Veblen’s Institutionalist Elaboration of Rent Theory. Michael Hudson’s new book The Bubble and Beyond has just been released and can be purchased here.

Speech given at the Veblen, Capitalism and Possibilities for a Rational Economic Order Conference, Istanbul, Turkey, June 6th, 2012 Simon Patten recalled in 1912 that his generation of American economists – most of whom studied in Germany in the 1870s – were taught that John Stuart Mill’s 1848 Principles of Political Economy was the high-water mark of classical thought. However, Mill’s reformist philosophy turned out to be “not a goal but a half-way house” toward the Progressive Era’s reforms. Mill was “a thinker becoming a socialist without seeing what the change really meant,” Patten concluded. “The Nineteenth Century epoch ends not with the theories of Mill but with the more logical systems of Karl Marx and Henry George.[1] But the classical approach to political economy continued to evolve, above all through Thorstein Veblen.

Chief Source of Our Economic Woes. Second Bill of Rights. The Second Bill of Rights was a list of rights proposed by Franklin D.

Roosevelt during his State of the Union Address on January 11, 1944.[1] In his address Roosevelt suggested that the nation had come to recognize, and should now implement, a second "bill of rights". Roosevelt's argument was that the "political rights" guaranteed by the constitution and the Bill of Rights had "proved inadequate to assure us equality in the pursuit of happiness. " Roosevelt's remedy was to declare an "economic bill of rights" which would guarantee eight specific rights: Roosevelt stated that having these rights would guarantee American security, and that America's place in the world depended upon how far these and similar rights had been carried into practice.

Background[edit]

MMT. Modern Monetary Theory is an unconventional take on economic strategy. What’s more, his father, John Kenneth Galbraith, was the most famous economist of his generation: a Harvard professor, best-selling author and confidante of the Kennedy family.

Jamie has embraced a role as protector and promoter of the elder’s legacy. But if Galbraith stood out on the panel, it was because of his offbeat message. Most viewed the budget surplus as opportune: a chance to pay down the national debt, cut taxes, shore up entitlements or pursue new spending programs. He viewed it as a danger: If the government is running a surplus, money is accruing in government coffers rather than in the hands of ordinary people and companies, where it might be spent and help the economy. “I said economists used to understand that the running of a surplus was fiscal (economic) drag,” he said, “and with 250 economists, they giggled.” –The Washington Post’s best economics article, ever. And still it’s wrong. « #Monetary Sovereignty – Mitchell.

Mitchell’s laws: The more budgets are cut and taxes inceased, the weaker an economy becomes.

To survive long term, a monetarily non-sovereign government must have a positive balance of payments. Austerity = poverty and leads to civil disorder. Otherwise Good WaPo Article on Modern Monetary Theory Marred by Undeserved Praise of Roosevelt Institute. In the “wonders never cease” category, the Washington Post, which is normally firmly in the camp of orthodox economic thinking and budget hawkery, ran a very well researched and complementary article by Dylan Matthews on Modern Monetary Theory.

This may be a sign of MMT moving out of being regarded in policy circles as fringe (some might say lunatic fringe) to a useful part of an economist’s toolkit. Matthews tries to be scrupulous in giving credit where credit is due, in both how much effort it has taken for the idea to obtain some legitimacy and who its major proponents are. Modern Monetary Theory’s Big Weekend: The Problem with Surpluses - US News Business Blog. It was obvious to me way back before I had ever heard of MMT that governments should probably never run a budget surplus—or should do so only in dire emergencies.

When the government runs a surplus, that means it is taking more money out of the economy than it is spending back into the economy. It is making us poorer. The Challenge to Status Quo Economics Everybody is Talking About. Over the last week, an important approach to economics that has spent years on the sidelines went mainstream: Modern Monetary Theory.

This is good news for anyone who wants to see the neoliberal paradigm challenged, and a positive sign to heterodox economists who have difficulty getting a hearing in a field still gripped by outmoded models. The theory, which provides unusual perspectives on issues including currency, debt, and government spending, kicked off in the mid-90s and has since grown into a movement. Its roster of proponents includes James K. Galbraith; Australian economist Bill Mitchel; Randall Wray and Stephanie Kelton of the University of Missouri-Kansas City; Rob Parenteau; Pavlina Tcherneva; Scott Fullwilier; Warren Mosler; and blogger Marshall Auerback.

Mainstream economics and Modern Monetary Theory: A family tree. Culture Connoisseur Badge Culture Connoisseurs consistently offer thought-provoking, timely comments on the arts, lifestyle and entertainment.

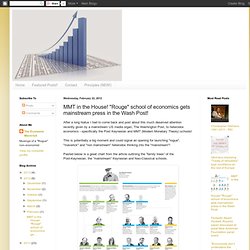

More about badges | Request a badge Washingtologist Badge Washingtologists consistently post thought-provoking, timely comments on events, communities, and trends in the Washington area. Economic Maverick: MMT in the House! "Rouge" school of economics gets mainstream press in the Wash Post! After a long hiatus I had to come back and post about this much deserved attention recently given by a mainstream US media organ, The Washington Post, to heterodox economics - specifically the Post Keynesian and MMT (Modern Monetary Theory) schools!

This is potentially a big moment and could signal an opening for launching "rogue", "maverick" and "non mainstream" heterodox thinking into the "mainstream"! Pasted below is a great chart from the article outlining the “family trees” of the Post-Keynesian, the “mainstream” Keynesian and Neo-Classical schools. The fact that MMT even received this kind of attention in the mainstream media is itself now becoming a story.

FT Alphavile had a few great posts here and the major Post Keynesian blogs from the Univ. Modern Monetary Theory: What's Modern About It? In a newspaper that relies on the same old crew of reliably wrong experts for the vast majority of its economic reporting, it's good to see this piece by Dylan Matthews on Modern Monetary Theory (MMT).

I've had many people ask me my assessment of MMT. I consider many of the leading proponents of MMT to be friends and generally find myself on the same side of political debates. However, I have to confess to being a bit unclear as to what exactly separates MMT from the good old Keynesian economics I learned in my youth. My reading of Keynes is that economies will often be constrained by demand, absent intervention from the government. That means that expansionary fiscal and/or monetary policy will often be in order to keep an economy running near full employment. I see three channels through which expansionary policy can boost demand. Dan Kervick responds to Dean Baker. Quick Thoughts on Modern Monetary Theory. Since there were many thoughtful comments on my earlier post, it seemed worth saying a bit more by way of response. As I noted at the onset, I did not see a difference between MMT and the Keynes that I first studied more than 30 years ago.

I guess I still don’t see the difference. In my prior post I noted that there were three channels to raise the economy back towards its potential: Government spending and tax cuts;Expansionary monetary policy; andDevaluing the dollar to increase net exports. I should also add a fourth channel that can move the economy to full employment by reducing the average workweek or work year: work sharing. As best I can tell, the MMT folks would have us only use the first channel and seem to disparage the other three routes to raising employment levels. The WaPo MMT Post Explosion: Dean Baker's Second Try (1) Dean says that MMT economists advocate focusing on the first channel and “disparage” using the other two, while not recognizing the fourth at all.

Dean goes on to discuss his views compared to what he thinks is the MMT position on the “four” channels beginning with the monetary channel. Like MMT Says: Monetary Policy Would Be Ineffective He replies to criticisms saying that the monetary policy channel would be ineffective in creating recovery by saying that he was only claiming that the Fed can do more than it has so far done, and not that monetary policy could produce full employment. The WaPo MMT Post Explosion: Dean Baker's Second Try On MMT (2)

This is the second installment of a critical review of Dean Baker's second reaction to the debate kicked off by the WaPo's piece on Modern Monetary Theory, written by Dylan Matthews. The first installment discussed Dean's views on using the monetary channel to boost aggregate demand, and began criticism on his views on devaluing the currency and increasing exports. This post continues that critique, and later takes up his views on work sharing. Expanding US Exports at the Expense of Decreasing Real Wealth? The WaPo MMT Post Explosion: Dean Baker's Second Try On MMT (3) I don't think Dean is directly addressing MMT proposals in this area.

MMT doesn't advocate wasteful spending, or digging holes for the sake of the activity, or spending money on projects and programs that will waste real resources or people's lives. There is a risk that any spending, private or public, will be wasteful or involve an excess of real costs over real benefits. But that's no excuse for avoiding private sector spending, so why should it be one for avoiding public sector spending when that's called for? The events of the last ten years show that both Federal spending on Wars, and private spending on financial adventures can be disastrous, but it was wasteful investments on fantasy sand castles that crashed much of the world economy; not deficit spending in the United States intended to achieve public purpose.

In fact, that kind of spending has been starved for the past 35 years at least. WaPo Covers MMT, But Does Its Usual Bad Job: Part Four, The Victory. You don't learn that the hawks are viewing the Government from the viewpoint that it is like a giant household, and that some of the doves share that perspective. You don't learn that the hawks often claim that the Government can run out of money.

You don't learn that the hawks accept the Quantity Theory of Money, or that both hawks and doves, but not the owls believe in the existence of an inter-temporal Governmental budgetary constraint (IGBC) on spending. More Musings on Modern Monetary Theory. MMT in the Headlines. I know some visitors here will be happy to see this piece on “modern monetary theory” in today’s WaPo today, as was I. It’s particularly gratifying to see my friend Jamie Galbraith featured, a rare economist whose ability to see outside the box has enabled him to be consistently right about a lot of things that others have missed.

For me, I’m down with MMTs up to a point. I very much agree that deficit reduction has been deeply miscast as pure virtue, with little regard for its economic impact. As I’ve written many times here, the first question re fiscal policy, at least until we’re reliably headed toward full employment is not “how quickly does your deficit come down?” It’s: “is your deficit large enough to replace lost private sector demand?” This emphasis on using the tools of government, including the ability to print money and run large budget deficits in times of market failure, is MMT’s most important contribution to the current debate.

The WaPo MMT Post Explosion: Jared Bernstein's Cool Up To a Point. Default vs. Hyperinflation? A False Choice for the US? Even though nations with their own fiat currencies can't default, default is preferable to hyper-inflation. The WaPo MMT Post Explosion: Matthew Yglesias's Reaction to MMT. Stephanie Kelton responds to Dylan Matthews at Ezra's. MMT and its discontents. Yes Virginia, there really is Modern Monetary Theory. Why MMT is like an autostereogram. Who's Afraid of a Little Inflation? This Episode of Life: A friendly response to Dylan Matt's "You know the deficit hawks. Now meet the deficit owls." New Economic Perspectives: Addressing the Dominant Critique of MMT. Modern Monetary Theory and Austrian Economics Walk Into a Bar... “If firms are optimistic then they will formulate investment plans and build capital and productive capacity reflecting their long-term expectations of a return,” Bill Mitchell has written.

So what causes a change in expectations of future returns? It’s at this step that Austrians and MMTers part ways. John Carney Doesn't Believe That Government Spending Can Achieve Public Purpose. John Carney commented on a post by David Brooks and a follow-up by Randy Wray. Brooks says that a tax credit is essentially the same as Government spending and used an example from David Bradford, a Princeton economist, of the Pentagon wanting to acquire a new plane and paying for it with a tax credit. Randy comments on the idea this way: "What is a sovereign currency? It is (mostly) a keystroke that results in an electronic entry on a bank’s balance sheet. (Yes it can also be shiny coins, paper notes, and watermarked checks—but those are increasingly less important.)

Jon Carney comments: ”What Brooks gets and Wray misses, however, is that government spending priorities are economically damaging. Now, that's not economics at all. Places like Germany, Italy, and Austria in the 1920s and France and Eastern Europe in the whole inter-war period. Do we really need to ask why we ought to believe that “. . . government spending priorities are economically damaging”? MMT and Austrian Econ: A (Wonky) Dialogue. More on Savings and Investment. 3spoken: Banks: Reserves sorted. Now lets talk capital. The MMT solvency constraint. MMT stabilization policy — some comments & critiques.

Capital Debates. The Challenge to Status Quo Economics Everybody is Talking About. Who's Afraid of a Little Inflation? Heterodox economics: Marginal revolutionaries. The Center of the Universe » Blog Archive » Heterodox economics: Marginal revolutionaries. Job Guarantee. JG Critiques. Job Guarantees – an economic stimulus worth considering? Monetary Realism. Ballinger & Full Reserve Banking (FRB) Brad Delong and MMT. Quiggin and MMT. PKT Archives. Eco ThinkTanks. Institute for New Economic Thinking. Australian Policy Online. EFE Home. Cpd.org. Mosler Economic Policy Center. PRIME ECONOMICS. CEPR. Naked capitalism. A Moment Among the Minskians. The Quantity Theory of Money and Fears of Inflation Are Nonsense « EconProph.

PKT Archives. TradingEconomics.com - Free Indicators for 231 Countries. The Federal Reserve We Need. YOUR MIND ON MONEY: Modern Monetary Theory going mainstream? Bitcoin Obliterates "The State Theory Of Money" Sorry, Libertarians, History Shows Bitcoin Isn't the Future.