Board Observers Weekly - August 19th, 2014. How to Get Startup Sales Right. Venture Outcomes are Even More Skewed Than You Think. The typical “successful” venture portfolio is often described as having the following outcome: 1/3 of companies fail1/3 of companies return capital (or make a small amount of money)1/3 of companies do well Fred Wilson, for example, described this a few years ago: I’ve said many times on this blog that our target batting average is “1/3, 1/3, 1/3″ which means that we expect to lose our entire investment on 1/3 of our investments, we expect to get our money back (or maybe make a small return) on 1/3 of our investments, and we expect to generate the bulk of our returns on 1/3 of our investments.

It’s a generalization but one that’s pretty well accepted in venture circles and it’s how many VCs describe target fund distribution, myself included. But does this heuristic match reality? Actually no. Correlation Ventures just released a study that shows the distribution of outcomes across over 21,000 financings and spanning the years 20014-2013. Advice on pitching - Aaron's Blog. We're currently getting ready for demo day at YC, which means quite a lot of pitch practice.

Here are the main points of feedback we tend to give to teams. This advice works for almost any kind of presentation you might give. Speaking Speak slowly and enunciateBe excited. Your pitch should not sound memorized. Charts/metrics Charts should be easy to understand - make one point with any graphic or chart. Slides Titles should describe the slideSlides should be reentrant - each should make sense and make your case individuallyRemember that minds wander, and people check phones. . [1] This feels like something PG might have said directly, but I can't honestly remember. Competition – The Pros and Cons. Today on MBA Mondays we are going to talk about competition.

For most businesses, competition is a given. When I walk to work, I am often struck how many local businesses have competitors literally right across the street. Clearly competition is something you can learn to live with and still operate successfully. In fact, there are some very good things about competition. And there are some challenging things. I was having breakfast with the CEO of one of our portfolio companies recently. There are a number of good things about competition. But competition is challenging. Competitors will also impact your fundraising and exit plans. Very few companies will operate in a market for long without competition. Startups in 13 Sentences. February 2009 One of the things I always tell startups is a principle I learned from Paul Buchheit: it's better to make a few people really happy than to make a lot of people semi-happy.

I was saying recently to a reporter that if I could only tell startups 10 things, this would be one of them. Then I thought: what would the other 9 be? When I made the list there turned out to be 13: 1. Cofounders are for a startup what location is for real estate. 2. The reason to launch fast is not so much that it's critical to get your product to market early, but that you haven't really started working on it till you've launched. Your Startup’s Three Horizons. Credit: Karl Scotland When I started at Redpoint in 2008, I wanted to find every way of analyzing companies I could.

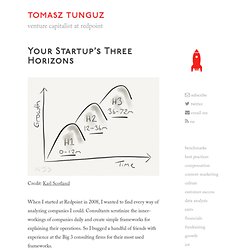

Consultants scrutinize the inner-workings of companies daily and create simple frameworks for explaining their operations. So I bugged a handful of friends with experience at the Big 3 consulting firms for their most used frameworks. Recently I came across an old friend, a framework I studied then called McKinsey’s Three Horizons in The Lean Entrepreneur, an anthology of lean startup techniques and case studies. The Three Horizons is a simple idea. If a management team can take the profits from the first successful project and invest in the second project, during the height of the first project, then two S curves overlap, and again for a third. For a business to prosper over many years, it must invest in more than one project or product. I’ve found the Three Horizons helpful in pitch meetings and board meetings to think through the evolution of a startup’s business.