Stocks & ETFs — EXANTE — FX, Forwards FX, Bonds, Stocks, Futures, Options Broker. Trade Stocks and ETFs with EXANTE Trading stocks online with EXANTE is easy and convenient, with over 10,000 equities from over 25 of the world’s major stock exchanges accessible through the EXANTE's Online MultiProduct Platform.

Investors can trade stocks online from the US markets to exchanges in Europe, Asia and Australia directly, and from a single account. Why trade Stocks with EXANTE: Over 35 000+ Stocks25+ major exchangesFast execution, ultra low latency (up to 10ms)Live pricesHedge currency exposure of stock investments by trading FX from the same accountProprietary trading platform with support of the FIX protocol and cross-platform client for Windows, Mac and Linux platformsAPI integration and support. Support of the FIX 4.4 protocol.Multi-product portfolios management from one trading account.Simple and intuitive interface. Maximum rates on the main exchanges: *Lower rates possible with demonstrated high volumes. **Occupy Wall Street promotion Direct Market Access Short Selling.

Why TD Direct Investing International? TD Direct Investing International offers a powerful investment platform and all the tools and help you need to realise your goals, from our flexible Multi-Currency Accounts to our talented and multilingual Client Services team.

Offshore Investing A full range of international investments and access to the world’s major stock markets. International Investors Multi-Currency Accounts, Stocks, Forex, Futures and CFDs on over 15 international markets, and offshore investment funds. Expatriate Investors We are a leading offshore bank renowned for our expatriate expertise which stretches back over ten years. Safety & Stability TD Direct Investing International is owned by TD Bank Group, one of the world’s largest banks. Why Interactive Brokers? Create a PDF of this page to save or print.

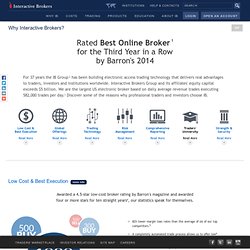

Rated Best Online Broker 1 for the Third Year in a Row by Barron's 2014 For 37 years the IB Group 2 has been building electronic access trading technology that delivers real advantages to traders, investors and institutions worldwide. Interactive Brokers Group and its affiliates' equity capital exceeds $5 billion. We are the largest US electronic broker based on daily average revenue trades executing 582,000 trades per day.3 Discover some of the reasons why professional traders and investors choose IB. Low Cost & Best Executionmore info Awarded a 4.5-star low-cost broker rating by Barron's magazine and awarded four or more stars for ten straight years4, our statistics speak for themselves. 82% lower margin loan rates than the average of six of our top competitors.5 A completely automated trade process allows us to offer low6 commissions.

Global Offeringsmore info Trade on over 100 market centers in 23 countries. Risk Management & Controlmore info. Options Trading, Stock Trading & Futures Trading at optionsXpress. Global AutoTrading - Fees. Flat Monthly Autotrading Fee Global AutoTrading charges a flat per-service, per-account monthly fee for autotrading for accounts with less than $100k in equity: The first service autotraded in an account is $70 per month;the second service costs an additional $30 per month;each subsequent service. costs an additional $10 per month.

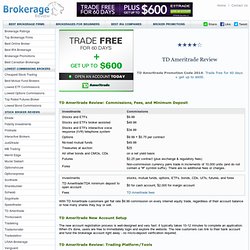

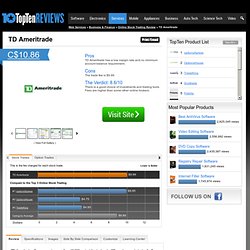

Some newsletters require more than one allocation line (for example, if the newsletter trades both stocks & options); each allocation line counts as a service for autotrading billing purposes. You are free to autotrade only stocks or options (or both). For accounts with more than $100k in equity, a multiplier is applied to the per-service fees described above. If you want to use multiple accounts (with the same broker), the 2nd and subsequent accounts get 20% off of their monthly autotrading fee (whether they are trading the same newsletters or not). Please see also the current promotions page to see the various discounts available! SogoTrade. Sogotrade Foreign Account. Discount Commission Stock Brokers, Online Pink Sheet Trading, Online BB Broker. TD Ameritrade Review. TD Ameritrade Review: Commissions, Fees, and Minimum Deposit With TD Ameritrade customers get flat rate $9.99 commission on every internet equity trade, regardless of their account balance or how many shares they buy or sell.

The new account registration process is well-designed and very fast: it typically takes 10-12 minutes to complete an application. When it's done, users are free to immediately login and explore the website. The new customers can link to their bank account and fund the brokerage account right away - no micro-deposit verification required. Investment Products. Get in touch Call, email 24/7 or visit a branch Call us: 800-454-9272Email us Trade commission–free for 60 days + get up to $600* See details Open new account Investment Products All you need to build and manage your portfolio—in one place Having access to a wide variety of online trading and investment choices, powerful trading platforms, and research and education can help you build a portfolio suited to your needs.

Open new account At TD Ameritrade, we don’t charge platform or data fees. Check the background of TD Ameritrade on FINRA's BrokerCheck. Best Online Brokerage - TopTenREVIEWS. TD Ameritrade offers access to more than 13,000 mutual funds, bonds, CDs, options and stocks.

It offers a good collection of third-party investment information and a powerful collection of trading tools. The TD Ameritrade control panel provides tools and information to plan investment strategies and buy and sell securities. Unfortunately this online stock trading service charges $44.99 for broker assisted orders and $34.99 for placing an order over the interactive voice response telephone system. TD Ameritrade charges a flat rate of $9.99 for market, limit and options trades. There is an additional $0.75 fee per options contract.

You can trade stocks, options, mutual funds and exchange traded funds.