Citizens Against Government Waste. Watch the latest video at <a href=" Introduction For the second time since Congress enacted an earmark moratorium beginning in fiscal year (FY) 2011, Citizens Against Government Waste (CAGW) has found earmarks in the 12 appropriations bills funding the federal government.

While a single earmark violates the moratorium, at least the number and cost of the earmarks contained in H.R. 3547, the Consolidated Appropriations Act, 2014, decreased from FY 2012, the last time Congress passed the spending bills. Earmark totals dropped by 28.3 percent, from 152 in FY 2012 to 109 in FY 2014, while the cost declined by 18.2 percent, from $3.3 billion in FY 2012 to $2.7 billion in FY 2014, the lowest amount since 1992. The costs in both 2012 and 2014 are significant reductions from the record $29 billion in earmarks set in FY 2006. The 2012 Pig Book noted that although there were fewer earmarks than in prior years, the projects involved larger amounts of money and included fewer details.

Home - Get Money Out Action. Lobbying. Shmoop Finance. Other Moolah. Capitalism simply isn't working and here are the reasons why. Suddenly, there is a new economist making waves – and he is not on the right.

At the conference of the Institute of New Economic Thinking in Toronto last week, Thomas Piketty's book Capital in the Twenty-First Century got at least one mention at every session I attended. New Busyness. What's the ultimatum game? Giving. CrowdFunDing. Global Property Guide. Promiscuous Inflation By Mortimer Duke (June 2011) Most people are surprised to hear that the word promiscuous has no sexual connotation on its own.

The word means “indiscriminate”, but through the repeated use of the term “sexually promiscuous”, the word promiscuous itself seemed to morph into the previous paired term and became synonymous with sexual indiscretion. Why is this relevant to a blog focused on the financial markets and economics? Government debt explained (in a few minutes) Blaming Capitalism for Corporatism - Edmund S. Phelps and Saifedean Ammous.

AP Macroeconomics - PavaforPresident2016. Moneychimp: learn Stock Investing, Index Funds, Valuation Models, and more. Preparing for Economic Depression in a Culture of Make-Believe. This article first appeared in Spirit of the Times, May 2012.

A dangerous cognitive dissonance is pervading our society. The earth is finite, yet our leaders seemingly act as though we can go on expanding both population and our per capita demand on resources. LBJ’s War On Poverty An Expensive Failure That Never Ends. Geez, it’s been 50 years since Lyndon Johnson launched his “war on poverty” and the war never ends.

It goes on and on, and gets more and more expensive. It didn’t eradicate poverty, it expanded it as it made living in poverty comfortable. Paying for all of these policies has put the squeeze on the middle class, so those of us who work hard every day aren’t much better off than those on the dole. LBJ's War On Poverty Turned Hope Into Despair, Dependency. Lessons-in-Spiritual-Economics-Part-1.

Home - Rethinking Economics. Fourth Corner Exchange Inc - Brief Introduction. Triple Entry Accounting. I wrote the following article in 1994 while working on my Masters degree.

Although it is written in the lingo and jargon of a student trying to impress a professor for a grade, I still like it (hehe). [PDF] Accounting in three dimensions — a case for momentum revisited.pdf. A Quick Note on Wealth and Balance Sheet Debates. I still like using my map for understanding why people disagree on the best course of action on getting the economy going even if they are in agreement that something needs to be done.

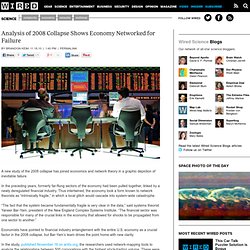

Take this exchange in Democracy Journal – Arguing About Growth – between Larry Mishel of EPI and William Galston of Brookings Institute. Galston: As Mishel says, I’ve been skeptical about the adequacy of the traditional demand-side stimulus strategy that the Administration has pursued. That’s not because I thought then, or think now, the government should stand back and do nothing, or because I thought stimulus was completely wrong-headed… Mortgages are the epicenter of household debt, and thus of our economic woes as I understand them. Origins of the Financial Mess. Analysis of 2008 Collapse Shows Economy Networked for Failure. A new study of the 2008 collapse has joined economics and network theory in a graphic depiction of inevitable failure.

In the preceding years, formerly far-flung sectors of the economy had been pulled together, linked by a newly deregulated financial industry. Thus intertwined, the economy took a form known to network theorists as “intrinsically fragile,” in which a local glitch would cascade into system-wide catastrophe. Deflation poses danger to business. Deflation is a fact of life in Japan.

In the past 10 years, consumer prices have tumbled, real estate values have plummeted and banks -- unable to collect their loans -- have been driven to insolvency or into forced mergers with stronger partners. Back in the spring, there was a lot of worry that deflation would lurk at Canada's shores as a sort of economic grim reaper. In the May 23 edition of ScotiaCapital's Market Trends weekly newsletter, economist Aron Gampel wrote, "The global economy has visibly lost momentum, increasing the threat of a deflationary undertow. Ellen Brown on Deficits Don't Matter. This is a pretty decent article on the intricacies of public finance and made pretty easy to understand.

The reader needs to be able to get his perceptions turned upside down though. What is important is to understand that much as passes for financial wisdom or at least self evident is wrong. Understanding the Ruling Elite. The elite are trusted placeholders sitting atop hierarchical structures that own or at least influence massive financial and physical resources whose husbandry they have been trained to manage.

They are ultimately trained decision makers reacting to proposals that finally cross their desks. To assign them the ability to actually conspire to a common goal is laughable. What is not laughable is the ambition of deal makers to do the next bigger deal until size becomes its own problem. There is no global conspiracy but there is plenty of evidence of short sighted thinking everywhere and a general lack of common cause unless an inspired leader pushes it. The counter example has been China. Much of the difficulty globally is that we lack a foundational economic theory that makes core decisions self-evident.

Understanding the Ruling Elite May 13, 2013. Rebounds Gone Wild « Real Climate Economics. This post by Real Climate Economics blogger James Barrett originally appeared on the Great Energy Challenge blog, in partnership with National Geographic and Planet Forward. Energy efficiency has become very popular in recent years. So much so that it’s becoming cool for the truly hip to hold it in disdain. Economics for Equity and the Environment. E3 Network Blog. Charting the Economic Life Cycle. NBER Working Paper No. 12379Issued in July 2006NBER Program(s): AG Understanding the economic lifecycle – how it varies and why – is important in its own right, but is also critical to understanding how changes in population age structure influence many features of the macroeconomy.

Economic behavior over the life cycle can be summarized by the average levels of consumption and labor earnings at each age, as shaped by biology, culture, institutions and individual choice. Romelecture. Kapicka.slides. 15%20lifecycle. A Brief History of the Post-Autistic Economics Movement. Post-Autistic Economics Movement. Economic Synopses - Research Publications. Home > Publications > Economic Synopses > 2013-09-25. Institutions and the Path to the Modern Economy: Lessons from Medieval Trade - Avner Greif. Real-World Economics Review. Stabilizing an Unstable Economy - Hyman Minsky - McGraw-Hill Education. €œMr.

Minsky long argued markets were crisis prone. Sequestration: A Glossary of Political Economy Terms - Dr. Paul M. Johnson. Economy Infographics. Visual Economics. Visual Economic Analysis - "Let every sluice of knowledge be opened and set a-flowing." - John Adams. Visualizing Economics. Visual 3d Economic Tool. No One Wants to See the Process - Mom and Dad Money, LLC. 360 Degrees of Financial Literacy. Stock Quest. Learn About the Complexities of Annuity Investments. Once Upon a Dime. Investing Tools - NASDAQ. NASDAQ.com offers a suite of free and premium tools that can help you make better investing decisions. Browse our Stock Tracking Tools & Stock Planning Tools and you're sure to find a valuable new addition to your investing toolkit. Stock Tracking Tools. Investing. Psychonomics, organizational psychology, stocks, investment, market psychology, personal finance, trading, investment research.

24 Quick Actions You Can Do Today That Can Change Your Financial Life Forever. NORTH DAKOTA’S ECONOMIC “MIRACLE”—IT’S NOT OIL. Tax Day 2013 - Analysis - National Priorities Project. Be Honest: Maybe You Shouldn't Do Your Own Taxes. A Tax Day Plan for Righting the Republic: Just Doing What’s Popular Would Make Us Healthier, Wealthier, Wiser, and Less Indebted. Why Tax Season is the Best Time For a Financial Spring Cleaning. Internet Value Systems and Monetary Policy.

Informal value transfer system. Hawala. Resistance & Support. Chart Reading Made Simple - The Ticker Tape Monthly. Finance Websites. THE FINANCIAL PHILOSOPHER. Feed the Pig. Credit Repair Guru - Free Credit Consultation. Off to College? Avoid These Financial Pitfalls. Behavioral Finance: Introduction. Behavioural Finance. Behavioral economics. Educating the world about finance. Explaining The World Through Macroeconomic Analysis. The Taylor Rule: An Economic Model For Monetary Policy. Macroeconomics. 20 Things Broke People Say. 20 Things The Rich Do Every Day. BLOG.RICHHABITS.NET. Opportunities and Choices. Mom and Dad Money - financial advice from one parent to another.

Credit Awareness. Public Banking.