next source of contagion, and big, multi-syllable words such as conservatorship and nationalization being thrown about with increasingly reckless abandon, perhaps it is time to consider the downstream effects of a French bank blow up. And we are not talking French sovereign troubles, which are about to get far worse with the country's CDS once again at record highs means the country's AAA rating is as good as gone. No: banks, as in those entities that are completely locked out from the dollar funding market, and which will be toppled following a few major redemption requests in native USD currency.

Which in turn brings us to...Morgan Stanley, the little bank that everyone continues to ignore for assumptions of a pristine balance sheet and no mortgage exposure. So if you are looking for a French bank implosion derivative play, look no more. CREDIT UPDATE – BAYESIAN THOUGHTS. By Martin, Macronomics “In the Bayesian (or epistemological) interpretation, probability measures a degree of belief. Bayes’ theorem then links the degree of belief in a proposition before and after accounting for evidence. For example, suppose somebody proposes that a biased coin is twice as likely to land heads than tails. Stop coddling Europe’s banks. After initial denials, Europe’s leaders have started to acknowledge that IMF Chief Christine Lagarde was right. Euro vs. Invasion of the Zombie Banks. In Ireland, there has been a “silent bank run” on financial institutions for much of the last year.

In February, for instance, Irish private sector deposits dropped at an annual rate of 9.8 percent.