[Exclu] Ce que J.A Granjon, PDG de Vente Privée, pense du modèle Groupon… en toute amitié ! The REAL data on Groupon’s performance. Groupon’s Founders Make Words Pay, But for Whom? The New York Times recently wrote a piece suggesting that “Groupon’s fate hinges on words.”

Unlike Google, which “had secret algorithms that gave superior search results,” or Facebook, which “provided a way to broadcast regular updates to friends and acquaintances that grew ever more compelling as more people signed up,” in the view of the Times, Groupon has “nothing so special.” Its unique asset is its “ability to make words pay.” Groupon’s cofounders and earliest investors, Eric Lefkofsky and Brad Keywell, have long displayed a skill at dressing up their investments with a catchy turn of phrase. Looking back on their long history together, dating back to their days as University of Michigan classmates, a pattern quickly emerges of canny operators who have rolled up mature, low-margin businesses and used their “ability to make words pay” to cast them as fast-growing, high-margin technology companies.

Chris dixon: A key question re Groupon... Groupon Revisited (with Echos of Kozmo.com) - Continuations. Groupon is Effectively Insolvent. To save people having to fight with that sites asshole design, here's the text: I'll start by tipping my hat to Andrew Mason.

He caught social mood just right, creating a coupon/local/flashmob hybrid business model at the perfect time, and has created the fastest-growing company on a revenue basis in American history. That being said, it's operating like a Ponzi scheme that needs constant infusions of cash to stay afloat as it's hemorrhaging money.

We'll start by looking at the balance sheet, which is typically a waste of time for hypergrowth companies. Short logic (Groupon IPO: Pass on this deal) Groupon’s Business is Decaying in its Established Markets. By David Sinsky 6/03/11 10:28am Share this: The following is an in-depth analysis of Groupon’s business in one of its oldest markets, Boston, by the folks at daily deal aggregator Yipit.

Patrice Lamothe: Lot of hype, shaky financi... Patrice Lamothe: Groupon calls its users "s... Groupon Is a Straight-Up Ponzi Scheme. Groupon IPO & S-1 Filing (June 2011): What are the most notable aspects of the Groupon S-1. Chris dixon: Looking at Groupon's S-1 a... Chris dixon: what's your position on gn...

CHART OF THE DAY: Groupon's Massive Revenue And Massive Losses. a2203913zs-1. Groupon Files For $750 Million IPO; Lost $413 Million In 2010. No discount: Groupon files for $750 million IPO. Groupon, the original and largest daily deals company, has filed to raise $750 million in an initial public offering.

Morgan Stanley and Goldman Sachs are listed as co-lead underwriters, with Credit Suisse also participating. The company did not say if it plans to trade on the NYSE or Nasdaq, but did say its ticker symbol would by GRPN. It features a dual-class stock structure, as have other recent Internet issuers like LinkedIn (LNKD) and Yandex (YNDX). Groupon Files to Raise $750 Million in IPO After Coupon Site’s Sales Surge. Groupon Inc., the top online-coupon provider, filed to raise $750 million in an initial public offering, riding a wave of Web-company share sales and giving investors a chance to bet on the surging daily-deal market.

The IPO will be handled by Morgan Stanley (MS), Goldman Sachs Group Inc. (GS) and Credit Suisse Group AG (CSGN), according to the filing. Chicago-based Groupon, founded in 2008, will trade under the ticker GRPN. Groupon has drawn increasing interest from Wall Street since December, when it opted to weigh an IPO instead of accepting a $6 billion takeover bid from Google Inc.

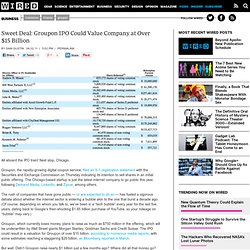

As early as March, Groupon was in talks with bankers about an IPO that would value the company at as much as $25 billion, people familiar with the matter said at the time. “You need to have a war chest,” said Sandeep Aggarwal, an analyst with Caris & Co. in San Francisco. Groupon had an implied valuation of $5.6 billion at the end of March, according to research firm Nyppex LLC. Copycats Abound. Where Did Groupon’s Billion Dollars Go? – AllThingsD. In January, Groupon raised $950 million.

By the end of March, it had $209 million in cash. What happened to all that money? The company’s IPO filing spells that out: Almost all of it went right back out the door, to employees and early investors. The details: Groupon raised a total of $946 million in two funding rounds last winter. It kept $136 million of it help run the money-losing company. Here’s how the stock sales broke down: And here are the footnotes you’ll need to interpret the chart: The manager of 600 West Partners II, LLC is Blue Media, LLC, an entity owned by Eric P. Of note: This wasn’t the first time Groupon had raised money and taken cash off the table.

Groupon IPO: Everything You Need to Know - Deal Journal. Groupon.

They’re so wacky they make fun of Buddhists, stage mock tiffs with a Van Halen-lovin’ shut-in named Michael, and turn down $6 billion checks from Google. Bloomberg News And now, the discount-of-the-day company has started down the road to its IPO riches. Groupon just filed its long-anticipated S-1 with the SEC, the first formal notice that Groupon expects to launch as a publicly traded company very soon.

In its filing, Groupon didn’t disclose how much money it expects to raise from its IPO. Sweet Deal: Groupon IPO Could Value Company at Over $15 Billion. All aboard the IPO train!

Next stop, Chicago. Groupon, the rapidly-growing digital coupon service, filed an S-1 registration statement with the Securities and Exchange Commission on Thursday indicating its intention to sell shares in an initial public offering. The Chicago-based startup is just the latest internet company to go public this year, following Demand Media, LinkedIn, and Zipcar, among others. The rush of companies that have gone public — or are expected to do so — has fueled a vigorous debate about whether the internet sector is entering a bubble akin to the one that burst a decade ago. (Of course, depending on whom you talk to, we’ve been in a “tech bubble” every year for the last five years, dating back to Google’s then-shocking $1.65 billion purchase of YouTube, so your mileage on “bubble” may vary.)