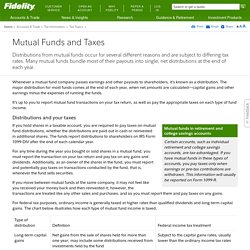

Mutual Funds and Taxes. Whenever a mutual fund company passes earnings and other payouts to shareholders, it’s known as a distribution.

The major distribution for most funds comes at the end of each year, when net amounts are calculated—capital gains and other earnings minus the expenses of running the funds. It’s up to you to report mutual fund transactions on your tax return, as well as pay the appropriate taxes on each type of fund income. Distributions and your taxes Mutual funds in retirement and college savings accounts Certain accounts, such as individual retirement and college savings accounts, are tax-advantaged.

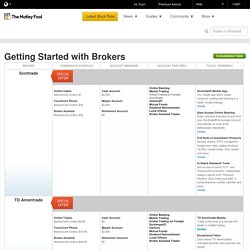

If you hold shares in a taxable account, you are required to pay taxes on mutual fund distributions, whether the distributions are paid out in cash or reinvested in additional shares. For any time during the year you bought or sold shares in a mutual fund, you must report the transaction on your tax return and pay tax on any gains and dividends. When there is no distribution. Online Brokers – The Motley Fool. Consolidated Table Note: Offers may be valid in the US only.

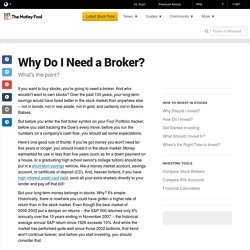

The information and links on this page are provided for your convenience only. Compare online brokers and find out how to invest your money the best way you can. Our handy discount brokerage comparison chart shows you where to invest and includes great promotional offers. The Motley Fool is not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. Why Do I Need a Broker? If you want to buy stocks, you're going to need a broker.

And who wouldn't want to own stocks? Over the past 100 years, your long-term savings would have fared better in the stock market than anywhere else -- not in bonds, not in real estate, not in gold, and certainly not in Beanie Babies. The Motley Fool. For small investors, mutual funds are the best financial product ever designed.

With very little money, you can invest in funds that own shares of hundreds of different companies. Unfortunately, many of the thousands of mutual funds available don't perform well. Most actively managed funds, with holdings chosen and maintained by financial professionals, lag the overall market, largely because of transaction costs and fund fees. That's why many fund investors stick with index funds, which simply seek to match the performance of a specific market index. Finding the right funds Nonetheless, we believe that the right actively managed funds can outperform the market over the long term. Diversification: Strong mutual funds provide broad, risk-controlled exposure to the market's sectors without watering down their managers' best ideas amid hundreds of picks.Performance: The average fund lags the S&P 500 over time, but the funds we recommend are far from average.

How to Invest $20, $100, and $1,000 (and More) This article was updated on Dec. 30, 2015.

Got only $20 to put away right now? It may not sound like much, but you can use it to buy shares in Ford Motor. Or Bank of America. Or Hertz. And those are just a few of the thousands of options available for cash-strapped investors. The Motley Fool. * Calculators are for estimation purposes only, and are not financial planning or advice.

As with any tool, it is only as accurate as the assumptions it makes and the data it has, and should not be relied on as a substitute for a financial advisor or a tax professional. Trump's potential $1.6 trillion investmentWe aren't politicos here at The Motley Fool. But we know a great investing opportunity when we see one. Our analysts spotted what could be a $1.6 trillion opportunity lurking in Donald Trump's infrastructure plans. And given this team's superb track record (more than doubling the market over the past decade*), you don't want to miss what they found. What Should I Invest In? As you may have noticed, there are several categories of investments, and many of those categories have thousands of choices within them.

So finding the right ones for you isn't a trivial matter. The single greatest factor, by far, in growing your long-term wealth is the rate of return you get on your investment. There are times, though, when you may need to park your money someplace for a short time, even though you won't get very good returns. Here is a summary of the most common short-term savings vehicles: Short-term savings vehicles Savings account: Often the first banking product people use, savings accounts earn a small amount in interest, so they're a little better than that dusty piggy bank on the dresser.Money market funds: These are a specialized type of mutual fund that invest in extremely short-term bonds. Fools are partial to investing in stocks, as opposed to other long-term investing vehicles, because stocks have historically offered the highest return on our money.

The Motley Fool. Once you've figured out why you should invest, the next step is learning how.

We'll break that question into two parts. First, we'll talk about how you can structure your financial life to make it possible to invest. The Motley Fool. 13 Steps to Investing Foolishly You may not realize it yet, but you are staring at a ticket to financial independence.

That's right; this little guide is your one-way pass to the financial future of your dreams. Read the 13 Steps We believe that the best way to invest your money in stocks is to buy great companies and hold them for the long term. The best investments don't need you to check on them daily because they are solid companies with competitive advantages and strong leadership. How to Save Money. Home page – Get Financial Security. Scwab. Ameritrade. Investing - personalfinance. Robinhood - Global.