“Low time preference is the process of civilization.” Michael Goldstein. Hyperbolic discounting. In economics, hyperbolic discounting is a time-inconsistent model of discounting.

The discounted utility approach: Intertemporal choices are no different from other choices, except that some consequences are delayed and hence must be anticipated and discounted (i.e. reweighted to take into account the delay). Given two similar rewards, humans show a preference for one that arrives sooner rather than later. The Power of Low Time Preference. Time Can Make You Happier Than Money. Time preference. In economics, time preference (or time discounting,[1] delay discounting, temporal discounting[2], long-term orientation[3]) is the current relative valuation placed on receiving a good at an earlier date compared with receiving it at a later date.[1] There is no absolute distinction that separates "high" and "low" time preference, only comparisons with others either individually or in aggregate.

Time-Preference Theory Of Interest. What is the Time-Preference Theory Of Interest The time preference theory of interest explains interest rates in terms of people's preference to spend in the present over the future.

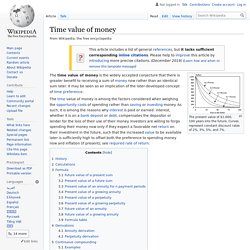

This theory was developed by economist Irving Fisher in "The Theory of Interest, as Determined by Impatience to Spend Income and Opportunity to Invest It. " Time value of money. Conjecture that there is greater benefit to receiving a sum of money now rather than later The present value of $1,000, 100 years into the future.

Curves represent constant discount rates of 2%, 3%, 5%, and 7%. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference. History[edit] Discounting. Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.[1] Essentially, the party that owes money in the present purchases the right to delay the payment until some future date.[2] This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects.[3] The discount, or charge, is the difference between the original amount owed in the present and the amount that has to be paid in the future to settle the debt.[1] The discount is usually associated with a discount rate, which is also called the discount yield.[1][2][4] The discount yield is the proportional share of the initial amount owed (initial liability) that must be paid to delay payment for 1 year.

As indicated, the rate of return is usually calculated in accordance to an annual return on investment. Impulsive Decision Making. Priority. Time Management. Compounding.

How to explain interest and the time value of money to kids. When trying to teach our young children about the value of compound interest – or the time value of money - one possible place to start is with a small number of marshmallows.

Truly. In the late 1960’s Stanford University psychologist, Walter Mischel ran a series of delayed gratification tests on a total of 653 three to five year-olds. One well-known example was the marshmallow test, whereby each preschool child was left alone in a room with one marshmallow and a promise that if they could refrain from eating the sweet until the researcher returned, they would receive another one. The focus of the test was on the ability of the children to exercise restraint, but it could also work as a good lesson in how compound interest works. ‘Compound interest’ simply means earning interest on your savings and also, eventually, on the interest that those savings earn. That example might be beyond our young children, but there are plenty of fun compound interest lessons you might try. The Power of Delay. ‘The greatest remedy for anger is delay.’

~Thomas Paine By Leo Babauta I once had a boss who had a favorite strategy for dealing with donations-seekers, demanding colleagues, and basically anyone who wanted anything from him he was reluctant to give. Delay. For example, lots of people would come to our office seeking handouts, and he didn’t believe handouts were helpful. I’ve found this strategy works really well with habits you’re try to break. An example: I tend to go back for seconds when I’m really hungry and especially if the food is really tasty. Another example: I often have the urge to go check email or one of my favorite online sites. And another: Sometimes I see something cool online that I really want to buy. Yet another example: I would have the urge to go snack on something sweet or salty, and I used to rush to find the snack and shove it in my face, with no small amount of guilt sitting in my heart. You can delay smoking by keeping yourself busy.

Immune System. Civilization. Buying Bitcoin.