The TJX Companies, Inc. - Investor Relations - Investor Information. Consistency, Growth, Excellent Financial Returns.

Investor Information. Succeeding in All Types of Environments The TJX business model is built to have tremendous flexibility and grow with the times, enabling us to navigate through economic downturns as well as upturns.

Over our 36-year history, we have achieved consistent, strong performance. In fact, over this period we have had only one year with a comparable store sales decline. Over the last 17 years, we have delivered annual comparable store sales increases each year, and earnings have grown solidly. Our long, successful track record through many types of economic and retail environments is one of the reasons for our confidence that our strong top- and bottom-line growth will continue for many years to come. Our Businesses. Our Businesses We are The TJX Companies, Inc. and our vision is to be a global, off-price value Company.

Our over 3,000 stores offer a rapidly changing assortment of quality, fashionable, brand name and designer merchandise at prices generally 20%-60% below department and specialty store regular prices, every day. Over our history, we have successfully expanded the off-price concept throughout the U.S. and internationally.

Operating in the U.S., Canada and Europe, our experience has shown us that our great value equation plays well in many countries around the world and appeals to customers from a wide range of income and age demographics. Indeed, we believe that we have one of the widest demographic reaches in retail. What is a business model? Update: Business Model Innovation Book.

We are currently writing a groundbreaking book on business model innovation (publication: June 2009). You can get special privileges and participate in the innovative business model of our book project on our book chunk platformUpdate: Based on the overwhelming interest this post got, I updated the version from 2005 A business model is nothing else than a representation of how an organization makes (or intends to make) money. TJX Companies (TJX)

The TJX Companies, Inc. (TJX): The TJX Companies: High Quality Retailer In the Bargain Bin. The recent credit card breach at TJ Maxx has evoked loud criticism from all corners of the investment and political spectrum over the company's lax security measures and has equated the companies actions as those of the criminals themselves.

In a recent Lightening Round on Cramer's Mad Money, Jim went as far as to say that TJX is a "mismanaged" company. How thoughtful Jim! Perhaps had he given more than the 12 allotted seconds to each stock idea, he may have constructed a more thoughtful position. While I am concerned that more stringent controls were in place before the breach, at the end of the day, I view TJX as more a victim than culprit.

I love when short term issues like this give us the opportunity as long term investors to buy great companies to buy and hold until the market lets them out of the penalty box. Do you trust this author to give you good analysis? Follow and be the first to know when they publish. Follow Jonathan Callahan (9 followers) New! Follow these related stocks. Callisto.ggsrv. Harvard Business Review: Case Analysis - Security Breach at TJX (908E03-PDF-ENG) from Strategic Role of IT perspective. Case Background: The chief security officer of TJX Companies Inc.

(TJX) faces a dilemma on his first day on the job. The company has discovered in December 2006, a computer intrusion dating back to 2005. There is an ongoing investigation, involving the Federal Bureau of Investigation (FBI) into the attacks. The company is also in the middle of several class action law suits over losses suffered by financial institutions due to breaches of customer privacy.

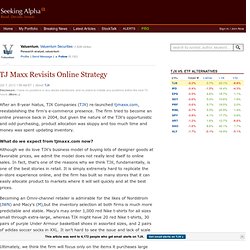

The TJX Companies, Inc. (TJX) news: TJ Maxx Revisits Online Strategy. After an 8-year hiatus, TJX Companies (TJX) re-launched tjmaxx.com, reestablishing the firm's e-commerce presence.

The firm tried to become an online presence back in 2004, but given the nature of the TJX's opportunistic and odd purchasing, product allocation was sloppy and too much time and money was spent updating inventory. What do we expect from tjmaxx.com now? Although we do love TJX's business model of buying lots of designer goods at favorable prices, we admit the model does not really lend itself to online sales. In fact, that's one of the reasons why we think TJX, fundamentally, is one of the best stories in retail. It is simply extremely hard to replicate the in-store experience online, and the firm has built so many stores that it can easily allocate product to markets where it will sell quickly and at the best prices. Target's Internal Factors: Corporate Business Strategy Positioned for Success.

Target rapidly became such a well-known brand and name, that the corporation, formerly known as Dayton-Hudson adopted it as its larger name.

The well-known name has become an icon for stylish, fun and affordable shopping. Though the company has several other strengths, unfortunately the company's weaknesses are of significant importance and lessen the weighted score on the internal factor evaluation matrix. First, Target's commitment to maintain its underperforming divisions, Mervyn's and Marshall Fields, demonstrates less than astute business acumen.

Getting rid of this dead weight could significantly reduce Target's costs and free up resources to invest in its more successful and profitable business operations. Secondly, and most significantly, Target's failure to enter global markets, though patriotic in theory is limiting the scope of operations and the level of competition that Target is able to achieve. Could Target's New Strategy Overcomplicate the Business? (TGT) It seems discount retailer Target (NYSE: TGT ) is having an identity crisis.

Known for its penny-wise pricing on trendy merchandise, the retailer now plans to open upscale mini-shops within its stores, and it just might work. Let's take a closer look to see whether the new brand strategy will be a bull's-eye for the retailer. Target's recent partnership with Apple (Nasdaq: AAPL ) is part of its plan to open smaller stores within Target locations. However, some analysts argue that the retailer is trying to go in too many directions at once. I disagree.