Useful Gift Ideas for Class of 2019 Elementary School Graduates - LinkAndThink. Graduation season is upon us and for children who have completed kindergarten or even elementary school, this rite-of-passage warrants a unique gift from parents or other family members as a way to mark the occasion.

Recent grads have a lot of needs, so a thoughtful gift can help ease the transition into the next chapter of their lives, whether that may be the transition to a full-day of school or junior high. Here are 10 considerate and practical gifts for the little graduate in your life: An alarm clock Great for those early morning classes, a reliable alarm clock can help your student get out of bed on time. Your Career as a Children’s Education Funds (CEFI) Dealing Representative. Your Career as a Children’s Education Funds (CEFI) Dealing Representative Canadian families have relied on education savings plans offered by Children’s Education Funds (CEFI) for more than 28 years.

We know first-hand that Registered Education Savings Plans (RESPs) make a significant difference in how families prepare for the high cost of post-secondary education after high school. 4 Smartest Things You Can Do With Your Money in 2019. As a young person with an established career and a steady income, it can be fulfilling to watch your bank account grow.

Although it may be tempting to spend your extra money on a vacation or a new big-ticket item, the Smartest Things You Can Do With Your Money is pay yourself first. While financial planning can seem like a complicated task, it doesn’t have to be. Here are some of the smartest things you can do with your money. #1 Create a budget and monitor spending Cash flow is one of the most important things to be aware of, so knowing where your money is going is important.

To find out exactly how much you’re spending each month, start by determining your overall income. . #2 Save for big purchases When it comes to setting money aside, you can never have enough. HuffPost is now a part of Oath. Recently, news of our digital job fair of the future has spread across the country.

Many Canadians have been intrigued by the jobs we predict will be around in 2030, including nostalgists, robot counsellors, simplicity experts and more. While the aim of our Inspired Minds Careers 2030 project is to get parents and kids excited about the future, the question we keep hearing over and over again is 'how? ' How did we come up with these jobs, and how can we really make informed predictions about what might happen in the next 10-15 years? The approach we took was rigorous and collaborative.

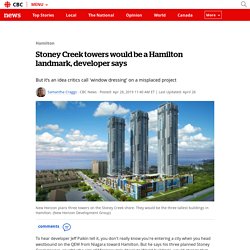

It was based on the input of not only foresight strategists, but close to 50 thought leaders across Canada across a wide range of industries. Community Connection: Kris Thorkelson’s Vision for My Place Realty. Stoney Creek towers would be a Hamilton landmark, developer says. To hear developer Jeff Paikin tell it, you don't really know you're entering a city when you head westbound on the QEW from Niagara toward Hamilton.

But he says his three planned Stoney Creek towers, roughly the size of Mississauga's Absolute World buildings, would change that. The president of New Horizon Development Group wants to build three condo towers — one 48 storeys, one 54 and one 59 — at 310 Frances Ave. If approved, they'd be the three tallest buildings in Hamilton. It's an area without regular bus service, served only by trans cab. It also needs sewer infrastructure upgrades to service the estimated 2,500 Hamiltonians who would live there. Children’s Education Funds Inc. Children’s Education Funds Reviews: Common RESP Mistakes Made By Parents - Valley Family Fun.

Disclosure: This is a sponsored post, brought to you to share information to with you about RESP mistakes parents can make. Posts like this not only bring you new information, but also help to offset the many costs associated with running a website! When you become a parent, you receive plenty of advice on how to raise a child, whether you ask for it or not.

Your friends and family may swoop in and tell you how to burp, feed, dress, and carry your baby, but more than likely, they never end up giving you the advice you need most — what is best for your child in the long-term? When your children are young, long-term doesn’t resonate with you. Those early years are all about survival, meeting daily needs and keeping your head above water. Once you get past the infant stage, being mindful of your child’s future shifts to the forefront. Have I done enough to save for their higher education? Reviewing Children’s Education Funds RESPs, Other Ways To Save for Education - Suburban Finance. Despite the rising cost of a post-secondary education in Canada, more than three in five (61 per cent) parents surveyed in HSBC’s latest global report – The Value of Education: Foundations for the Future are funding their child’s education from day to day income, while over a third (35 per cent) are using a specific education savings or investment plan.

Still, the money parents save likely won’t be enough to cover all costs. Figures from Statistics Canada for 2018/2019 show that, on average, Canadian students are currently paying just over $6,838 per academic year for tuition, which does not include room and board, food, transportation and books.* Parents feel responsible to help their children pay for schooling, but numbers like these leave parents surfing the web for data, asking advice from their peers, and seeking out financial advisors. [INTERVIEW] Kris Thorkelson, Entrepreneur And Business Leader. Successful entrepreneurs become that way by being on the leading edge of trends involving consumer behaviors and preferences and ways to capitalize on them.

![[INTERVIEW] Kris Thorkelson, Entrepreneur And Business Leader](http://cdn.pearltrees.com/s/pic/th/thorkelson-entrepreneur-198144300)

Such has been the case for Winnipeg’s Kris Thorkelson. A licensed pharmacist since 1991, it wasn’t enough for Thorkelson to merely fill customers’ prescriptions. He knew he could do a better job anticipating and meeting their expectations for the whole pharmacy and pharmaceutical experience if he was in control as the pharmacy owner. A single establishment grew into four Prescription Shop stores, and he seized on another related trend – in-store medical clinics. 5 ways you can afford to go back to school: Children’s Education Funds (CEFI) RESPs, Other Ways to Save - Everybody Loves Your Money. Top Tips from Serial Entrepreneurs - ABRITION. Top Tips from Serial Entrepreneurs Serial entrepreneurs are always thinking of new ideas and starting new businesses.

This is different from the typical entrepreneur, who comes up with one idea, starts a company and remains involved in the daily operations of that company. Serial entrepreneurs are constantly moving to the next big thing, sometimes leaving successful businesses behind. The Prescription Shop. Proposed Executive Profile to add to www.prescriptionshop.ca Kris Thorkelson is proud to be the founder and owner of The Prescription Shop and bring more than twenty-five years of experience in the pharmacy industry to his leadership at the company.

Kris graduated from the University of Manitoba with his Bachelor of Science in Pharmacy in 1991. He then returned to the University of Manitoba graduating in 1996 with a Psychology degree. Paying for University Education: Role RESP Providers Like Children’s Education Funds (CEFI) Playing – Henry M Blog. For most Canadian high schoolers, graduation is only the first completed path in the road to a well-rounded education.

For many students, the most difficult task lies ahead in choosing the right university for their post-secondary studies. Acceptance to a university is not guaranteed and it can be very expensive, depending on which school they choose. Students must be prepared to pay oftentimes hefty tuition fees, which vary from school to school, and even program to program. Of course there is financial aid available to assist students and their families with these costs, including student loans – which you do have to pay back – or scholarships, bursaries and grants which you do not. Both the federal government and the provincial or territorial governments have programs that provide low-cost loans, grants and scholarships for students.