Global political risk (pdf) ISIS Oil Trade Full Frontal: "Raqqa's Rockefellers", Bilal Erdogan, KRG Crude, And The Israel Connection. Damascus wants Russia to develop Syrian oil — RT Business. Syrian authorities are hoping Russian companies will develop the country's offshore oil deposits, said Syrian Foreign Minister Walid Muallem during a meeting with Russian Deputy Prime Minister Dmitry Rogozin.

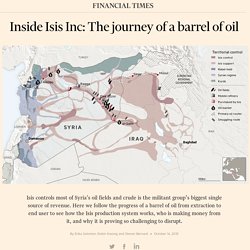

"We have data that oil and gas deposits on a shelf off the coast of Syria have enormous potential. And we hope to see not only Russian warships in Syria, but also platforms for extracting oil,” Muallem said on Thursday. He added that one Russian firm has already signed a contract and Damascus is waiting for other companies will follow suit. Syria is ready to offer Russian companies “all possible incentives.” Syria oil map: the journey of a barrel of Isis oil. Kurdistan Regional Government.

Dear GOP, you really want to hurt ISIS? Get out of Big Oil's pocket. Of course, none of this is particularly controversial.

We’ve known for over a decade the insidious role of petroleum money in the funding of terror networks, including from supposed allies like Saudi Arabia. What is surprising about all of this is how resistant conservatives are to drying up this source of terrorist money. Mysterious Middleman: Who is Buying ISIS's Crude and Dropping Oil Prices? Who is the commodity trader buying ISIS's crude?

And is the sharp oil price fall the result of the Islamic State's successful oil trade, Tyler Durden asks. Incredibly, it has taken over a year for the US-led anti-ISIS coalition to recognize that the Islamic State's funding is significantly dependent on crude, extracted by ISIS from captured oil wells, anonymous analyst for the financial website Zero Hedge Tyler Durden underscores.

"Still, without a doubt, the dominant source of funds for the terrorists is oil, and not just oil, but a well-greased logistical machine that keeps thousands of barrels moving from unknown pumps to even refineries, and ultimately to smugglers who operated out of Turkey and other countries," Durden wrote in his recent piece. Can Russia Withstand The Saudi Onslaught In The European Oil Market?

Saudis intensify battle for European markets with Russia as its biggest competitor.

Lower oil prices and a weaker ruble could wreak havoc on Rosneft’s debt obligations. Rosneft and the Russia government have reason to feel anxious: Rosneft would face the prospect of a protracted battle over market share in Europe with a lower-cost producer. By Dalan McEndree Is Saudi determination to continue to defend its global crude market share and to let market forces determine crude prices finally unnerving Russia in general and Rosneft (OTC:RNFTF) CEO Igor Sechin in particular? Low Oil Prices Could Bankrupt OPEC in 5 Years. Would you be happy to see the Saudis going broke?

A lot of people would, seeing the swoon in oil prices as a premeditated plot from the No. 1 OPEC producer. Putin: Assad Would "Accept" Snap Elections To Avoid "Total Chaos" Overnight, we brought you the latest on the “friggin mess” (to quote the Pentagon) that is Syria, where Bashar al-Assad is desperately clinging to power while his depleted army fights a three-front war against a dizzying array of “freedom fighters”, jihadists, former CIA strategic assets, current CIA strategic assets, the Kurds, and god only knows who else.

The Assad regime is (literally) surrounded by hostile states who are angling for his ouster and if you had any lingering doubts about why it is that everyone wants Syria’s strongman gone, look no further than this map: Note the purple line which traces the proposed Qatar-Turkey natural gas pipeline and note that all of the countries highlighted in red are part of a new coalition hastily put together after Turkey finally (in exchange for NATO’s acquiescence on Erdogan’s politically-motivated war with the PKK) agreed to allow the US to fly combat missions against ISIS targets from Incirlik. His Town - The Huffington Post.

Ryan Grim and Akbar Shahid Ahmed By Ryan Grim and Akbar Shahid Ahmed Last September, as Islamic State militants rampaged through Syria and Iraq, the Pentagon hosted a top-secret meeting to debate strategy.

At the invitation of the Defense Policy Board, which advises the secretary of defense, a small group of foreign policy eminences, including former National Security Advisor Zbigniew Brzezinski, former Secretary of State Madeleine Albright and former ambassador to Iraq Ryan Crocker, gathered in a conference room in the E-ring of the building. The assembled experts were trying to make sense of a Middle East in greater turmoil than it had been since World War I.

Starting in 2010, the Arab Spring had toppled dictators in Tunisia, Egypt, Libya and Yemen. Russia wants to build a massive superhighway that would make it possible to drive from the UK to the US. Flickr/Boccaccio1The Trans-Siberia Railway.

A report by the Siberian Times has detailed one of Russia's more outlandish schemes to date: a super motorway that would connect the eastern border of Russia with Alaska in the United States. The highway would make it possible to drive from the United Kingdom to the US, with help from bridges, tunnels, and trains. Ласточка на рельсах. Практически незамеченной прошла очень важная новость.

Первый контейнерный поезд прибыл из Китая в Нидерланды. Маршрут поезда проходил по территории России и Белоруссии, потом поезд сузил колёса и въехал в Польшу, а далее через Европу достиг границ страны тюльпанов. Маршрут станет регулярным, на август и сентябрь запланировано ещё несколько рейсов. Chart of Russia's militarization of Arctic - Business Insider. Нефтяная компания ExxonMobil закрывает представительство в Украине - Экономика. В Украине закрывается представительство американской нефтяной компании ExxonMobil - ExxonMobil Exploration and Production Ukraine.

Об этом сообщили в пресс-службе компании. "Указанное выше не касается других представительств компании ExxonMobil в Украине", - говорится в сообщении. Putin’s Energy Diplomacy is Getting the Cold Shoulder. Russian President Vladimir Putin has been trying his own pivot to Asia, hoping that his country’s vast natural gas holdings could cement a new relationship with China while making it easier to bypass his quarrelsome neighbors in Europe.

Unfortunately for the Russian strongman, things aren’t going so well. Over the past year alone, Putin has inked a massive, $400 billion natural gas deal and a strategic partnership with Beijing. Russia also hoped to build a second Siberian pipeline to China that could give Moscow the ability to play off European energy customers against those in Asia. "Greece Is No One's Hostage": Leftist Energy Minister Lays Out €2 Billion Russian Gas Project. The prospect of a so-called “Russian pivot” by Greece still hangs over Angela Merkel’s head. The conflict in Ukraine and the attendant economic sanctions imposed on the Kremlin combined with the EU’s anti-trust proceedings against Gazprom have raised the geopolitical stakes of a Grexit. Merkel has repeatedly warned that the consequences of Greece exiting the eurozone go far beyond short-term financial turmoil and political contagion (e.g. the spread of the Syriza “germ”).

And Vladimir Putin is acutely aware of the opportunity. "Just because Greece is debt-ridden, this does not mean it is bound hand and foot, and has no independent foreign policy,” Putin said earlier this year, as tensions between Athens and Brussels intensified. The new Silk Road will underpin the next commodity supercycle. Remember the great commodities bull market of the 2000s? Oil began it at $10 a barrel, iron ore at $10 a ton, and copper at 60 cents a pound. Gold was $250 an ounce and wheat $2.50 a bushel.

Some ten or so years later, oil was $147 a barrel, iron ore $180 a ton and copper $4.65 a pound. Gold was $1,920 an ounce and wheat reached $13.50 a bushel. It was one heck of a bull market. Ъ - Натаниэль Ротшильд разочаровался в индонезийском угле. Компания NR Holdings Натаниэля Ротшильда, которая в консорциуме с SUEK Plc, головной компанией холдинга СУЭК Андрея Мельниченко, планировала купить индонезийский угольный актив Asia Resource Minerals Plc (ARMS), выбыла из борьбы за него. NR Holdings сообщила, что принимает улучшенные условия оферты конкурента — группы Sinarmas, принадлежащей индонезийской семье Виджайя,— и продает свои 17,25% в компании. Натаниэль Ротшильд заявил, что для него это первая и последняя инвестиция в индонезийский угольный сектор.

NR Holdings Натаниэля Ротшильда, владеющая 17,25% индонезийского угольного холдинга ARMS, отказалась от попыток перебить оферту конкурента Asia Coal Ventures и продает свою долю в компании на предложенных им сегодня новых условиях. Об этом заявила NR Holdings. Компания приняла условия оферты и выходит из ARMS и индонезийского угольного бизнеса в целом. Saudi Arabia Takes Out Its Energy Weapon. The OPEC oil cartel made a surprising decision last fall to keep pumping oil into a market already awash in the black gold.

On Friday in Vienna, they’ll almost certainly double down on that strategy. Dr. Strange-oil. Russian President Vladimir Putin has been acting with supreme confidence and relative impunity in Ukraine, but one looming vulnerability is bound to be making him nervous: the price of oil. It’s the key to regime stability, and in both the near term and the run-up to the 2018 elections, it’s going to dictate Putin’s political fortunes. In the past six months, the price of oil has dropped more than 50 percent from slightly above $100 per barrel to the mid-$40 range, with a small recent rebound. Analysts are split on whether this decline is temporary, but no one is predicting a rapid return to the sustained high prices that had buoyed Russia’s economy since the end of the Yeltsin period.

While EU antitrust actions against Gazprom and other sanctions on the Russian energy sector exacerbate Russia’s current position, the key fundamental is the global price of oil per barrel and the centrality of oil to the Russian economy. Sabotage the P5+1 talks. Shell Oil’s Cold Calculations for a Warming World. The shale boom is over, and oil companies have just one thing left to do. It's complicated: The US, Venezuela, and China's crude oil relationship. Oil's Well in Central Asia. For 13 years, the shadows of NATO supply planes have flecked Central Asia. As the war in Afghanistan stretched on, troops, equipment, and fuel passed through or over Central Asian territories on a daily basis.

It's complicated: The US, Venezuela, and China's crude oil relationship. China buys 5 percent of Ukraine's land. China has just struck a deal to farm 3 million hectares (about 11,580 square miles) of Ukranian land over the next 50 years to feed its ballooning population. U.S. faces meager options for further Russia energy sanctions. US Foreign Policy In One Photo. Un-Photoshopped Reuters photo sums up US foreign policy perfectly as Abdul Latif bin Rashid Al Zayani, representing the Gulf Co-operation Council, appears to leave U.S. President Barack Obama hanging during a welcome ceremony at the White House this week. Source: CBC. China slams the Philippines for taking journalists to disputed island - Business Insider. Gazprom, Ankara agree to start gas deliveries via Turkish Stream in December 2016 — RT Business.

Putin Warns of Restricting Natural Gas Supply to Ukraine. MOSCOW — President and other senior Russian officials threatened on Wednesday to restrict supplies of to , and they reiterated the Kremlin’s contention that Ukraine owes more than $16 billion in unpaid gas bills and other debts. The declarations, at a government meeting just outside Moscow, were the latest pointed reminders to the West that Russia holds substantial sway over Ukraine’s financial future — even without a military incursion into eastern Ukraine.

The declarations also seemed intended to increase the Kremlin’s leverage in talks with the United States over resolving the political crisis. Putin-warns-of-restricting-natural-gas-supply-to-ukraine. Gazprom’s Ties to Putin Could Help It Try to Escape the EU’s Wrath. The European Union’s antitrust case against Russian energy giant Gazprom is a clear challenge to a company that has alternately succored and bedeviled the Old Continent for decades. US to launch blitz of gas exports, eyes global energy dominance - Telegraph. Mr Moniz said the surge in US output from shale fracking has already transformed the global market.

Why are global oil prices dropping? Vladimir Putin has a theory. Yemen and unintended Consequences — Oil's New Battleground. China's secret gold stockpile may be the world's 2nd biggest. A twist in the pipeline Hungary and Greece join Turkey in a new route for Russian gas. Saudi Arabia is setting the world up for a major oil shock. Oil shock morphs into global monetary shock – again. Russia Frees Itself From Oil's Curse. Here’s how Iran could prevent a rebound in oil prices. World's eight oil chokepoints. Russia oil and gas. Sorry Ukraine, You Still Need Russian Gas. These 8 narrow chokepoints are critical to the world's oil trade. Ukraine situation opportunity for U.S. energy producers. The myth of Russia’s energy strength. Iran Nuclear Deal Massive Blow To Crude Oil Prices. How the US government made $200 million on an oil trade.