Observingrealities. PRIME ECONOMICS. Anti-mankiw. Twenty-Cent Paradigms. Library of Economics and Liberty. CONVERSABLE ECONOMIST. Macrobusiness.com.au. EconoSpeak. Econometrics Beat: Dave Giles' Blog. Olaf Storbeck on current economic research. Variant Perception. Worthwhile Canadian Initiative. This is speculative. I don't know whether it works empirically. Or, I should say, I don't know how much it works empirically. The effect I am talking about here might be large, and explain almost everything. Or it might be small, and explain almost nothing. I'm just throwing it out there. Legally required reserves, if those reserves pay low or no interest, are a tax on banks. The main reason that Canada got rid of required reserves 20 years ago was precisely to eliminate this tax on banks, and to 'level the playing field' between banks and other financial intermediaries. Bearish Market News.

Economic Principals. Modern Money Mechanics. Brave New World. Today’s Financial Times articles: Swiss central bank discord provides a warning bell (Feb 24), Sovereigns turn to pre-crisis financial wizardry (Feb 24) On facing pages in the print version of the FT, the reader is invited to consider the encounter of the modern state with the modern market.

Stumbling and Mumbling. Nobody will thank me for saying so, but I have a bit of a mancrush on Ed Smith.

Yet again, he has raised a profound point in the social sciences: Nakedly ambitious people rarely achieve their ambitions...Simplistic self-interest is not just bad PR, it is often bad strategy. Coordination Problem. A non-economist explores economics and the economy in the wake of the financial crisis. Janet Tavakoli. Bronte Capital. Greg Mankiw's Blog.

Real-World Economics Review Blog. Credit Slips. Abnormal Returns. Turning Academic Insight Into Investment Performance™ Free exchange. Antonio Fatas and Ilian Mihov on the Global Economy. True Economics. Front Page. Rortybomb. Felix Salmon. Brad DeLong's Grasping Reality with Both Hands. Planet Money.

Rick Bookstaber. Economics for public policy. Calculated Risk. Blog. Today is Equal Pay Day, a reminder that women and men are not always compensated at the same rate.

While the widely reported statistic that women, on average, earn 77 cents to every man’s dollar has been is a great indicator that women are put in situations every day that for a variety of reasons mean they earn less, it has been criticized for not measuring individuals of similar characteristics, such as age, occupation, education, or experience. To try to get a better understanding of the gender wage gap among specific age groups, and given that many high school and college seniors are on the brink of graduating and entering the labor force, I thought it would be interesting look at the gender wage gap by age and education, to see how women and men fare as they enter today’s unsteady labor market. To close the gender wage gap, women need to see real wage growth faster than their male counterparts. The best type of narrowing occurs when both women and men see real annual wage growth.

The Street Light. Noahpinion. Mike Norman Economics. The Economics Anti-Textbook. Blogs Author Ian Fraser. ECONOCLASM. Real Time Economics. China’s GDP growth fell in the first quarter to its slowest pace since September of 2012, slipping to 7.4% on-year growth from 7.7% the in the fourth quarter.

The increase was slightly higher than economists’ expectations of a 7.3% gain. Authorities released other data that suggested continuing weakness, but not at a quickening pace. Industrial production grew 8.8% on year in March below expectations of 9% but up from an average 8.6% expansion in January and February, combined to limit distortions from the Lunar New Year holidays.

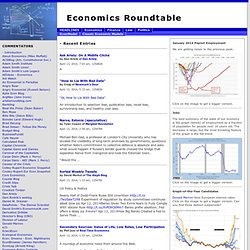

Retail sales were 12.2% higher on-year in March, up from 11.8% growth in January and February. Fixed-asset investment, meanwhile, slipped to 17.6% on year in the first quarter from 17.9% growth in the first two months. Markets rose on the data, with both the Shanghai and Hong Kong stock markets clicking higher. CEPR. John Quiggin. Jesse's Café Américain. Modern Monetary Theory … alternative economic thinking. Naked capitalism. Watching for the next financial crisis by keeping an eye on the repurchase market. Interfluidity. Hussman Funds Weekly View. Uneasy Money. Rajiv Sethi. Economist's View. Economics Roundtable. January 2014 Payroll Employment We are getting closer to the previous peak.

Click on the image to get a bigger version. Jobs. Economics of Contempt. On a long enough timeline, the survival rate for everyone drops to zero. Steve Keen's Debtwatch. TheMoneyIllusion. Mainly macro. NAKED KEYNESIANISM. Diary of a Mad Hedge Fund Trader. Cheap Talk. EconoMonitor. Home. Dan Ariely. TradingEconomics.com - Free Indicators for 231 Countries. Resources. Black Swan Insights. TripleCrisis.

The Physics of Finance. Statistical Modeling, Causal Inference, and Social Science. Grant's Interest Rate Observer. James Grant was born in 1946, the year interest rates put in their mid-20th century lows.

He founded Grant’s Interest Rate Observer, a twice-monthly journal of the financial markets, in 1983, two years after interest rates recorded their modern-day highs. Economics blog from the Financial Times. Global economic recovery stuck below takeoff speed By Eswar Prasad and Karim Foda The global economic recovery remains stuck below takeoff speed, unable to achieve liftoff and facing the risk of stalling.

Half-hearted fiscal austerity measures are proving to be a drag on growth and doing little to rebuild investor and consumer confidence. Monetary policy continues to shoulder the burden of limiting downside risks and has kept financial markets buoyant even in the face of weak growth prospects. Not the Treasury view... Angry Bear. Business / Economics. National Security Notice We are NOT calling for the overthrow of the government.