Find Apartments for Rent and Rentals - Get Your Walk Score. Enter your details - Government Gateway. Landlord vs tenant responsibilities - a quick-start guide. Landlords and tenants each have their own specific set of responsibilities, and it’s important to make sure that you know who is expected to do what.

Read our guide to learn about some of the obligations for each party, but please take professional advice before you make any important decisions. Landlords’ responsibilities Landlords have a series of important responsibilities to their tenants. It is vital that you fulfill them. Safety Landlords must ensure that their properties are safe. There are also important fire safety obligations, including: smoke alarms on every storey; carbon monoxide alarms in at-risk rooms; accessible escape routes; and fire-safe furnishings and fittings where they are supplied by the landlord. Information Landlords must provide information at the beginning of a tenancy, including: their full name and address, or those of the letting agent; the property’s Energy Performance Certificate; the How To Rent guide, which is available on the government’s website.

London and UK Property Investment Blog. Taking advantage of expertise in property investments The truth about property investments vs. stock market portfolios is that property investments knock the spots off the stock market.

If you’d bought an average-value house 90 years ago, your capital growth today would be around 47,000%. The same investment in shares would have grown by just 11,000%. Property Tax Round-up 2016 « « LandlordZONE. Aspen™ White Tile. A basic grout suitable for tiling Ceramic, Marble, Travertine and Limestone tiles onto indoor and outdoor walls.

Can be used in some wet areas. For more details and information, view our BAL Grout chart here. A premium grout suitable for use with most tile types on both walls and floors. Can be used indoors and outdoors as well as in wet areas. A specialist grout suitable for both walls and floors, inside and outside. Changing your meter. The great news is we don’t charge you if you want to swap your prepayment meter to a credit meter.

The only requirement is that you pass a credit check, we don’t want to help customers into debt as it’s not good for you or us. When we carry out a credit check, we'll make sure we take good care of your personal details, keeping them secure, but we'll need to share them with credit reference agencies (CRAs) who'll carry out the actual checks. Could you pay less investment property tax through a company? Buy-to-let property in university towns: Sunderland offers best yields. As the start of the new university year looms, many parents will be asking if it makes financial sense to buy a property to help with their children’s university accommodation costs.

There will be undoubtedly be many factors that need to be considered, including the price of the house, the rent that can be achieved, and - perhaps most importantly from an investment perspective – what yield the property will produce. Help is at hand with the decision-making process as new research shows where the best yielding university towns for landlords can be found. Northern towns take top spots The figures from property crowdfunding platform Property Partner found that northern university towns have the best yields, with Sunderland taking the top spot with a net yield of 6.9 per cent.

Other best performers include Middlesbrough in second place at 5.9 per cent and Newcastle in eighth place at 4.3 per cent.

324. Pest Control Charges. Tenant If you are a tenant your landlord may be responsible for ensuring that the pest problem is dealt with.

Please telephone your landlord or managing agent first. If they are liable and refuse to undertake treatments please contact Customer Services on 020 8489 1335 for further information or advice. Concessions All services are chargeable. Back to top Means Tested Benefits Means Tested Benefits include: Income Support Income based Jobseekers Allowance Pension Credit Working Tax Credit Council Tax ReductionHousing Benefit The charges will be in three bands: Concession Rate - for clients who receive Means Tested Benefits.Domestic Rate - for clients who do not receive benefits, Homes for Haringey, Council Properties and Registered Social Landlords.Commercial Rate – this will include Commercial Landlords.

Please note Back to top Please note, the price quoted is provisional, and may be subject to change on arrival of the Pest Control Officer. Table of Charges Contact. Is the landlord responsible for this rodent infestation? » The Landlord Law Blog. Enfield Borough Council's landlord licensing scheme quashed at the High Court following judicial review. Landlord licensing scheme quashed in judicial review A scheme that would force landlords to hold licences has been quashed by the High Court.

The High Court today ruled that the judicial review called for by landlord Constantinos Regas challenging Enfield Borough Council's licensing scheme was to be upheld. The council's scheme would have required landlords to hold a £500 five-year licence from the authority for each property they owned. Non-registration would carry a potential £20,000 fine and a criminal record, with any breach of licence conditions carrying a £5,000 fine. Ten tips for buy-to-let. By Simon Lambert for Thisismoney.co.uk Updated: 06:24 EDT, 3 May 2018 Buy-to-let is much tougher than it once was.

A tax crackdown on buying properties and a tax raid on the rental income from owning them has seen to that. But for many Britons the idea of investing in property still appeals, as they trust bricks and mortar and may feel that they can add value to a property. A world of low interest rates helps polish the attraction of buy-to-let. Returns on savings are low and mortgages are cheap. But interest rates are forecast to rise and the 3 per cent stamp duty surcharge eats a large amount of your money. Nonetheless, buy-to-let remains popular. Buy-to-let rental yield calculator: What return would a property deliver? By This Is Money Published: 15:45 GMT, 12 March 2015 | Updated: 11:20 GMT, 18 May 2015.

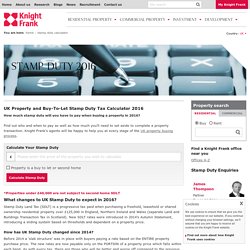

UK Stamp Duty Calculator. *Properties under £40,000 are not subject to second home SDLT Stamp Duty Land Tax (SDLT) is a progressive tax paid when purchasing a freehold, leasehold or shared ownership residential property over £125,000 in England, Northern Ireland and Wales (separate Land and Buildings Transaction Tax in Scotland).

New SDLT rates were introduced in 2014's Autumn Statement, introducing a sliding system based on thresholds and dependent on a property price. Regional map. Savills Auctions. Homes - Property - Buying at auction. House Prices in Hungerdown, Chingford, East London, E4. 7 Hungerdown, London, Greater London E4 6QJ 77 Hungerdown, London, Greater London E4 6QJ 47 Hungerdown, London, Greater London E4 6QJ 73 Hungerdown, London, Greater London E4 6QJ 67 Hungerdown, London, Greater London E4 6QJ 29 Hungerdown, London, Greater London E4 6QJ Contains Ordnance Survey data © Crown copyright and database right 2011 Source acknowledgement: House price data produced by Land Registry This material was last updated on 29 June 2015. It covers the period from 03 January 1995 to 29 May 2015. © Crown copyright material is reproduced with the permission of Land Registry under delegated authority from the Controller of HMSO.