What is the best strategy for dramatically increasing the price of a SaaS product without angering customers? SaaS. It’s a frothy time and during such times people can develop a tendency to get sloppy about their numbers.

The first sign of froth is when people routinely discuss company size using market capitalization instead of revenue. This happened constantly during Bubble 1.0 and started again several years ago – e.g., all the talk of unicorns, private companies with $1B+ valuations. Oneupsmanship becomes the name of the game in frothy times. If your competitor’s site had 1M pageviews to your own site’s 750K, marketing quickly came up with a new metric on which you could win: “we had 1.5M eyeballs.” This kind of gaming, pardon the pun, is seen through rather easily. The more disturbing distortions are those intended to impress industry influencers to validate strategy. Public companies try to demonstrate results through revenue allocation games, robbing from non-strategic SKUs to pump up strategic ones (e.g., “cloudwashing” as the megavendors are now often accused). This is great. Unit Economics: CLTV, CAC and cohorts - StartupDocs.se.

December 3rd, 2015, by Erik Byrenius How much is a customer worth?

How much does it cost to acquire a customer? If you can’t answer these basic questions, it’s hard to know if your business is sustainable or not. Your unit economics analysis will help you answer these questions. In this blog post, I will guide you through how I use unit economics to better understand a business. Saas. TOMASZ TUNGUZ venture capitalist at redpoint saas Pricing for SaaS Enabled Marketplaces - When to Go Free How Much Cash Should Your SaaS Startup Burn?

What is the Optimal Quick Ratio for Your SaaS Startup? What Quota Attainment Reveals About Your SaaS Startup's Go to Market Five Words of Wisdom from SaaS Office Hours with Bill Macaitis 5 Mistakes SaaS Startups Often Make with Pricing The Essential Go To Market Math for Beating Your SaaS Startup's Growth Targets Data Network Effects in SaaS Enabled Marketplaces The Importance of Payback Period for SaaS Startups.

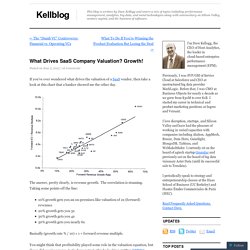

What Drives SaaS Company Valuation? Growth! If you’ve ever wondered what drives the valuation of a SaaS vendor, then take a look at this chart that a banker showed me the other day.

The answer, pretty clearly, is revenue growth. The correlation is stunning. Taking some points off the line: 10% growth gets you an on-premises-like valuation of 2x (forward) revenues20% growth gets you 3x30% growth gets you 4x50% growth gets you nearly 6x Basically (growth rate % / 10) + 1 = forward revenue multiple. The Rule of 40% For a Healthy SaaS Company. There are lots of blogs and anecdotes on (a) how to build a successful SaaS company and (b) what a successful SaaS company looks like.

Yesterday’s post by Neeraj Agrawal from Battery Ventures titled The SaaS Adventure is another great one as he describes his (and presumably Battery’s) T2D3 approach. If you want to follow these posts more closely on a daily basis, I encourage you to subscribe to the Mattermark Daily newsletter. Or take a look at the VCs I follow in my Feedly VC channel. I was at a board meeting recently and heard something I’ve not heard before from a late stage investor.

He described what his firm called the 40% rule for a healthy software company, including business SaaS companies. The 40% rule is that your growth rate + your profit should add up to 40%. Now, growth rate is easy in a SaaS-based business. Profit is harder to define. While the punch line is that you can lose money if you are growing faster, the minimum point of happiness is 40% annual growth rate. 18 Extraordinary Lessons Learned from Interviewing The World’s Top SaaS Entrepreneurs. We’ve learned a lot from businesspeople at the top of their game.

Here are some of the biggest takeaways. Six months ago, we launched a new series on this blog. We set out to interview successful entrepreneurs – businesspeople at the very top of their game – about how they took their businesses to $100K in monthly revenue… and beyond. I expected it to be successful. After all, it was exactly the sort of thing I craved: the most valuable lessons from the entire careers of people much more successful than me, condensed into an easily readable format.

But I didn’t expect it to have such an impact on our own business. The truth is, we’ve taken key insights from the monthly interviews, and applied at least one from each entrepreneur to Groove… and the results have been incredible. Today, I’m sharing the top takeaways for us (yours might be different, which is why I encourage reading all of the interviews in their entirety) from the six interviews we’ve done so far. 1) Have a “Forever Free” Plan.

How We Increased Our Traffic by 12,024% with Zero Advertising. How We Measure and Optimize Customer Success Metrics in Our SaaS Startup.