Businessinsider. How The 2016 Candidates Are Getting Their Money, In 1 Infographic : It's All Politics. Jeb Bush is getting all the millionaires, and Bernie Sanders is getting the small donors — those have been two prominent storylines in the 2016 money race for the presidency.

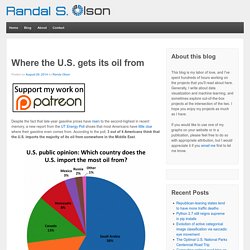

But what about everyone in between? The Washington, D.C. -based Campaign Finance Institute released data on campaign fundraising, and it paints a fascinating picture — which we decided to make into a literal picture. Where the U.S. gets its oil from. Despite the fact that late-year gasoline prices have risen to the second-highest in recent memory, a new report from the UT Energy Poll shows that most Americans have little clue where their gasoline even comes from.

According to the poll, 3 out of 4 Americans think that the U.S. imports the majority of its oil from somewhere in the Middle East. Yet when all of the U.S.’s oil imports are stacked up, oil from the Middle East comprises less than quarter of U.S. oil imports. In fact, the majority of the U.S.’s imported oil comes from countries in North and South America. If we look up the top 10 exporters of oil to the U.S., we might be surprised to find that our friendly neighbors to the north are the ones working the hardest to keep our gasoline tanks full. 47% of Americans would have to Borrow or Sell Something to Cover an Unexpected Expense of $400. Financial security has been elusive for millions of Americans since the Great Recession ended.

A new report (pdf) from the Federal Reserve demonstrates one way that this insecurity can manifest itself for people. As part of its October 2014 survey, the agency asked 50,000 people if they could handle an unexpected “financial disruption” costing them $400. Just over half (53%) said they could “fairly easily handle such an expense” by using money in their bank accounts (checking or savings) or by leaning on a credit card.

Rich got 14.6% richer in 2013. Global private financial wealth grew by 14.6 per cent in 2013 to reach a total of $152 trillion, with the spike in stock prices helping to power the expansion, according to a study from Boston Consulting Group.

Wealth is growing most quickly in the Asia-Pacific area, excluding Japan, where it expanded by 30.5 per cent in the year. The Asia-Pacific region is expected to overtake Western Europe in 2014 to become the second-wealthiest region and to beat out North America to become the wealthiest part of the world by 2018, the report said. Surviving the post-employment economy - Opinion. A lawyer.

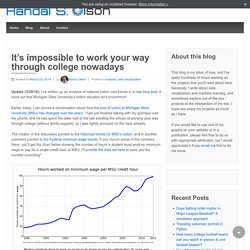

A computer scientist. A military analyst. A teacher. What do these people have in common? They are trained professionals who cannot find full-time jobs. It’s impossible to work your way through college nowadays, revisited with national data. Last weekend, I wrote a brief rant about how it’s far more difficult to work your way through college nowadays than 30 years ago.

Some folks took it for a scientific study rather than the rant it was, and criticized it for only looking at Michigan State University’s tuition trends. In response, I decided to run a proper analysis of national public university tuition data. With the help of some of my awesome Twitter followers, I managed to find a comprehensive data set of the in-state tuition costs for all public 4-year universities in the U.S. from 1987 through 2010.

Combining that data with the Federal minimum wage trends from before, we get the chart below showing the number of hours a student would have to work on minimum wage to pay for 1 year of public university tuition in the U.S. It's impossible to work your way through college nowadays. Update (3/29/14): I’ve written up an analysis of national tuition cost trends in a new blog post.

It turns out that Michigan State University’s tuition situation isn’t uncommon! Half Of Interns Are Victims Of This Illegal Act After College. It's Really Not OK. U.S. income inequality, on rise for decades, is now highest since 1928. President Obama took on a topic yesterday that most Americans don’t like to talk about much: inequality.

There are a lot of ways to measure economic inequality (and we’ll be discussing more on Fact Tank), but one basic approach is to look at how much income flows to groups at different steps on the economic ladder. Emmanuel Saez, an economics professor at UC-Berkeley, has been doing just that for years. 9 Out Of 10 Americans Are Completely Wrong About This Mind-Blowing Fact. There's a chart I saw recently that I can't get out of my head.

A Harvard business professor and economist asked more than 5,000 Americans how they thought wealth was distributed in the United States. This is what they said they thought it was. Dividing the country into five rough groups of the top, bottom, and middle three 20% groups, they asked people how they thought the wealth in this country was divided.

Then he asked them what they thought was the ideal distribution, and 92%, that's at least 9 out of 10 of them, said it should be more like this, in other words more equitable than they think it is. A CEO Tried To Give A Senator A Math Lesson. So She Had To Calmly Explain How Math Actually Works. The Correct US Poverty Rate Is Around And About Zero. Why Are American Health Care Costs So High? Is Democracy Hopeless? Who Is The Smallest Government Spender Since Eisenhower? Would You Believe It's Barack Obama? Eight causes of the deficit "fiscal cliff." Which party is most responsible? To many U.S. voters, one issue towers foremost -- the Fiscal Cliff of rising public debt.

We appear to have come a long way since Vice President Dick Cheney famously said "deficits don't matter. " Today, frightened by much-worse debt crises in Greece, Spain etc, Americans fret about floods of red ink that reached more than a trillion dollars a year under George W. Bush, and that have gone down only slightly under Barack Obama. Wasn't it just a little while ago that we were paying down the debt, under Bill Clinton? FACT CHECK: Presidential debate missteps. WASHINGTON (AP) — President Barack Obama and Republican rival Mitt Romney spun one-sided stories in their first presidential debate, not necessarily bogus, but not the whole truth.

They made some flat-out flubs, too. The rise in health insurance premiums has not been the slowest in 50 years, as Obama stated. How Lobbyists Literally Run The Country.