Marketplace for startup equity. Unlocking pre-IPO startups for private investors. StartupPerColator. Taking the first step to start a business can be difficult, particularly since moving from the idea stage to startup stage in pursuit of perishable market opportunities requires cash.

Founders who are unable to personally finance their early stage startup activities quickly discover the need to raise external funding. Seed Capital Seed capital can come from many sources, the most frequent being “angel capital.” Angels are investors who have a penchant for being the first investors in a new startup. Often these are family, friends and/or close associates of the entrepreneur. Angels, professional angels, “super” angels, and early stage venture capitalists tend to structure their investments of seed capital in one of two forms – either through a loan or the purchase of equity. Loans When raising a modest amount of seed capital, for instance, less than $1 million, founders often favor a “seed loan.” Seed Equity. Valleywag - Sorry to disrupt.

Series Seed Financing Documents: - SeriesSeed.com. Sample funding templates for Ontario entrepreneurs. MaRS Discovery District has developed a set of templates of funding documents for use by Ontario entrepreneurs under Canadian law out of the need for standard legal documents for start-ups.

While these documents may simplify the process of seeking funding, MaRS strongly encourages start-ups to seek legal counsel. Context for developing sample funding templates Angels and micro-venture capital firms play an increasingly important role in the funding landscape for many early-stage technology entrepreneurs, particularly those in the web and mobile-application sectors. Invest in Startups You Love - Wefunder. Why invest in startups?

It shouldn't be to make bundles of risk-free money! This isn't real estate or the stock market. Startups are much riskier. Everyone has their personal motivations for investing in startups, but ours is to support entrepreneurs that we believe in, pursuing a vision we care about, with a good chance of earning a return should that vision transform into reality. Is startup investing appropriate for me? If you can't afford to lose every dollar you invest on Wefunder, the answer is no.

25 Ways to Make Your First Online Sale. As an online merchant, making your first sale is as symbolic as it is necessary.

Completing the first sale sounds straightforward enough, yet the optimism and reassurance it brings can make it the biggest turning point in the life of your business. However, don’t let the simple concept of a first sale mislead you. Obtaining that first customer can sometimes be a long, arduous battle. To make the battle easier to win, below are 25 sure-fire ways to make your first sale, and then some. 1. The Internet is packed with influential bloggers, journalists, entrepreneurs, and vloggers from a wide range of industries and niches. Founders' Agreement Template. The Company This agreement governs the partnership between the Founders, doing business as [company name] (the “Company”).

The Company will continue perpetually, unless dissolved in accordance with this agreement. The Founders will cause the Company to register its fictitious name in the jurisdiction where it conducts its business, as soon as reasonably practicable after the date hereof. For Entrepreneurs. Business Basics - Equity: Dividing the Pie. Email: mike@risktaker.com I'd rather have a small piece of a big pie than a large piece of nothing!

(M. Volker) Why Do You Need a Partner? If you are very bright, very tenacious, and financially well endowed, then you can start a company which you own in its entirety and in which you can hire a bright, capable, highly motivated and well-paid management team. Peter thiel course. How to Divide Equity to Startup Founders, Advisors, and Employees. Since returning from MIT back in June I’ve been focusing on the growth of the company.

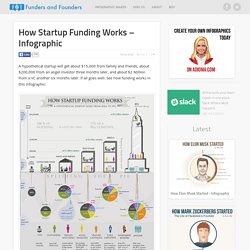

It has been pretty much on mind non-stop for months now. The part that I’d like to zero in on is when you’ve got a high growth company what are some of the best practices out there to distribute equity to the founders, advisors, and employees? Equity for Founders The Founders’ Pie Calculator by Frank Demmler, an Associate Teaching Professor of Entrepreneurship at the Donald H. Co-Founder Equity Calculator. How Funding Works - Splitting The Equity With Investors - Infographic. A hypothetical startup will get about $15,000 from family and friends, about $200,000 from an angel investor three months later, and about $2 Million from a VC another six months later.

If all goes well. See how funding works in this infographic: First, let’s figure out why we are talking about funding as something you need to do. This is not a given. Business Basics - Equity: Dividing the Pie. The Equity Equation. July 2007 An investor wants to give you money for a certain percentage of your startup.

Wiki. Equity agreements are used to legally detail how equity will be divided amongst founders, key employees, advisors and investors in a startup company.

The details of equity agreements will specifically determine who gets what payoff should the company be acquired or go public. CasJam Media. Swapping start-up equity for professional services. What happens when you gives shares to another business? Back in the halcyon days of the dotcom boom, a nice little trend evolved that cut through the airy, overinflated fads of the day. Start-ups reluctant or unable to sell great slabs of their equity to drooling VCs instead gave shares to businesses who could actually help them grow, in return for that company's services. What usually happened was some creative spark with a big idea for a website gave shares to a development business. And the development team would work hard to build a top-notch site in the hope it would pump up the value of their shares.

Things worked out pretty nicely for both parties: the business founder didn't have to spend a dime, the development company got a good chunk of equity in a potential next-big-thing. This idea of swapping equity for professional services outlived the dotcom boom, expanded to all types of B2B businesses, and is still going strong in the US today. Why and when it works The risks The risks. Standardized Legal Documents. What is VentureDocs? VentureDocs is a system for automating the first draft of important legal documents for startup companies, investors, crowdfunding portals and attorneys. How to Fund a Startup. November 2005 Venture funding works like gears. A typical startup goes through several rounds of funding, and at each round you want to take just enough money to reach the speed where you can shift into the next gear.

Few startups get it quite right. Equity Allocation in New Ventures: OPIM 651 (Ulrich) - Fall 2011 Q2. We won't go over this explicitly in class. However, many of you ask questions outside of class related to the challenge of allocating equity to founders. I bet this note answers most of these questions. This note may also be helpful in thinking about the valuation exercise. What We Offer. Clerky. VC4Africa – Venture Capital for Africa - Connecting Entrepreneurs and Investors.

Gumroad. Wiki. How to Create a Million-Dollar Business This Weekend (Examples: AppSumo, Mint, Chihuahuas) Noah Kagan built two multi-million dollar online businesses before turning 28. He also looks great in orange. (Photo: Laughing Squid) I first met Noah Kagan over rain and strong espressos at Red Rock Coffee in Mountain View, CA. It was 2007. We were both in hoodies, had a shared penchant for the F-bomb and burritos, all of which led to a caffeine-infused mindmeld.

It would be the first of many. The matchmaker then introducing us was the prophetic and profane Dave McClure, General Partner of 500 Start-ups, which is now headquartered just down the street from Red Rock. Mr. He was employee #30 at Facebook, #4 at Mint, had previously worked for Intel (where he frequently took naps under his desk), and had turned down a six-figure offer from Yahoo. The purpose of this post is simple: to teach you how to get a $1,000,000 business idea off the ground in one weekend, full of specific tools and tricks that Noah has used himself. He will be your guide… Enter Noah. Crowdfunding Platform for Science Research Grants. Notes Essays—Peter Thiel’s CS183: Startup—Stanford, Spring 2012.