The FairCoop practical guide to what is and how to use Faircoin. One of the main objectives of FairCoop is to provide tools that facilitate the development and expansion of a new postcapitalist economic system based on collaboration.

That‘s why the FairCoop team has developed a practical guide on how to use each of these tools, available for PCs, mobile devices and even on paper. FairCoin, one of the pillars of FairCoop economic system is the first cryptocurrency distributed in a fair way, completely secure, negotiated in the foreign exchange market, decentralized, green (does not require high energy consumption) consensual, not controlled, and encourages saving. From a practical point of view, the main feature of this electronic coin is that with it you can transfer value to other people safely, quickly and cheaply, and most importantly, without relying on governmental or financial powers.

To start using FairCoins the first thing you need to do is get an electronic wallet. You have several options; you can install on your computer or your smartphone: A Cryptocurrency Operated File Storage Network. Bitcoin isn’t Money—It’s the Internet of Money. Ever since Paul Krugman started weighing in on Bitcoin recently, people have been using his notorious 1998 Internet prediction to mock him: By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.

Krugman was dead wrong, but rather than mocking a man who now says he does not “claim any special expertise in technology,” I think we are better served by fleshing out the extremely apt Internet:communication::Bitcoin:finance analogy his critics raise. If we can see why Krugman might have thought that the Internet would not be significant, we might come to understand why many smart people think Bitcoin isn’t compelling and be able to explain why they’re wrong. The Internet is a telecommunication system, but it was not our first telecommunication system. Telegraphs and telephones have been around for over a century. In contrast, the traditional telephone system defines its applications more centrally. Which brings us to Bitcoin. Bitreserve - A cloud money service reimagining money. Blockchain revolution: open source democracy for the 99% “The Pitchforks Are Coming ...

For Us Plutocrats”! This is how self-proclaimed unapologetic capitalist Nick Hanauer addressed the explosion of global economic inequality. In this rather sensational title, he wrote a warning to his fellow .01%ers that the end game is in the cards with an imminent social uprising. In the wake of OccupyWallStreet in 2011, America heard the rumbling of citizens, similar to the discontent that made president Franklin Roosevelt pass the New Deal, Jimmy Carter sign progressive legislation and made corporate executives afraid of Ralph Nader during the 60’s.

We saw an apathetic and obedient populace begin challenging the managed democracy and refusing to play the game of electoral politics. Though most people are not aware of it, the revolution is now underway with blockchain based cryptocurrencies. The Business of Bitcoin. The nature of Bitcoin - The Business of Bitcoin. Note: if you are not familiar with how Bitcoin works from a technical perspective, you may want to read some background first.

It is not strictly necessary, but probably useful. I would recommend this post by Michael Nielsen or the original paper (PDF) by Satoshi Nakamoto. The first item in my frameworks post was the difference between the Bitcoin protocol and the currency. This is an important distinction, but it is not completely straightforward as both aspects are very tightly interrelated. Thinking of them as distinct entities is actually misleading. Let's start with the protocol. There are 3 key elements in how the Bitcoin protocol enables these decentralized transactions: a public ledger (the "blockchain") of all past transactionsthe cryptographic encoding of transactors' identities and the info being transacted, andthe work of "miners" to verify a transaction's validity and formalize it in the blockchain. The problems with Bitcoin - The Business of Bitcoin. There are a number of things that Bitcoin doubters bring up (and rightly so) and that will need to get ironed out if Bitcoin, in one form or another, will end up being successful.

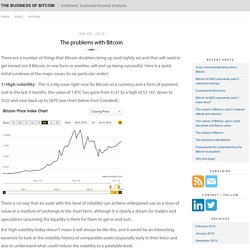

Here is a quick initial rundown of the major issues (in no particular order): 1) High volatility - This is a big issue right now for Bitcoin as a currency and a form of payment. Just in the last 3 months, the value of 1 BTC has gone from $121 to a high of $1,147, down to $522 and now back up to $870 (see chart below from Coindesk).

There is no way that an asset with this level of volatility can achieve widespread use as a store of value or a medium of exchange in the short term, although it is clearly a dream for traders and speculators (assuming the liquidity is there for them to get in and out). 2) Deflationary bias - The Bitcoin currency, as defined today, has a limited supply: the total number will never exceed 21M. 3) No intrinsic value - This is a big one for Bitcoin doubters (including Krugman himself!). What is the “irreducible core” of Bitcoin?