Board Observers Weekly - April 8th, 2014. The Games Startups Play. Every startup plays two complementary games–the air game and the ground game.

The air game is always more romantic. It is the emotional narrative of how your startup revolutionizes a market. It’s the aspirational hope that the company could become one of the great ones. It’s the buzz in the market, the great PR machine, talented people fighting to get in, and investors who can’t get enough money into the company. The ground game is much uglier. In the startup world, early-stage companies are largely valued–at least for a while–on the air game, which tends to be way out ahead of the ground game. Though most companies are better at one game than the other, both are necessary for success. Companies that thrive on the ground game, but struggle to build buzz, face an equally uphill battle. Funding Probabilities: Are You One of The Best 10? 100? 1000? Companies Raising This Year? “The partner is likely writing just two or three checks this year.

How are you going to convince them you’re one of those companies?” This was the way a friend described their mentality in pitching VCs on A, B or C round financing. What he meant was, the average venture capitalist at those stages will only be funding a few companies each year but seeing many pitches. In that sense it’s not just about proving that you’re a great opportunity, but also that you’re worth the opportunity cost of using one of those “slots.” I’m thinking more deeply about the A Round fundraising process as the set of companies we’ve backed start to mature. I don’t think it should be a large part of your initial deck but do recommend a few minutes and single slide (or whiteboard sketch!)

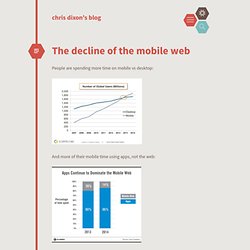

For some it’s also about matching the type of risk inherent in your business to the partner or firm who (a) is comfortable with that risk and/or (b) believes they can help solve it. The decline of the mobile web. People are spending more time on mobile vs desktop: And more of their mobile time using apps, not the web: This is a worrisome trend for the web.

Mobile is the future. What wins mobile, wins the Internet. Right now, apps are winning and the web is losing. Moreover, there are signs that it will only get worse. The likely end state is the web becomes a niche product used for things like 1) trying a service before you download the app, 2) consuming long tail content (e.g. link to a niche blog from Twitter or Facebook feed). This will hurt long-term innovation for a number of reasons: 1) Apps have a rich-get-richer dynamic that favors the status quo over new innovations. 2) Apps are heavily controlled by the dominant app stores owners, Apple and Google.

Most worrisome: they reject entire classes of apps without stated reasons or allowing for recourse (e.g. Startups Are Hard. So Work More, Cry Less, And Quit All The Whining. I slept at work again last night; two and a half hours curled up in a quilt underneath my desk, from 11am to 1:30pm or so.

That was when I woke up with a start, realizing that I was late for a meeting…But it was no big deal, we just had the meeting later. It’s hard for someone to hold it against you when you miss a meeting because you’ve been at work so long that you’ve passed out from exhaustion. Suddenly everyone’s complaining about how unfair things are in Silicon Valley. How hard everyone has to work so darn hard, and how some people don’t get venture capital or a nice sale to Facebook or Google even though lots of other people are getting those things.

Silicon Valley is an unfair place, say all the headlines. As if all of this was new. I saw Ian today, for the first time in months. And Well the kids went out to get drunk, or rather, more drunk. I’m so fucking burnt. Yes, there was crying. Risk and Reward Are Not Obvious. I went to business school in the mid 80s.

Investment banking was hot. The leveraged buyout craze was on. Junk bonds were hot. Everyone wanted to work on wall street. I was obsessed with venture capital and had worked in a small venture firm the previous summer and had gotten an offer to work full time in venture capital for $60k per year with no bonus and no incentive comp. Those investment banking job offers were all over the business school and almost everyone I knew took them. I took the VC job, made basically enough to live and work in NYC for ten years (subsidized by The Gotham Gal's income), but I did set myself up for Flatiron and then USV.

I told this story in a comment to my MBA Tuesdays post and figured it was worth posting as a full blog post. The Pmarca Guide to Startups, part 5: The Moby Dick theory of big companies - pmarca *ARCHIVE* The Moby Dick theory of big companies "There she blows," was sung out from the mast-head. "Where away? " demanded the captain. "Three points off the lee bow, sir. ""Raise up your wheel. There are times in the life of a startup when you have to deal with big companies. Maybe you're looking for a partnership or distribution deal. The most important thing you need to know going into any discussion or interaction with a big company is that you're Captain Ahab, and the big company is Moby Dick.

"Scarcely had we proceeded two days on the sea, when about sunrise a great many Whales and other monsters of the sea, appeared. When Captain Ahab went in search of the great white whale Moby Dick, he had absolutely no idea whether he would find Moby Dick, whether Moby Dick would allow himself to be found, whether Moby Dick would try to immediately capsize the ship or instead play cat and mouse, or whether Moby Dick was off mating with his giant whale girlfriend.