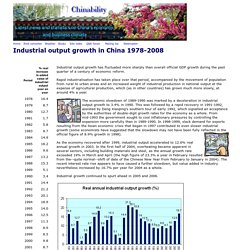

Industrial output. Industrial output growth has fluctuated more sharply than overall official GDP growth during the past quarter of a century of economic reform.

Rapid industrialisation has taken place over that period, accompanied by the movement of population from rural to urban areas and an increased weight of industrial production in national output at the expense of agricultural production, which (as in other countries) has grown much more slowly, at around 4% a year. The economic slowdown of 1989-1990 was marked by a deceleration in industrial output growth to 3.4% in 1990. This was followed by a rapid recovery in 1991-1992, assisted by Deng Xiaoping's southern tour of early 1992, which signalled an acceptance by the authorities of double-digit growth rates for the economy as a whole.

From mid-1993 the government sought to cool inflationary pressures by controlling the expansion more carefully than in 1989-1990. The car I drive to work is made of around 2,600 pounds of steel, 800 pounds of plastic, and 400 pounds of light metal alloys.

The trip from my house to the office is roughly four miles long, all surface streets, which means I travel over some 15,000 tons of concrete each morning. Once I’m at the office, I usually open a can of Diet Coke. Over the course of the day I might drink three or four. All those cans also add up to something like 35 pounds of aluminum a year. I got to thinking about all this after reading Making the Modern World: Materials and Dematerialization, by my favorite author, the historian Vaclav Smil. This isn’t just idle curiosity. I had already read Smil’s books on energy and diet.

Smil excels at answering big questions like these. He argues that the most important man-made material is concrete, both in terms of the amount we produce each year and the total mass we’ve laid down. Here’s how the idea applies to soda cans: What does all this tell us about the future? The Sinocism China Newsletter. Asia's top 4 oil users record slowest demand growth in 6 years. Singapore (Platts)--11Dec2014/221 am EST/721 GMT Combined oil demand by Asia's four biggest consumers -- China, Japan, India and South Korea -- inched up a meager 0.4% in the first 10 months of 2014, on course to register the slowest pace of full-year annual growth since 2008, according to data analyzed by Platts.

Platts data shows China, Japan, India and South Korea consumed on average 18.16 million b/d of liquid fuels (excluding LPG) over January-October, a mere 80,000 b/d or 0.4% higher than the approximately 18.08 million b/d used in the corresponding period of 2013. The four countries represent about a fifth of global oil demand, estimated to come in at 92.4 million b/d for 2014 by the International Energy Agency.

China and India for the past few years have been among the biggest contributors to incremental global consumption. Article continues below... The figures are based on official data and signify actual end-user, or apparent consumption, in each country. China: the world’s energy superpower on.ft.com/1muVRCY. China Energy Needs and Economic Growth. China’s Oil Hoarding Is Raising Prices. China has been buying up oil at a record pace in order to stockpile reserves for a rainy day as part of its strategy to insulate the country from geopolitical conflict or supply disruptions.

It’s modeled after the U.S. strategic petroleum reserve (SPR). However, the heightened rate at which China is purchasing oil is driving up global oil prices. Dating back to the oil embargo of 1973, the U.S. government has maintained an SPR to guard against future oil supply disruptions and/or price spikes. Located in salt caverns in Texas and Louisiana, the Department of Energy’s SPR has a capacity of 727 million barrels of storage. Similarly, the International Energy Agency (IEA) – whose 29 members include Western countries plus Australia, Korea, and Japan – are required to hold the equivalent of 90 days’ worth of oil supply in a reserve. China, who is not a member of the IEA, for years did not have significant volumes of oil set aside as in a reserve.

Click here to get the free guide now.