More On Seed Rounds. There was a good discussion in the comment threads to yesterday’s post.

This comment from Rick made me think a follow-up post would be helpful. Seed, Later Stage, etc. all mean different things to different people. That’s where the confusion comes from. I wrote a post explaining how we think about seed last June. Here’s the important part from that: The first step you need to climb is building a product, getting it into the market, and finding product market fit. At USV, we like to invest in a company once they have launched a product and we think that they have either found product market fit or they are well on their way. But occasionally one or two people, working nights or weekends, or working in an accelerator, or working for themselves and bootstrapping, are able to get a product into the market, get adoption, and get to or close to product market fit. Here are some examples: Tumblr – David Karp and Marco Arment built Tumblr while doing consulting to others.

Some Thoughts On Seed Investing. We (USV) raised a new venture fund at the start of last year and started investing it in the spring of 2014.

It is called USV 2014. We have made six investments in it so far and five of them are seed investments. That’s a very high ratio for USV and we do not expect that ratio to continue over the life of the fund. In fact our next investment will be a classic Series A so we are already lowering the ratio. But it is a bit of a return to form for USV as half of the initial investments in our first fund (USV 2004) were made at the seed stage. In our core early stage funds (as opposed to our Opportunity Funds), we make initial investments at the seed, Series A, and Series B stages. The current market environment has pushed us to invest earlier. So that explains the move to seed as our primary entry point last year. Ok. How venture capitalists focus on their customers.

“Focus on the customer”.

“Fall in love with the problem”. We hear those all the time as absolute startup advice. What about venture capital firms? They’re not startups but shouldn’t that kind of advice apply to them? How? Startup founders are not the VCs’ customers If you already know about this, skip to the last sentence of this part. The Venture Capitalist Struggle — Bonanzinga @ Entrepreneurship at Work (European view)

In the startup community, we often hear and read a lot about the entrepreneurial struggle — the daily difficulties and challenges facing those building companies.

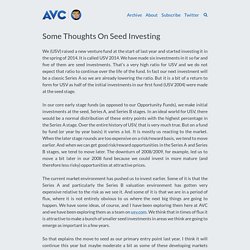

Rarely, however, do we hear about the other side of the equation — the investor struggle. Although it may appear that the life of an investor is a charmed one filled with great travel, luxury hotel and amazing conferences that couldn’t be farther from the truth. When you ask any VC how it is going you always get the same answer: amazing. Company XYZ is a home run! The new reality of venture capital. Disconnect between value creation and capture The venture capital industry creates value that far outweighs the dollars allocated to it.

But ten year returns to investors haven’t reflected that fact. Innovation presents opportunities to solve customer problems more effectively and efficiently. But creating solutions that don’t yet exist involves a high degree of uncertainty. Usually, you need to spend a considerable amount of time and money before you know your efforts are going to pan out. A Few Non-Obvious Things I Learned as a New VC. What a VC Really Thinks About your Revenue Projections. As a venture capitalist, I meet companies seeking funding every day with projected revenue vastly exceeding current revenue.

How does a VC ascertain the likelihood of you achieving your forward revenue number? How do you demonstrate to a VC that you can credibly hit your projections? What follows is a diagnostic framework that shows how a VC with an analytical bent will dissect your revenue projections to ascertain how realistic they are. This framework will be most relevant for companies with SaaS or recurring revenue models, particularly those that sell into the enterprise. Let’s start with an example. USV Conversations. Venture firms operate a bunch of different ways.

Some have a geographical focus, others have a sector focus, still others have a stage focus. Union Square Ventures' focus has evolved into what we call a "thesis" but is probably better described as a macro level view about the world - the Internet world - that we then (attempt) to structure investment activities around. In short, as described by Brad last year in 140 characters, USV invests in: