Putting People Directly to Work Is “Too Radical” For Congress. All summer Colorlines is exploring how and why Washington has been so unwilling to take real action in the face of such a dramatic, lingering jobs crisis.

There are, in fact, solutions to this crisis; they just aren’t politically viable. Earlier this week, we dug up a few job-creation projects that are collecting dust while Washington prevaricates on the unemployment crisis. Infrastructure spending—bridges and roads and high-speed rail—generates up to $1.60 in new economic activity per dollar spent, according to economists, and cities across the country have projects just waiting for funding to get started. Republicans block Bring Jobs Home Act, protecting companies that outsource jobs. Made in the World. Majority of New Jobs Pay Low Wages, Study Finds. Brian Blanco for The New York Times A waitress at Arco Iris Restaurant in Tampa, Fla., last week.

The food industry has added 300,000 low-paying jobs in the recovery. The disappearance of midwage, midskill jobs is part of a longer-term trend that some refer to as a hollowing out of the work force, though it has probably been accelerated by government layoffs. “The overarching message here is we don’t just have a jobs deficit; we have a ‘good jobs’ deficit,” said Annette Bernhardt, the report’s author and a policy co-director at the National Employment Law Project, a liberal research and advocacy group. The report looked at 366 occupations tracked by the Labor Department and clumped them into three equal groups by wage, with each representing a third of American employment in 2008.

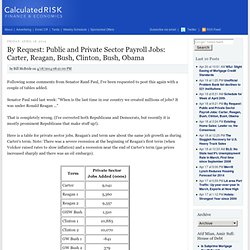

The job market has turned around since then, but those fields have represented only 22 percent of total job growth. By Request: Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama. By Bill McBride on 4/18/2014 08:21:00 PM Following some comments from Senator Rand Paul, I've been requested to post this again with a couple of tables added.

Senator Paul said last week: "When is the last time in our country we created millions of jobs? It was under Ronald Reagan ... " The Scary Economic Trend Making Americans More Job-Insecure Than Ever. Job applicants waiting to get interviewed at Yongsan Child Youth and School Services Job Fair, January 29, 2014.

No More Industrial Revolutions? The American economy is running on empty.

That’s the hypothesis put forward by Robert J. Gordon, an economist at Northwestern University. Let’s assume for a moment that he’s right. The political consequences would be enormous. In his widely discussed National Bureau of Economic Research paper, “Is U.S. How the recession changed where the jobs are, in one chart. What Happened to the Craftsmanship Spirit? — Essay. THE scene inside the on Weyman Avenue here would give the old-time American craftsman pause.

In Aisle 34 is precut vinyl flooring, the glue already in place. In Aisle 26 are prefab windows. Many American Workers Are Underemployed and Underpaid. She opened it occasionally to reread a favorite verse from Philippians: “And my God will meet all your needs according to the riches of his glory in Christ.”

Ms. Woods’s current job has not been meeting her needs. When she began driving a passenger van last year, she earned $9 an hour and worked 40 hours a week. Up to 95 Million Low-Skill Workers in Danger of Being Left Behind - Real Time Economics. 1 in 2 new college grads are jobless or underemployed. WASHINGTON (AP) - The college class of 2012 is in for a rude welcome to the world of work.

A weak labor market already has left half of young college graduates either jobless or underemployed in positions that don't fully use their skills and knowledge. Young adults with bachelor's degrees are increasingly scraping by in lower-wage jobs - waiter or waitress, bartender, retail clerk or receptionist, for example - and that's confounding their hopes a degree would pay off despite higher tuition and mounting student loans. An analysis of government data conducted for The Associated Press lays bare the highly uneven prospects for holders of bachelor's degrees.

Opportunities for college graduates vary widely. While there's strong demand in science, education and health fields, arts and humanities flounder. The Rise of the Permanent Temp Economy. For Jobless Young People, New Advocacy Groups. THIS may be little consolation to recent graduates who have sent out dozens of résumés with nary a response; who have been turned down for unpaid internships; who have vast amounts of student debt to repay as they continue in jobs as baby sitters and waiters.

But employers say they will hire 10.2 percent more college graduates from the class of 2012 than they did from the class of 2011, according to the National Association of Colleges and Employers. Nuggets of news like this are welcome as the economy fitfully recovers. Even so, joblessness among the young remains at crisis levels, economists say. In April, the unemployment rate for workers under age 25 was 16.4 percent, compared with 8.1 percent over all. Money Chart. America Is Europe. The U.S. does not have a significantly smaller welfare state than the European nations.

We’re just better at hiding it. The Europeans provide welfare provisions through direct government payments. We do it through the back door via tax breaks. For example, in Europe, governments offer health care directly. Bailout List: Banks, Auto Companies, and More. Tax Moochers: Banks. Corporate Welfare vs. Social Welfare Statistics. Time Magazine, Vol. 152 No. 19 About $59 billion is spent on traditional social welfare programs. $92 billion is spent on corporate subsidies. So, the government spent 50% more on corporate welfare than it did on food stamps and housing assistance in 2006. Revisiting the cost of the Bush tax cuts. ((Andrew Harrer/Bloomberg)) “After Democrats and Republicans committed to fiscal discipline during the 1990s, we lost our way in the decade that followed.

We increased spending dramatically for two wars and an expensive prescription drug program — but we didn’t pay for any of this new spending. Instead, we made the problem worse with trillions of dollars in unpaid-for tax cuts — tax cuts that went to every millionaire and billionaire in the country.” — President Obama, April 13, 2011 Obama, in a speech on budget policy last month, offered this summary of how he thought the nation lost its way fiscally during the presidency of George W. A person making $50,000 a year pays 10 cents a day in taxes for food stamps - Detroit liberal. Growth of Welfare Entitlements: Principles of Reform and the Next Steps. The American Welfare State: How We Spend Nearly $1 Trillion a Year Fighting Poverty.

On January 8, 1964, President Lyndon B. Johnson delivered a State of the Union address to Congress in which he declared an “unconditional war on poverty in America.” At the time, the poverty rate in America was around 19 percent and falling rapidly. Robert_rector_testimony.pdf (application/pdf Object) Contrary to "Entitlement Society" Rhetoric, Over Nine-Tenths of Entitlement Benefits Go to Elderly, Disabled, or Working Households.

Some conservative critics of federal social programs, including leading presidential candidates, are sounding an alarm that the United States is rapidly becoming an “entitlement society” in which social programs are undermining the work ethic and creating a large class of Americans who prefer to depend on government benefits rather than work. Whites and Welfare: GOP and the Food Stamp Fallacy. Welfare myths. Is Government Spending On Entitlement Programs REALLY To Blame? The Geography of Government Benefits - Interactive Map. The U.S. Federal Budget: Infographic. U.S. National Debt Clock : Real Time. Mark Blyth on Austerity. Does High Public Debt Stifle Economic Growth? Nobody Understands Debt. Keynes Was Right. Death of a Fairy Tale.

For the past two years most policy makers in Europe and many politicians and pundits in America have been in thrall to a destructive economic doctrine. This Republican Economy. The Austerity Agenda. Money for Nothing. That Terrible Trillion. The Myth of Americans Living Beyond Their Means with Robert Reich. Sen. Bernie Sanders: The Soul of America. Portal:Fix the Debt. Edit. In Blind Poll, Republicans Choose Progressive Budget Solutions Over Their Own Party's.