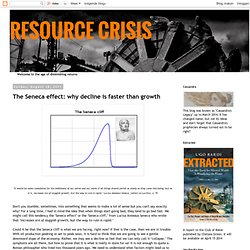

The Seneca effect: why decline is faster than growth. "It would be some consolation for the feebleness of our selves and our works if all things should perish as slowly as they come into being; but as it is, increases are of sluggish growth, but the way to ruin is rapid.

" Lucius Anneaus Seneca, Letters to Lucilius, n. 91 Don't you stumble, sometimes, into something that seems to make a lot of sense but you can't say exactly why? For a long time, I had in mind the idea that when things start going bad, they tend to go bad fast. We might call this tendency the "Seneca effect" or the "Seneca cliff," from Lucius Anneaus Seneca who wrote that "increases are of sluggish growth, but the way to ruin is rapid. " Could it be that the Seneca cliff is what we are facing, right now? I have been working on this idea for quite a while and now I think I can make such a model. Models of growth and decline The paradigm of all models of growth and decline is the Hubbert model. However, the Hubbert model does not generate the Seneca effect. Cassandra's legacy. Videos From 2011 Debt Conference. Feasta: the Foundation for the Economics of Sustainability.

JAK Members Bank. The JAK Members Bank, or JAK Medlemsbank, is a cooperative, member-owned financial institution based in Skövde, Sweden, and based on a concept that arose in Denmark in 1931.[1][2][3] JAK is an acronym for Jord Arbete Kapital in Swedish or Land Labour Capital, the factors of production in classical economics.

A membership of approximately 38,000 (as of November 2011) dictates the Bank's policies and direction. The Board of Directors is elected annually by members, who are each allowed only one share in the bank. JAK Members Bank does not charge or pay interest on its loans, a principle it shares with Islamic banking. All of the bank's activities occur outside of the capital market as its loans are financed solely by member savings.

As of 2011 members had accumulated 131 million euros in savings, of which 98 million have been allocated as loans to the members.[4] Administrative and developmental costs are paid for by membership and loan fees. History[edit] Philosophy[edit] Membership[edit] Make £3,300 from your mobile phone. I really like the idea of giffgaff.

The mobile network is completely different to other networks out there in that it is community-based — if you have an issue, you don't have to phone up a call centre in goodness knows where. Instead, you post your problem on giffgaff's community pages, where fellow users will then post advice and help out. There are two big bonuses to this model. First off, it keeps giffgaff's costs pretty low as they don't have to cover the cost of a call centre, meaning the network's tariffs are exceptionally competitive.

But there's also a benefit to be had from being helpful on the community board — by doing so, you earn points, which can then be exchanged for money off your bill, extra texts and internet access, or just cold, hard cash. Last week giffgaff paid out more than £250,000 to its users, including £3,357.57 to one particularly helpful user, Usman Aslam from Birmingham. Recycling your old mobile Earn cashback [See also: Get paid for walking into a shop] Service your credit cards, plus great deals and offers.